Potential postal disruption. Prepare for possible mail delays due to Canada Post labour negotiations. You can use our mobile app or log in to my Sun Life to submit claims and/or check on your investments.

Quick links

Plan sponsors, consultants & group advisors

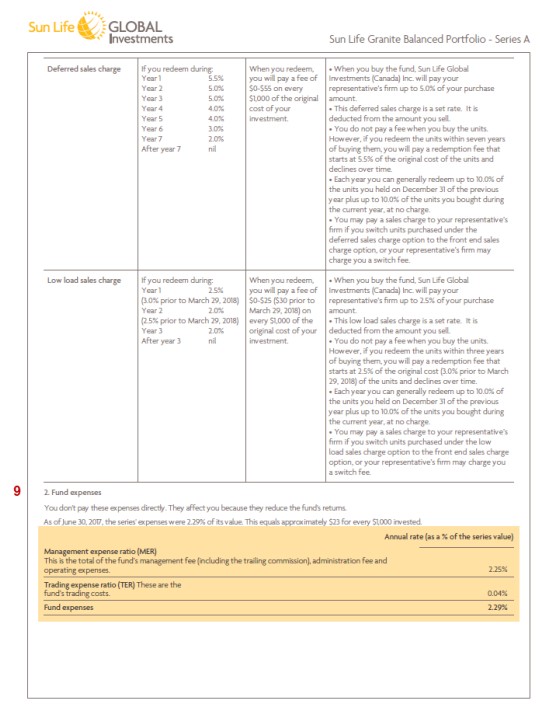

SLGI Asset Management Inc. is the investment manager of the Sun Life family of mutual funds. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the fund’s prospectus. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Sun Life Assurance Company of Canada is the issuer of accumulation annuities (insurance GICs), payout annuities and individual variable annuity contracts (segregated fund contracts). Any amount that is allocated to a segregated fund is invested at the risk of the contract owner and may increase or decrease in value. Sun Life Financial Trust Inc. is the issuer of guaranteed investment certificates.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada and Sun Life Financial Trust Inc. all of which are members of the Sun Life group of companies.