Source: Bloomberg. Data as of December 31, 2024.

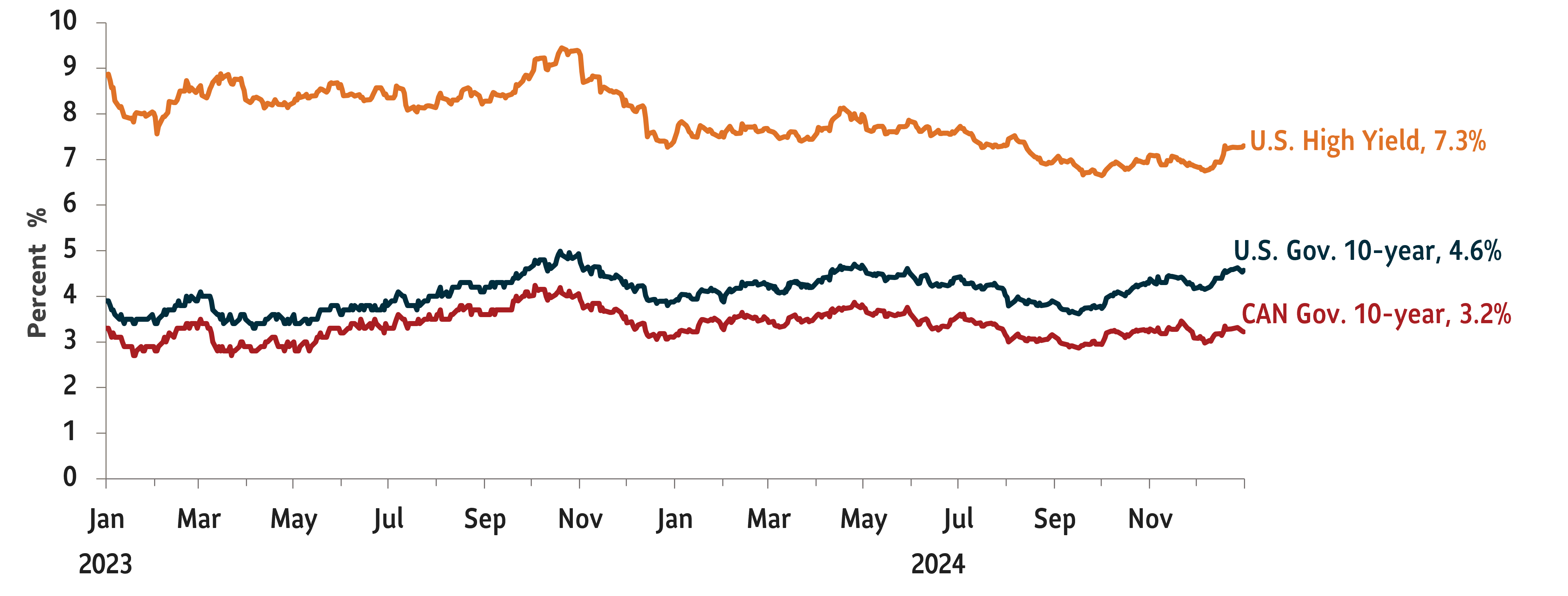

We think markets are correct in reducing their expectations of upcoming interest rate cuts from the Fed. December’s labour market report confirmed our predictions that the U.S. economy is in good shape. A gain of about 256,000 jobs in December, a low unemployment rate of 4.1%, and inflation stuck between 2% and 3% alongside lower immigration could warrant fewer rate cuts. We now think a “no landing” scenario - resilient growth and inflation slightly above target - as the most likely outcome for the U.S. over the next few quarters. We expect the Bank of Canada to cut rates twice in the first half of 2025 as it tries to balance slowdown worries against a falling domestic currency.

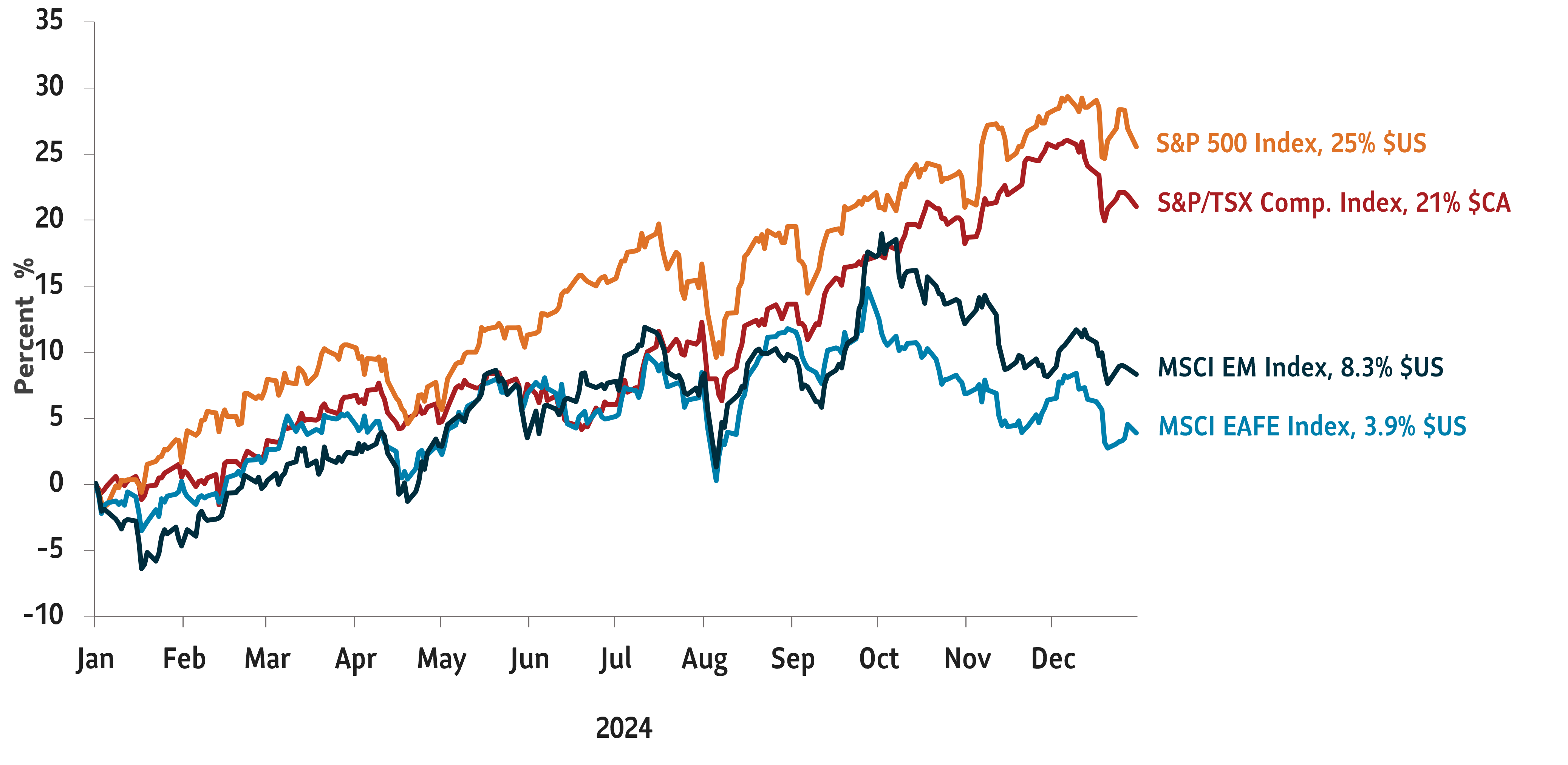

As for our tactical positioning, we are overweight U.S. equities. Some of our sentiment models have indicated that markets are overly pessimistic despite positive economic data. Within equities, we are positive on the U.S. semiconductor sector, where earnings growth has risen to meet expectations and momentum continues. While valuations have trended higher for large cap technology stocks, we expect the earnings growth and rally to broaden to other sectors. While we are largely neutral on bonds, we think they’re getting more attractive despite a chance that yields may rise a bit from current levels.

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by SLGI Asset Management Inc. These views are subject to change and are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. This commentary is provided for information purposes only and is not intended to provide specific individual financial, investment, tax or legal advice. Information contained in this commentary has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy.

This commentary may contain forward-looking statements about the economy and markets, their future performance, strategies or prospects or events and are subject to uncertainties that could cause actual results to differ materially from those expressed or implied in such statements. Forward-looking statements are not guarantees of future performance and are speculative in nature and cannot be relied upon.