Q2 2022 | Market Update

Soaring inflation, rising interest rates and falling consumer confidence are hitting markets.

Potential postal disruption. Prepare for possible mail delays due to Canada Post labour negotiations. You can use our mobile app or log in to my Sun Life to submit claims and/or check on your investments.

Soaring inflation, rising interest rates and falling consumer confidence are hitting markets.

Opinions as of July 10, 2022

Financial markets across the world had a punishing quarter for the period ending June 2022. Two of the world’s major asset classes – equities and fixed income – fell in tandem leaving investors with few hiding places. Beneath the dismal market performance is the U.S. Federal Reserve’s (the Fed’s) behind-the-curve, but determined desire, to rapidly raise interest rates to suppress record inflation. After hiking rates by 25 basis points (bps) in March 2022, the Fed followed up with rate hikes of 50 bps and 75 bps in May and June of 2022.

Despite the Fed’s forceful efforts, inflation has been unrelenting. Defying all expectations to peak, May U.S. CPI jumped 8.6%, the highest since December 1981. To some extent, the Fed was dealt a bad hand. Factors outside its control – the Russia-Ukraine war that roiled commodity markets and China’s zero-Covid strategy that scrambled supply chains – have made fighting price pressures hard.

After belatedly curtailing quantitative easing, the Fed has now indicated that it may take borrowing costs beyond neutral to battle rising prices at the expense of output. The Fed is not the only central bank facing such a predicament. Central banks across the UK, Europe, Canada, and Australia are ratcheting the pace of interest rate hikes to combat price pressures.

Markets, however, are feeling the heat of aggressive tightening. The S&P 500 slumped 21% for the first half of 2022, entering a bear market. The tech-heavy Nasdaq fell harder, plummeting 30% for the six months ending June 2022. Similar falls characterized both international developed and emerging market equities, with the MSCI EAFE index falling 21% and the MSCI Emerging Markets index tumbling 19%.

Chart 1: Major markets take a hit in Q2

Total return, indexed to 0 as of January 1, 2022

Source: Bloomberg. Data as of June 30, 2022.

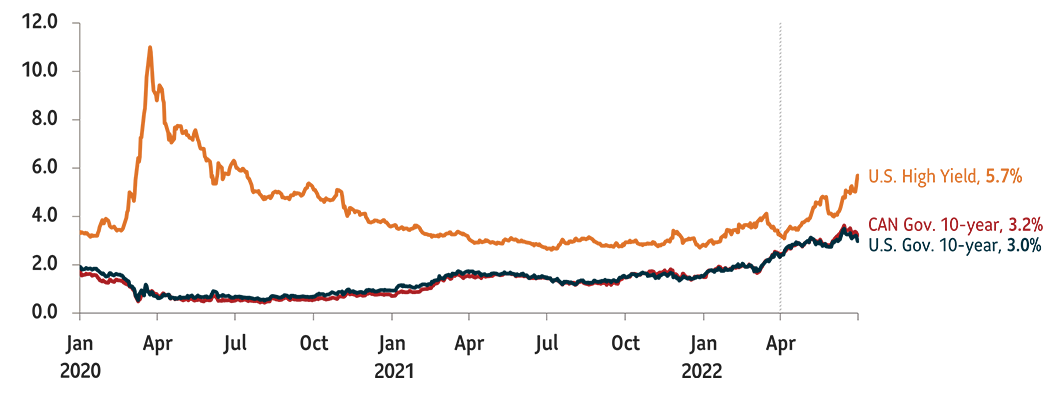

Fixed income markets faced their own troubles. The yield on 10-year U.S. treasuries spiked to 3.48% in mid-June, the highest level since April 2011, imposing substantial losses on fixed income investors. However, the yield on 10-year treasuries slid to 2.89% to end the June quarter of 2022, offering some respite to bruised bondholders (Chart 2). But this was cold comfort for bond investors who had enjoyed a nearly three-decade secular bull market in bonds.

Chart 2: 10-Yr Treasury yield spikes to a high last seen in 2011

Across the developed world, rapid growth gave way to a perceptible slowdown in the second quarter of 2022. In the U.S., both consumers and businesses are showing increasing signs of fatigue. For instance, the ISM Manufacturing PMI, which started 2022 in the high 50’s, has now trickled to the low 50’s. The index measuring new orders in May fell nearly 6 points to 49.2, the largest drop since May 2020.

Further, consumer spending, which accounts for nearly two-thirds of the U.S. economy, advanced just 0.2% in May, the slowest pace of monthly gains this year according to data from the U.S. Department of Commerce. Additionally, U.S. consumer confidence, as measured by the Michigan Consumer Sentiment Index, hit a multi-decade low in June. With consumers strained, we believe U.S. corporations may face headwinds to pricing power and that profit margins for S&P 500 companies could slip from their current elevated levels.

The prospects for growth in developed markets outside the U.S., especially in Europe, look even more weak. Buffeted by an acute energy crisis, Germany, which accounts for about a third of the eurozone’s economic activity, grew just 0.7% in the first quarter of 2022. This was the slowest pace of growth for any country in the European Union other than Italy during this period. Other rate sensitive economies, such as Australia and Canada, are also heading for a growth slowdown as interest rate hikes work their way into the economy.

Given the bearish backdrop, we continued to increase the defensive positions within the Granite portfolios to navigate the volatile environment. During the second quarter, we took advantage of market rallies to de-risk our portfolios, positioning them for a slowing growth environment. We trimmed our overweight position in U.S. equities and stayed underweight in international developed equities. We also maintained our neutral positioning in emerging markets equities in the face of rising rates and a strengthening U.S. dollar.

As the Fed continued to raise short-term rates, bond markets suffered a historic rout during the June quarter. At its lowest point mid-June 2022, the Bloomberg U.S. Aggregate Bond Index returned -12% for the year, far exceeding its next worst performance of -2.9% recorded in 1984 and denting a three-decade bull market in bonds.

Further, the constant push and pull between inflation expectations and recession fears with an aggressive Fed in the background meant that 2-Year Treasuries continue to catch up with 10-Year Treasury notes. The spread between these two maturities ended the quarter flat indicating yet another sign of slowing growth in the U.S.

Frantic action in bond markets drove significant fixed income volatility. The MOVE gauge of volatility sprang to its highest level since March 2020, as bond market participants struggled for direction. Other bond market indicators such as rising spreads for junk bonds and the cost of protecting corporate bonds against defaults point to further difficulties.

We believe policy makers will be laser focussed on tightening until inflation data, which is lagging in nature, has shown a sustained cooling trend while paying less attention to softening economic leading indicators. Under this scenario of rising risks and elevated borrowing costs, we have grown cautious on credit. We have maintained our underweight to U.S. and emerging market investment grade bonds. Given our concerns on economic risks, we reduced our position in high yield bonds over the quarter. On the other hand, we continued to add to high quality bonds, more specifically to our core Canadian bond component as yields became more attractive. In addition, we also maintained our overweight position in cash to deal with any possible episodes of elevated volatility in the wake of aggressive central bank action.

This article contains information in summary form for your convenience, published SLGI Asset Management Inc. Although this article has been prepared from sources believed to be reliable, SLGI Asset Management Inc. cannot guarantee its accuracy or completeness and is intended to provide you with general information and should not be construed as providing specific individual financial, investment, tax, or legal advice. The views expressed are those of the author and not necessarily the opinions of SLGI Asset Management Inc. Please note, any future or forward looking statements contained in this article are speculative in nature and cannot be relied upon. There is no guarantee that these events will occur or in the manner speculated. Please speak with your professional advisors before acting on any information contained in this article.