While markets may not get interest rate cuts from central banks as quickly as expected, we think rates have peaked. We see more value in emerging market equities than in developed equities.

Major equity markets globally continued to trade at record-high levels as of early March. The S&P 500 Index in the U.S., Canada’s S&P TSX Composite Index and Europe’s STOXX 600, all traded at lifetime highs during the month. The S&P 500 Index posted standout performance in the past six months: rising for 16 of the past 19 weeks, one of the longest such stretches. Another indicator of its strength - the index has not lost more than 2% in any of the past 266 trading days (as of mid-March). Also, volatility has been extremely low.

Diverse factors have driven markets up. The main one is expectations that major central banks across the developed world are closer to cutting benchmark policy interest rates. Also contributing is the fact that aggressive interest rate hikes over the past two years has not caused a recession or widespread job losses. This is despite inflation falling from multi-year highs. Lastly, tech themes such as artificial intelligence, which may boost corporate earnings, has fueled equity market gains.

While we think stock markets are a bit too enthusiastic about the prospects of interest rate cuts, we see some merits in the current upswing. For one, we see a broad recovery in manufacturing activity across the world. Secondly, we also see earning revisions bottoming out across major regions and we expect this to contribute to market resilience. Despite a recent uptick in inflation in the U.S., we think major contributors such as shelter inflation may moderate in the coming months. While markets may not get the magnitude of interest rate cuts they expect or as quickly as they anticipate, we believe the next move by central banks is likely an interest rate cut. As a result, we are cautiously optimistic about equities.

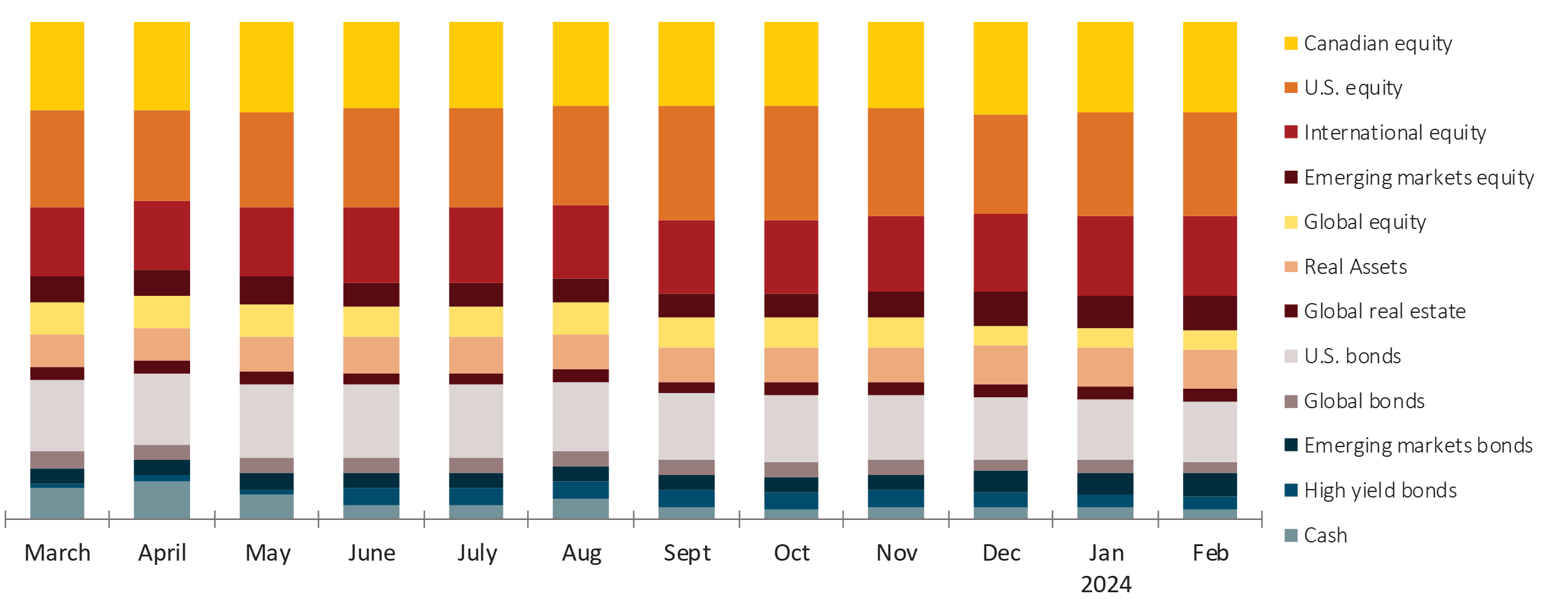

Our tactical overweight in equities is mostly a result of our positive view on emerging markets. While the U.S. economy has moved from strength-to-strength, we see U.S. stocks richly valued. We see more value in emerging markets, especially in China. Over the past many quarters, China’s stock markets suffered a multi-year downturn as both domestic and international investors exited markets. Policy makers are finally acting to stem this capital outflow. We expect more policy support for Chinese shares, and we forecast better risk-reward for the asset class. In most other markets, we have largely maintained a neutral stance to equities.

We are currently neutral towards bonds. We trimmed our overweight position in Canadian and U.S. investment grade bonds to conserve cash. However, we still expect these two asset classes to provide resilience to overall portfolios should fears of any financial crisis flare up. We are underweight global high-yield bonds and emerging market bonds given their tight spreads. This along with a strong U.S. dollar could make them vulnerable.