Source: Bloomberg. Data as of September 30, 2024.

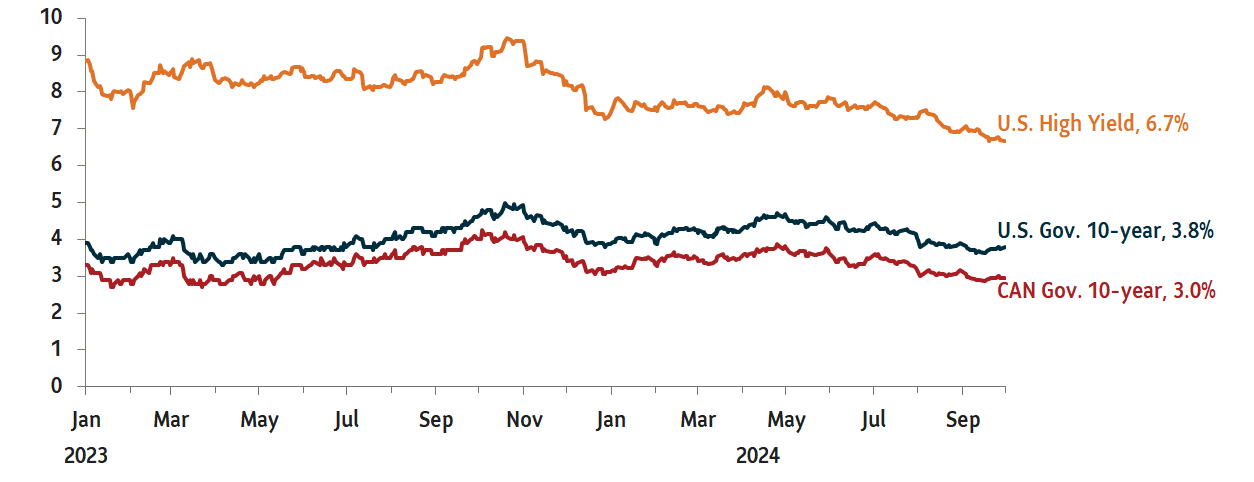

While the U.S. economy has been strong, we are concerned about record deficits in the country. U.S. budget deficits now equal about 7% of GDP in 2024, a record figure for an expansionary phase of the economy. While such deficits may be sustainable in the short term, we fear bond markets could quickly turn volatile in the medium-term should certain tail risks materialize.

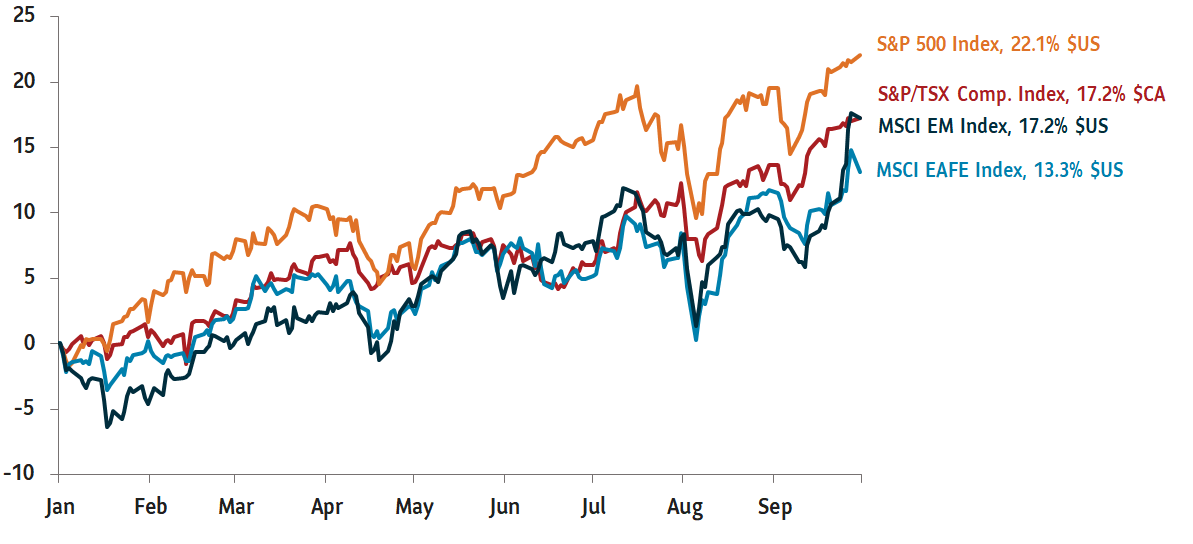

As for our tactical positioning, we hold a modest overweight position to U.S. equities as we think the U.S economy may avoid a recession. While equity valuations are still high in the U.S., we think valuations are not unreasonable outside the technology sector. We are also modestly overweight international equities as the rate-cutting cycle could provide a tailwind to these assets. We also hold an overweight position in commodities. We think an exposure to precious metals such as gold could be a good hedge to equities should a recession materialize or should inflation rise again. We are also neutral towards bonds.

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by SLGI Asset Management Inc. These views are subject to change and are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. This commentary is provided for information purposes only and is not intended to provide specific individual financial, investment, tax or legal advice. Information contained in this commentary has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy.

This commentary may contain forward-looking statements about the economy and markets, their future performance, strategies or prospects or events and are subject to uncertainties that could cause actual results to differ materially from those expressed or implied in such statements. Forward-looking statements are not guarantees of future performance and are speculative in nature and cannot be relied upon.