- Please enter a search term.

- Please enter a search term.

-

-

Mutual funds

Segregated funds

-

Advisor marketing & resources

-

Welcome to Sun Life Global Investments

We use cookies to enhance your experience by saving your advisor or investor selection. If you prefer not to accept these cookies, please select “I’d rather not to say”.

Who we are

Global vision. Canadian roots.

For the past 15 years we have been bringing global asset management expertise to Canadian investors through our innovative suite of solutions crafted for Canadians’ unique needs. Whether investors are looking for growth or protection, we help them prepare for retirement, generate income in retirement and leave a legacy for the next generation.

We bring the world to your portfolio

Building wealth today requires you to look beyond Canada’s borders. We are part of the Sun Life group of companies, a global asset manager with offices in nearly 20 countries and over $1.5 trillion under management.1 And we’ve built a truly global investment platform by combining the strength of Sun Life with world class asset managers helping to bring you more choice.

Sun Life Global Investments: By the numbers

We work with institutional managers to offer mandates not available elsewhere in Canada to retail investors

Sun Life: 160 years of growing and protecting wealth for Canadians (since 1865)

Sun Life Global Investments: over $61 billion AUM2

Sun Life: over $1.5 trillion AUM1

Scale = pricing power and broad global reach

Insurance roots = strong risk management culture

Sun Life Global Investments Multi-Asset Solutions Team

Manages institutional and retail portfolios dedicating 100% of their time to fund manager selection, oversight, and building managed solutions for Canadian investors through rigorous research-oriented investment process. They research and analyze fund managers for the portfolios they build from around the globe—and they only invest with fund managers they believe to be the best in each category. Their goal is to create favourable outcomes for investors no matter what life stage or goal they are working towards.

Solving for more investor needs, our suite of solutions:

A broad choice of investment solutions that can help you diversify your portfolio to manage risk, protect your assets from market downturns, build income portfolios, guarantee an income for life and plan for your legacy.

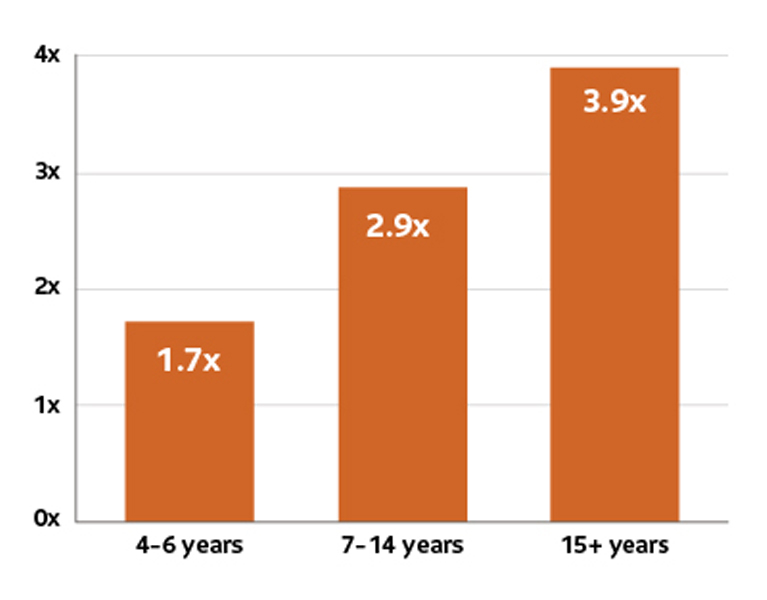

Growth in financial assets over time of households that received advice compared to those that did not receive advice.

Consider the value of advice

The most important advice we can give you is to work with an advisor. Why? Evidence clearly shows that households with an advisor have greater net wealth than those that don’t.3 That is why we stand shoulder-to-shoulder with advisors, offering the products and strategies they need to plan for your financial future.

1 AUM as of June 30, 2025

2 AUM as of June 30, 2025. Includes Institutional, mutual funds, payout annuities, guaranteed and Sun GIF. Institutional mandates are sub-advised by SLGI and offered as group segregated funds by Sun Life Assurance Company of Canada through Group Retirement Services.

3 Financial Advice in Canada, 2022 and CIRANO 2020 More on the Value of Financial Advisors.