In retirement, there are three potential threats to your financial well-being:

- Longevity risk: You may outlive your savings

- Inflation risk: The cost of living may be higher than you planned for

- Market risk: Market volatility may decrease the value of your portfolio

- Sequence of returns risk: A subset of market risk where the market falls just before or early in your retirement, making it difficult to recover your savings

Market risk-specifically sequence of returns risk-is perhaps the most unpredictable and harmful to your financial well-being. This is especially true at or around your retirement date.

That’s where a Cash Wedge Strategy can help.

What is it?

A Cash Wedge Strategy can help to steady your retirement income in times of volatility. The goal is to allocate a portion of your portfolio to cash to help meet your current income needs, while still diversifying the rest of your portfolio so you can benefit from participating in the market.

Who should consider it?

Retirees who rely on their portfolio for a regular source of income, and are concerned with potential market volatility might consider employing a Cash Wedge Strategy.

What are the benefits?

Employing a Cash Wedge Strategy can help you:

- Reduce the impact of sequence of returns risk on your portfolio

- Increase portfolio liquidity to better manage large purchases or unexpected expenses

- Ensure short term income is not subject to market declines

Sequence of returns is the order in which gains or losses happen in a portfolio—which is particularly important as you begin to draw income from your portfolio (withdrawal phase).

Exhibit 1 shows what happens to an investment of $100,000 over a 10-year period in the accumulation phase when an investor is saving for retirement. The three hypothetical scenarios all have average annual returns of 7%, with returns happening in a different order, but since no money is withdrawn they result in same ending dollar value of $196,717 in all three cases.

Exhibit 1: Sequence of returns in accumulation phase

| Accumulation Years |

Scenario 1 (Steady returns) |

Scenario 2 (Good early returns) |

Scenario 3 (Poor early returns) |

|---|---|---|---|

| 1 | 7% | 10% | -7% |

| 2 | 7% | 14% | -4% |

| 3 | 7% | 13% | 21% |

| 4 | 7% | 23% | -1% |

| 5 | 7% | -4% | 10% |

| 6 | 7% | 10% | -4% |

| 7 | 7% | -1% | 23% |

| 8 | 7% | 21% | 13% |

| 9 | 7% | -4% | 14% |

| 10 | 7% | -7% | 10% |

| Avg. Annual Return | 7% | 7% | 7% |

| Portfolio Value | $196,717 | $196,717 | $196,717 |

Exhibit 2 shows what happens to $100,000 investment over a 10-year period when an investor is withdrawing $7,000 per year. While the average return over 10 years is 7% for all three hypothetical scenarios, the order of returns does make a difference. Negative returns early in the 10-year period (Scenario 3) result in significantly less capital at the end of the investment period.

Exhibit 2: Sequence of returns in withdrawal phase

| Accumulation Years |

Scenario 1 (Steady returns) |

Scenario 2 (Good early returns) |

Scenario 3 (Poor early returns) |

|---|---|---|---|

| 1 | 7% | 10% | -7% |

| 2 | 7% | 14% | -4% |

| 3 | 7% | 13% | 21% |

| 4 | 7% | 23% | -1% |

| 5 | 7% | -4% | 10% |

| 6 | 7% | 10% | -4% |

| 7 | 7% | -1% | 23% |

| 8 | 7% | 21% | 13% |

| 9 | 7% | -4% | 14% |

| 10 | 7% | -7% | 10% |

| Avg. Annual Return | 7% | 7% | 7% |

| Portfolio Value | $100,000 | $112,566 | $83,603 |

These illustrations do not reflect any taxation, fees, or expenses.

Clearly, the sequence of returns is very important in the early years of retirement. Negative markets early on are far worse than negative markets later. In fact, they can mean that your savings may not last the full length of your retirement.

How does the Cash Wedge Strategy work?

This approach can help protect your portfolio in times of market volatility, while still allowing you to participate in the markets.

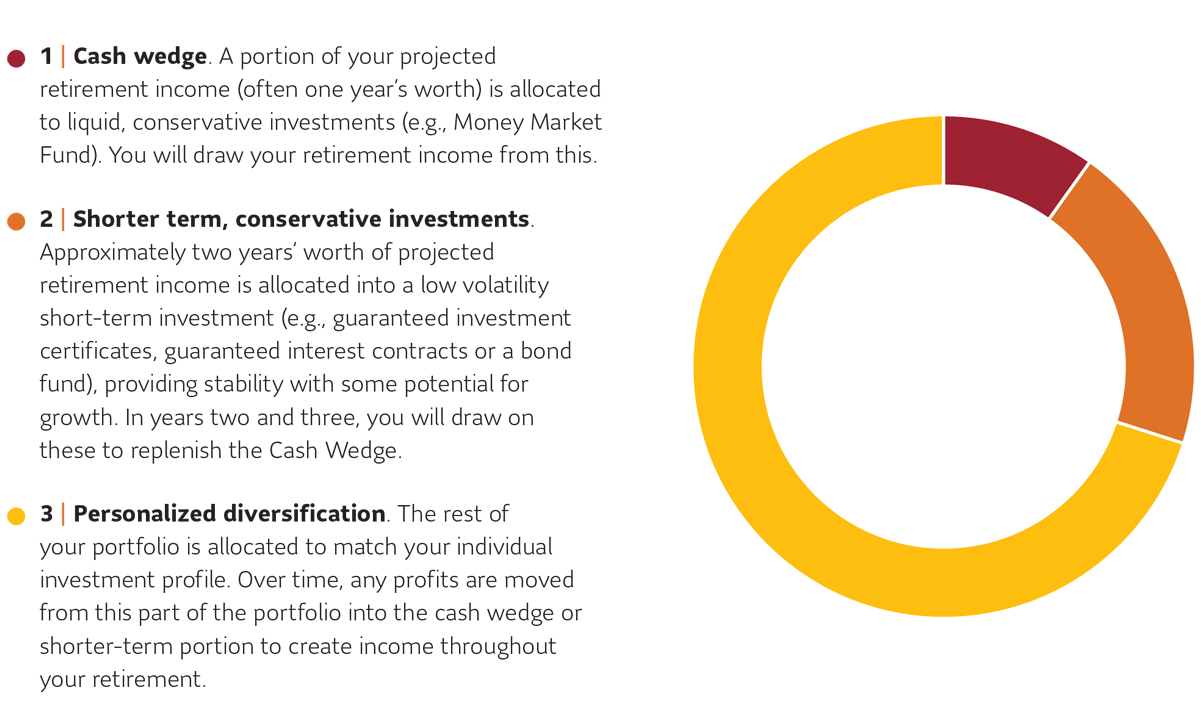

Your advisor can help allocate your retirement portfolio into three components:

Speak to your advisor about implementing a Cash Wedge Strategy to minimize your sequence of returns risk as you enter retirement.

This content is provided for information purposes only and is not intended to provide specific individual financial, investment, tax, accounting or legal advice and should not be relied upon in that regard and does not constitute a specific offer to buy and/or sell securities. Information contained in this document has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy.

Case studies presented are hypothetical in nature and are not intended to be representative of actual client scenarios. Each client will have individual personal income or tax situations that may have additional complexities outside the scope of materials discussed in this document. Investors should seek professional investment advice and/or the advice of a tax advisor for a comprehensive review of their personal situation prior to implementing any investment strategy.