Global trade uncertainties and the threat of an economic slowdown impact markets worldwide

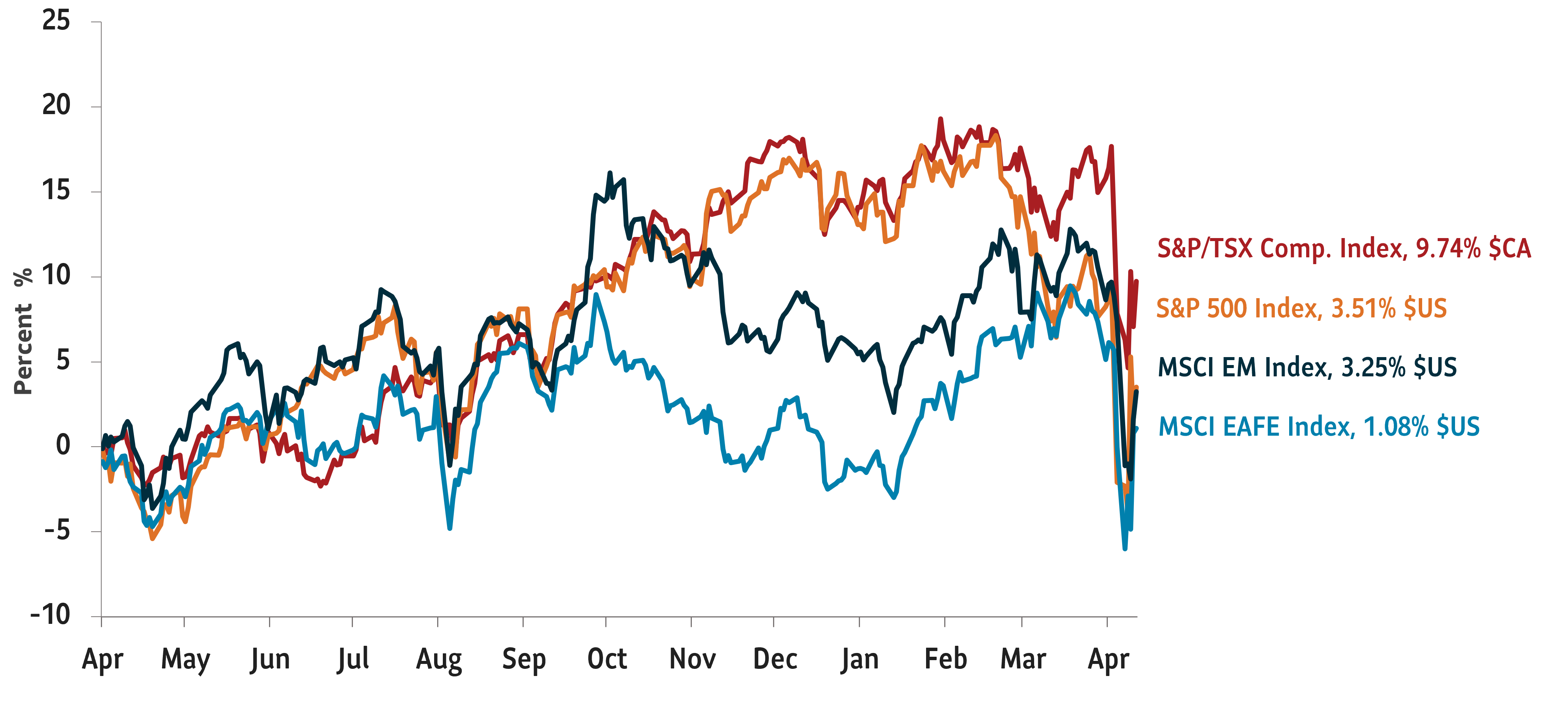

U.S. stocks largely lagged global peers in the first quarter (Q1) of 2025 due to extended valuations coming into the year and increasing earnings uncertainty due to potential tariffs. Over the quarter, there was an unexpected rotation – U.S. stocks, U.S. bond yields and the U.S. dollar fell while European equities and bond yields rose. AI-related tech stock valuations moderated, partly on reports that Chinese start-up, DeepSeek AI, could offer much cheaper AI versus tech giants.

On April 3, stock markets plunged on global tariff concerns. Both the benchmark S&P 500 Index and Canada’s S&P TSX Composite Index fell around 10% each over two days. International and emerging equities also suffered. Heightened volatility continues as the potential impact of tariffs play out with a possible full-scale trade war with the U.S. and China.

Graph 1: Drastic declines for equity markets in early April

Total return, indexed to 0 from April 1, 2024 to April 11, 2025