By: SLGI Tax & Estate Planning Team

Introduction

Over the years, governments have adopted various tax measures to allow retired taxpayers to split income with their spouses or common-law partners (CLP). Theses measures exist to help couples lower their tax bill when an economic disparity exists. It allows the higher income earning spouse/CLP to shift some of their income into the hands of their spouse/CLP, thereby benefiting as a family from our graduated tax system.

This article looks at some of the measures that allow couples to split their income in retirement.

Pension income splitting

A spouse/CLP can share up to 50% of their eligible pension income with their spouse. To split pension income, a joint election is filed with each spouse’s income tax return. What’s important to note is that income is split for tax purposes, only. No money changes hands.

Eligible pension income

The following qualify as eligible pension income for individuals in the year they turn 65 or later:

- Registered pension plan lifetime retirement benefits;

- Life annuity payments from a pension plan, including income from life income funds (LIFs) and locked-in retirement income funds (LRIFs);

- Registered Retirement Income Fund (RRIF) payments (any portion transferred into an RRSP, another RRIF, or used to purchase an annuity does not qualify);

- RRIF payments received from a spouse’s death;

- Annuity payments from an RRSP, a RRIF or from a deferred profit-sharing plan (DPSP);

- Payments from a pooled registered pension plan (PRPP);

- Income from non-registered annuities and insurance guaranteed investment certificates (GICs);

- Certain foreign pension payments.

For those who are under 65 for the entire tax year, qualified pension income is more limited, and includes:

- Registered pension plan lifetime retirement benefits (not applicable in the Quebec tax statement);

- Life annuity payments from a superannuation or pension plan (not applicable in the Quebec tax statement);

- Payments from a RRIF, an RRSP, DPSP, PRPP or of an annuity received because of a spouse’s death (not applicable in the Quebec tax statement);

- Annuity payments from the Saskatchewan Pension Plan;

- Certain foreign pension payments (not applicable in the Quebec tax statement).

Pension income amount

The pension income amount is a federal, non-refundable tax-credit of up to $2,000 which a person can claim if they have eligible pension income. The maximum federal tax savings available is $300 ($2,000 × 15%). As well, the provinces and territories have their own pension income credits, which can increase the tax savings. If one spouse has eligible pension income and the other does not, pension income splitting allows each spouse to claim this credit, resulting in family tax savings.

See section above for what qualifies as eligible pension income for the purpose of the pension income amount.

Note: Income from Old Age Security (OAS) and the Canada or Quebec Pension Plan (CPP/QPP) does not qualify for pension income splitting or the pension income amount.

Sharing CPP/QPP

Another tool available to families to reduce their household tax bill is CPP/QPP pension sharing. Like pension income splitting (discussed above), the goal is to reduce the family's overall tax rate by shifting income from the higher income spouse to the lower income spouse. Unlike pension income splitting, money actually does change hands.

To qualify for CPP/QPP retirement pension income sharing, both spouses/CLPs must be:

- 60 years of age or older;

- Living together and must have lived together while contributing to CPP/QPP, and;

- Receiving or have applied for their CPP/QPP retirement pension. If only one person contributed to CPP/QPP, this requirement must be met by the spouse/CLP who contributed to CPP/QPP.

How does it work?

CPP/QPP pension sharing does not change the total CPP/QPP that a couple can receive. It usually changes the amount that each person receives, so can often result in tax savings as a family.

The part of CPP/QPP that can be shared is based on the number of months you have lived together during the “joint contributory period.” The joint contributory period starts when the older spouse/or CLP turns 18 and ends when both starts to receive CPP/QPP pensions.

Example #1

John and Jill are CLPs and both receive their CPP retirement pensions. John is one year older than Jill and they both decide to take their CPP starting at age 65. Without CPP pension sharing, John’s CPP retirement pension is $1,000 per month while Jill’s is $500 per month. Since the joint contributory period began when John turned 18 and ended when Jill turned 65, their joint contributory period is 48 years. The amount of CPP that can be shared depends on how many years John and Jill have lived together as a part of their joint contributory period. For example, if John and Jill have lived together for 36 years (75% of their joint contributory period) then $400 of their retirement pension can be shared ($500, representing the difference between John’s and Jill’s CPP/QPP retirement pensions x 75% = $375). Half of that amount, $187.50, can be subtracted from John’s retirement pension and added to Jill’s retirement pension.

Pension sharing can stop at any time by a submitting a cancellation request, which must be signed by both spouses or CLPs. It will also stop upon death, separation or divorce.

Example #2

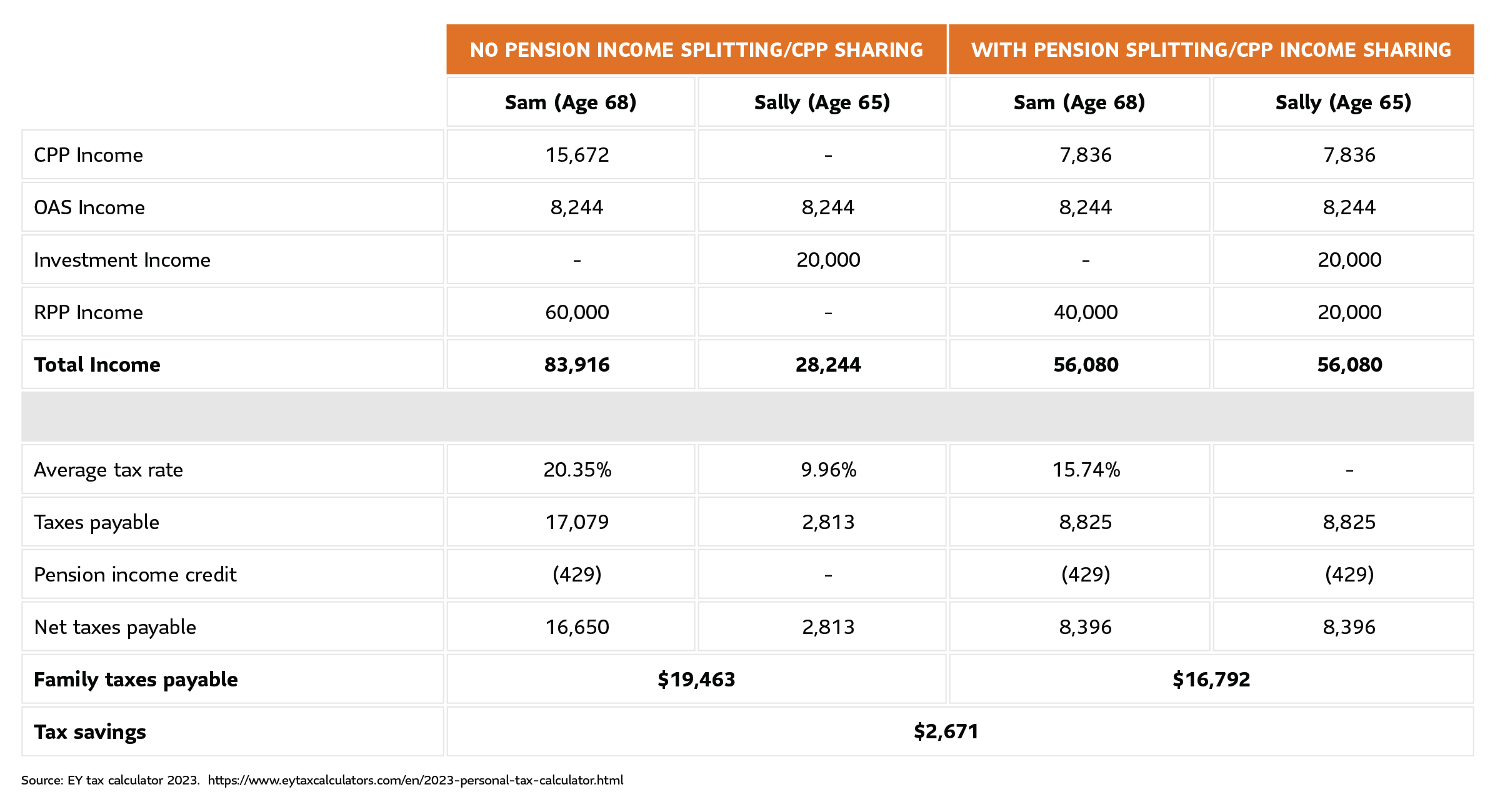

Sam and Sally reside in Ontario and have lived together long enough to allow for maximum CPP pension sharing. Sam's RPP income is eligible pension income for the purposes of pension income splitting. The table below shows the tax savings they gain from splitting their pension and sharing their CPP income. Please note that for this example, tax rates and credits used are Federal and Ontario rates for 2023.