Q2 2023 | Market Update

Markets rise spurred by high hopes for artificial intelligence and receding recession fears

Potential postal disruption. Prepare for possible mail delays due to Canada Post labour negotiations. You can use our mobile app or log in to my Sun Life to submit claims and/or check on your investments.

Markets rise spurred by high hopes for artificial intelligence and receding recession fears

Equities shrugged off warnings about more rate hikes from central banks amid falling inflation. We feel markets are getting ahead of themselves as the full effects of interest rate hikes are yet to kick in.

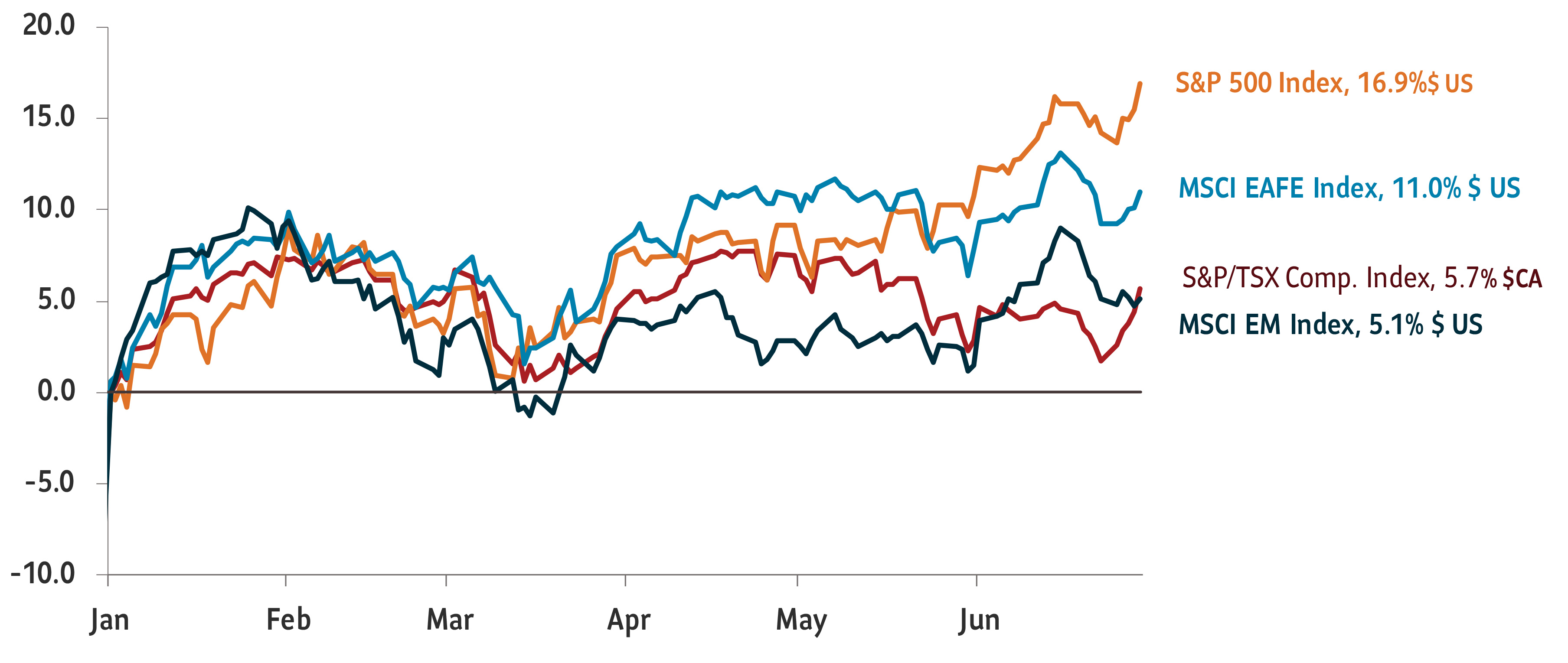

After falling most of last year, markets rose quickly in the first six months of 2023. Beginning in late 2022, markets sensed that inflation was receding and rose on expectations that central banks would cut interest rates by late 2023. Markets defied warnings from major central banks that interest rates would be higher for longer. This along with expectations about productivity gains from artificial intelligence fueled further rallies. In all, the tech-heavy Nasdaq had its best first-half calendar year performance since 1983. The S&P 500’s market capitalization jumped over USD$6 trillion.

Source: Bloomberg. Data as of June 30, 2023.

We remain cautious about this recent rally in equities. Firstly, equity gains, driven by a handful of tech stocks, comes on the backdrop of tightening monetary policy. Our proprietary index made up of global central banks shows that monetary policy has become restrictive but global manufacturing that closely tracks this tightening, is yet to fall sharply. Secondly, our scenario of higher rates for the rest of 2023 is beginning to play out. Despite the downward trend in inflation, price growth remains above target. As of early July, central banks across North America, Europe and the U.K. reiterated their inflation-fighting stance with further interest rate hikes.

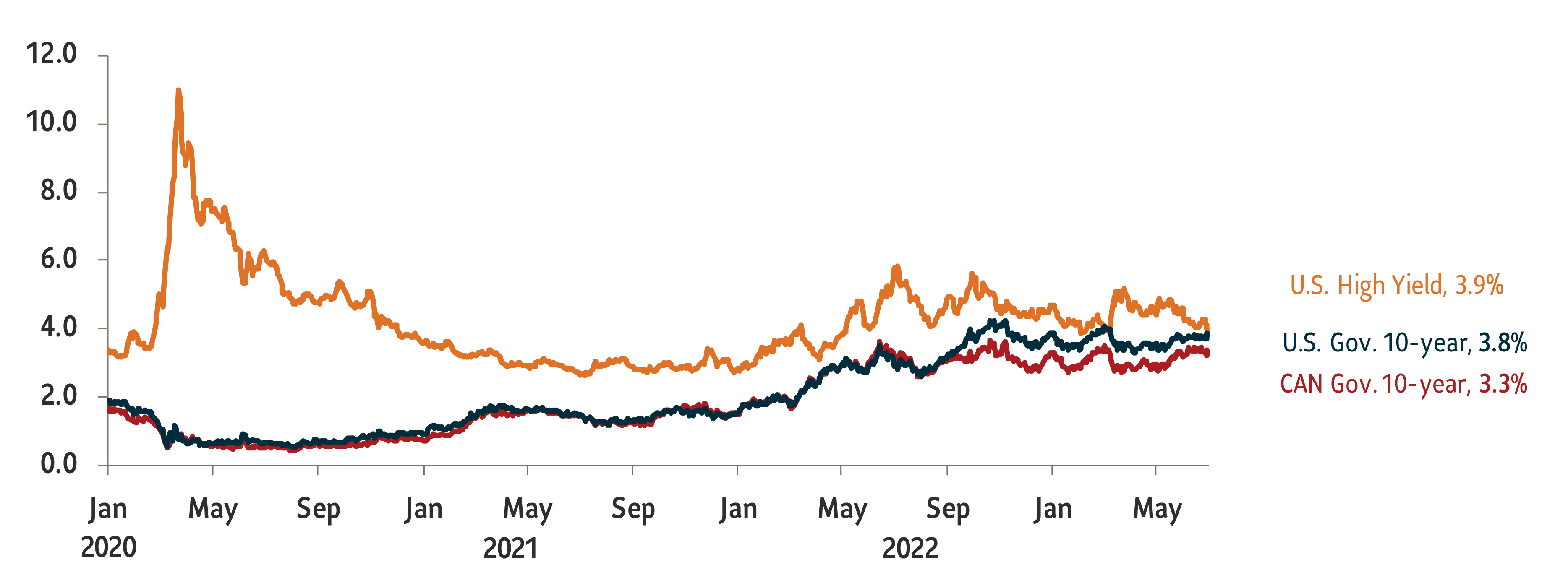

Source: Macrobond. Data as of June 30, 2023.

The U.S. and Canadian economies have remained resilient so far and dodged expectations of a recession in mid-2023. But looking at labour market trends – rising unemployment claims and slowing hiring rates – we feel a slowdown has been delayed and not entirely avoided. We expect further challenges to the economy as pent-up consumer savings dwindle and consumers tighten their wallets. In Europe and China, economic growth is already facing headwinds.

Driven by sentiment and flows, the stellar first half for equities, has also left valuations stretched, especially in the U.S. technology sector. That is making us cautious about equities. On the other hand, we favour high quality fixed income. Despite a few rate hikes on the horizon, we estimate interest rates are closer to the peak. We see conditions turning favorable to high-quality bonds in case the economy cools.

Positioning

Equities: We remain underweight equities as key global central banks seem focused on beating inflation even if it harms the economy. Our underweight position in equities is spread across all geographies including Canadian, U.S., and global developed and emerging markets.

Fixed income: We favour bonds as we believe interest rates are close to peak levels. Within bonds, we favour Canadian investment grade bonds that can better withstand credit risks. In case the economy slows down or enters a recession, we see high-quality bonds adding diversification to portfolios. On the other hand, we are underweight risky credit and global high yield bonds, where yield spreads are tight and risk-adjusted return prospects remain less advantageous. We also remain neutral on cash.

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by SLGI Asset Management Inc. These views are subject to change and are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. This commentary is provided for information purposes only and is not intended to provide specific individual financial, investment, tax or legal advice. Information contained in this commentary has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy.

This commentary may contain forward-looking statements about the economy and markets, their future performance, strategies or prospects or events and are subject to uncertainties that could cause actual results to differ materially from those expressed or implied in such statements. Forward-looking statements are not guarantees of future performance and are speculative in nature and cannot be relied upon.