Today, many income-focused investors are struggling to gain sufficient yield from their investments, while ensuring it can last through their lifetime. There’s a solution:

Income. Simplified.

Sun Life MFS Diversified Income Fund1

A multi-asset, income-oriented, global balanced portfolio.

Discover the benefits

Watch Rob Almeida, Global Investment Strategist & Portfolio Manager, MFS discuss the investment approach.

How the fund is managed

A diversified approach to income.

Sun Life MFS Diversified Income Fund is an income solution that has been specifically designed to address the challenges facing income-seeking investors today.

- Multi-asset.

- Income-oriented.

- Disciplined. Yet Flexible.

- Steady monthly cash flow.

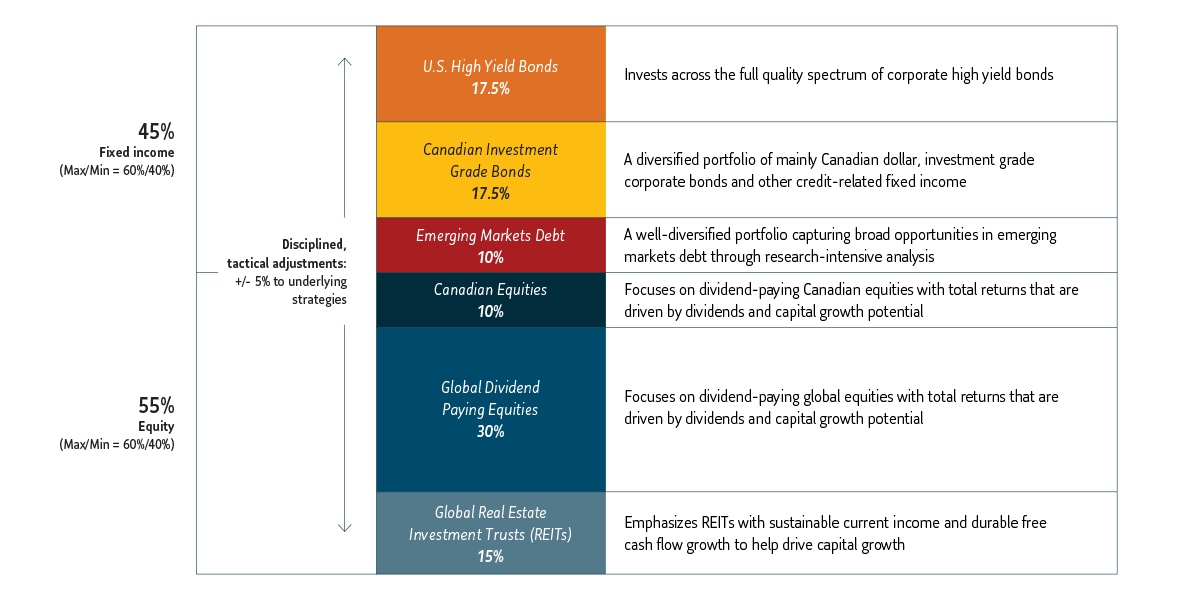

Six distinct income-generating asset classes

The Fund invests in a carefully optimized mix of six income-generating asset classes, and disciplined tactical shifts are made in response to market conditions.†

An elite investment team

The overall strategy of the Fund, including the asset mix and tactical adjustments, is led by Robert M. Almeida, Global Investment Strategist and Portfolio Manager, MFS Investment Management.*

Robert M. Almeida

27 years in the industry. 22 years with MFS. ~$ 3.5B in assets managed for MFS2

Backed by the collective expertise of all MFS

Each of the six income-generating asset classes is backed by highly experienced portfolio management teams from MFS, who directly pick the securities for their respective asset classes.

Why MFS for diversified income investing

The Fund is overseen by our world-class sub-advisor – MFS Investment Management. For nearly a century, MFS’s investment approach has thrived on three pillars: the collective expertise of their investment professionals, risk management and long-term discipline.

Today they can draw on a research platform that spans the globe.

- 107 Fundamental research analysts

- 8 Global sector teams

- 11 Analyst managed strategies

- 106 Portfolio managers

- 12 Quantitative research analysts

Data as of June 30, 2022

Fund Essentials

Series |

MER |

Distribution |

Fund codes |

|---|---|---|---|

A |

2.06% |

Monthly, 4% |

SUN 172 |

F |

0.89% |

Monthly, 5% |

SUN 472 |

Also available in Series O (fully unbundled). MERs as of June 30, 2022.

Get Started

Materials and Resources

Fund Insights

Why does income diversification matter?

Many investors want to grow their capital and achieve steady streams of income. There’s a solution.

Interested in our entire suite of Sun Life MFS Funds?

† The chart allocations shown represent the Fund’s neutral asset allocation. Actual allocations may vary due to tactical adjustments or market movements. The blended benchmark for the Fund is represented by: 30% MSCI ACWI High Dividend Yield Index, 10% S&P/TSX Capped Composite Index, 15% FTSE/EPRA Nareit Developed Index, 17.5% FTSE Canada All Corporate Bond Index, 17.5% Bloomberg U.S. High Yield 2% Issuer Capped Index, 10% JPMorgan EMBI Global Diversified Index.

*Sub-advisor to Sun Life MFS Diversified Income Fund.

1 Effective June 21, 2022, the investment strategies of the Fund changed, and its name changed from Sun Life MFS Dividend Income Fund to Sun Life MFS Diversified Income Fund.

2 Based on a similar U.S. fund, not available to Canadian investors. The investment parameters for Sun Life MFS Diversified Income Fund differ, though the basic strategy is similar in nature. Assets managed are in U.S. dollars, as of March 31, 2022.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Interested in our entire suite of Sun Life MFS Funds?

† The chart allocations shown represent the Fund’s neutral asset allocation. Actual allocations may vary due to tactical adjustments or market movements. The blended benchmark for the Fund is represented by: 30% MSCI ACWI High Dividend Yield Index, 10% S&P/TSX Capped Composite Index, 15% FTSE/EPRA Nareit Developed Index, 17.5% FTSE Canada All Corporate Bond Index, 17.5% Bloomberg U.S. High Yield 2% Issuer Capped Index, 10% JPMorgan EMBI Global Diversified Index.

*Sub-advisor to Sun Life MFS Diversified Income Fund.

1 Effective June 21, 2022, the investment strategies of the Fund changed, and its name changed from Sun Life MFS Dividend Income Fund to Sun Life MFS Diversified Income Fund.

2 Based on a similar U.S. fund, not available to Canadian investors. The investment parameters for Sun Life MFS Diversified Income Fund differ, though the basic strategy is similar in nature. Assets managed are in U.S. dollars, as of March 31, 2022.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.