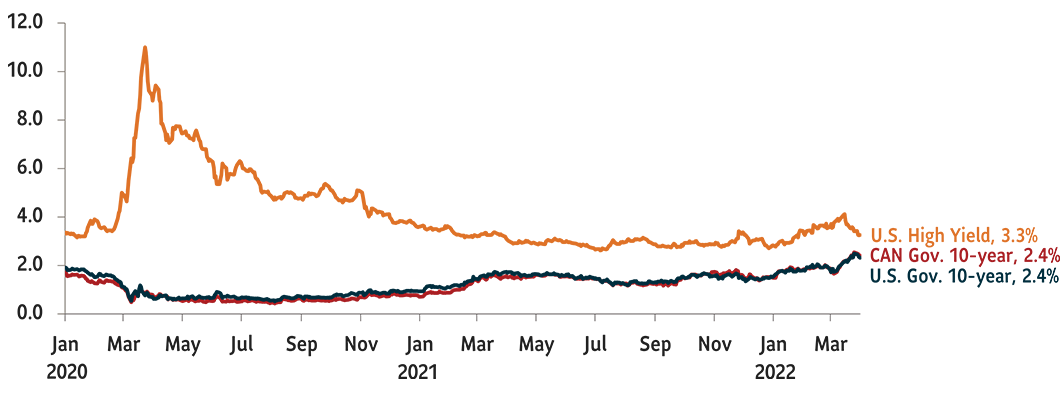

Source: Bloomberg. Data as of March 31, 2022.

Overweight U.S.: money flows into tech giants

In terms of the U.S., the country’s strong Q1 jobs report, and a 3.6% unemployment rate was overshadowed by war, inflation, and interest rate worries. Indeed, consensus forecasts suggest U.S. growth in Q2 will fall from 4.3% to 3.5%. However, U.S. households are sitting on US$2.5 trillion in excess savings. And while concerns over inflation and the Russia/Ukraine war appear to have hurt U.S. consumer confidence, strong household balance sheets could continue to support the economy. Further, the U.S. economy is not as exposed to Russia as Europe’s is. Hence, we may see U.S. large cap names hold up better in an uncertain market as investors seek potential security in stronger balance sheets.

Throughout much of the market’s two-year long rally off the March 2020 bottom, we have largely maintained our weighting in high-quality growth stocks. This worked as a counterweight to our exposure to value and cyclical stocks. And as noted in Q1 we added to our weighting in high quality growth, bringing us to a 2.2% overweight position in U.S. equities. This strategy worked well in Q1, with high-quality growth stocks leading the rebound following the market selloff in early March.

Europe: war, inflation – our largest underweight

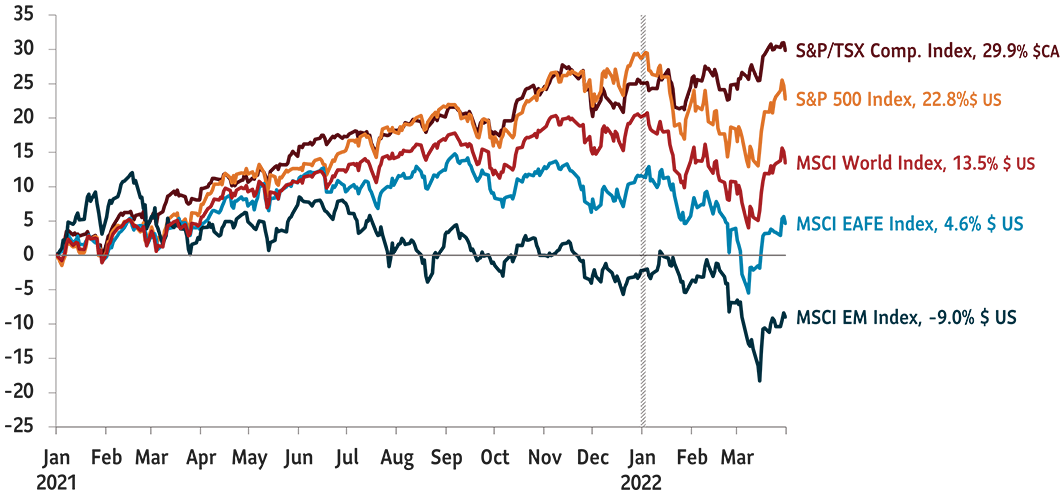

As noted, the crisis in Ukraine appears to pose a greater risk to Europe’s economy than it does to the U.S. In fact, the MSCI EAFE Index was down 6.96% in Canadian dollars on March 31, while the S&P was down 5.66%. Coming into the year, Europe already faced challenges from rising prices and slowing growth. But given the EU’s greater trade exposure to Russia, eurozone growth prospects have been cut, with Barclays reducing its forecast for 2022 by 1.7% to 2.4%.

Moreover, Germany’s economy (Europe’s export engine) shrank by 0.2% in the last quarter of 2021. The slowdown from the war could now push it into a shallow recession. Furthermore, Russia currently supplies 45% of Europe’s natural gas and 20% of its oil, and Germany has warned that its share of natural gas may have to be rationed. Even before rationing, rising energy prices had contributed to a 25.9% increase in Germany’s producer price index in the March. This drove prices up broadly, including for industrial metals, a key component in manufacturing and ultimately exports. Given the challenges the European economy faces, we remained 1.4% underweight to international equities with exposure to Europe.

Canada: neutral but positive on the economy

Going into the Russia/Ukraine war, Canada’s economic strength was reflected in a strong housing market and an employment rate that was back above pre-pandemic levels. As well, as the post-pandemic economy continues to improve globally, there has been a growing demand for commodities, particularly natural gas and oil. To help reduce Europe’s dependency on Russian oil, the federal government has agreed to increase oil exports by 4%. This would add about 300,000 barrels a day, to the record 4.7 million barrels a day the country was already producing. This, at time when benchmark West Texas Intermediate oil was trading in the US$100 a barrel range at quarter end, after hitting a high of US$123.70 on March 9.

The S&P/TSX Composite Index, with over a 25% weighting in energy and materials, has benefitted from the increased demand for commodities. In fact, while the S&P 500 was down 5.66% in Canadian dollars on March 31, the S&P/TSX was up 3.8%. However, given the volatility in commodity prices, and lack of diversification in the index, we remain neutral on Canada at this point.

China slows, COVID-19 spreads – neutral on EM

With memories of the 1997 Asian currency crisis in the background, Russia’s Ukraine invasion and subsequent collapse of the ruble caused stocks, bonds and currencies to fall sharply across emerging markets in Q1. The MSCI Emerging Markets Index was down 7% in Canadian dollars on March 31. Moreover, Russian equities, which MSCI Inc. no longer considers investible, were removed from the index.

Growth was declining in China prior to the outbreak of war. It had been slowed by the country’s zero-tolerance COVID-19 policy, supply chain bottlenecks and high debt levels in the real estate sector. China’s COVID-19 and supply chain problems came in focus near quarter-end, when the government all but locked down Shanghai, a city of 26 million people and a hub for finance and international business. The city is also home to the world’s largest container-shipping port.

China has cut interest rates to stimulate growth. However, China, accounts for about one-third of global manufacturing, and an economic slowdown will have a negative impact on global economy. More broadly, inflation, surging oil prices and a strengthening U.S. dollar could all combine to hurt emerging markets in the coming months. Hence, we held to our neutral weighting.