In brief

- A misalignment between investors and their asset managers potentially could be causing them to forfeit the full value of active management.

- The disconnect is evident through mismatched investment time horizons, where investors expecting alpha over increasingly short time periods don't invest through a full market cycle, often leaving alpha on the table.1

- Correcting the misalignment by helping investors define long-term objectives and more effectively assess and measure active skill could result in better investment outcomes.2

Through all the talk of market short-termism and the value proposition of active management, it's clear that investors and asset managers are out of sync, particularly on investment time horizons. Investors who expect alpha over increasingly short time periods may be leaving alpha on the table by failing to give active managers the full market cycle they need to potentially outperform.

For investors, the danger of that misalignment is not only giving up long-term value but also potentially falling short of their desired outcomes. Advisors and intermediaries can be part of the solution, by setting expectations for what active management is meant to deliver and using effective metrics to identify active skill and align it with their clients' long-term objectives.

What's the impact?

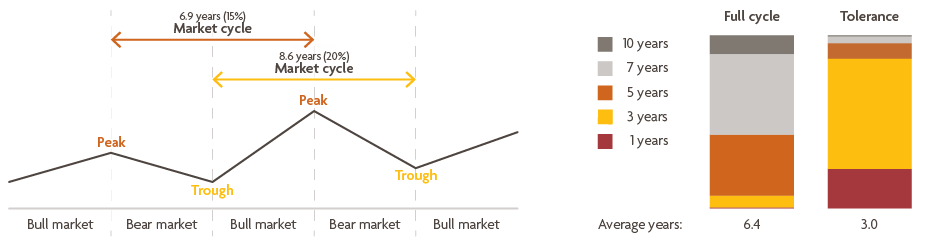

The impetus for correcting the misalignment comes from understanding its impact on investors. What we find troubling is that investors are making short-term decisions despite having long-term objectives, and their shorter investment time horizons don't match the market cycle needs of most active managers. Our industry seems to have developed an intolerance for underperformance, with active managers being measured on shorter time frames — often three years or less, despite the average market cycle being seven to 10 years.

This is a challenge for advisors and intermediaries, who feel pressured to respond to the short-term performance demands of their clients. Yet even here we see a disconnect. An MFS study found that roughly three-quarters of retail advisors around the globe believe that longer market cycles allow more opportunity to distinguish an active manager's skill from luck. But most would only tolerate underperformance for an average of three years before initiating a search to replace a manager.3

Watch for fundamental shifts

Here are a couple of examples of industries where we have seen fundamental changes to business models that have required a change in our investment thesis.

Throughout this low-growth economic cycle, Internet platforms and technology have steadily disrupted businesses across sectors worldwide, rapidly changing the economics of many industries. For example, video game publishers were historically largely single-product companies and often highly dependent on having a hit game, leading to highly variable cash flows. In recent years, the industry business model changed as the Internet afforded publishers the ability to move from physical discs and distribution through retailers to an all-digital direct-to-consumer distribution model. The result was a significant decline in costs and a shift up in margins along with less dependence on the console cycle.

However, over the past 18 months a new business model has arisen: free online multiplayer games. As MFS US growth portfolio manager Eric Fischman expressed in a global sector meeting, “Fortnite may have changed the equation by offering a free game and a high degree of player interactivity. The publisher makes money on in-game purchases versus upfront payment for the game itself. This potentially alters the economics of the industry and the long-term growth drivers.”

Another example where fundamentals have changed is the cruise line industry. Cruise line operators have always possessed high barriers to entry, such as the necessity of significant upfront capital expenditures — cruise ship construction costs range from $500 million to $1.5 billion each — scale and brand equity. However, the operators have been highly leveraged franchises dependent on the consumer’s willingness to spend on leisure, resulting in a wide range of cash flow outcomes and volatile financial returns.

A broader change affecting the industry has been society’s growing tendency to spend more on experiences than physical goods — as I wrote about last month — and better capital management. The industry is seeing unit growth from a variety of age cohorts, from retirees to millennials to even Generation Z. As MFS US credit analyst Lauren McCarthy shared, “The real cash flow growth has come from increased onboard revenue generated by on-ship entertainment such as wave riders, water slides, etc. The cruise ships are getting larger and better, and thus the ship itself is becoming part of the experience, along with attractive routes.” This translates into potentially better free cash flow via multiple monetization levers compared with past periods.

Investing may be simple, but it also may be hard. Simply put, cash flows drive stock and bond prices over the long term. The hard part is remaining disciplined, focusing on information or data points that are material while ignoring the rest.

Source: “Defining a Market Cycle,” Manning & Napier, Aug. 2012.

Source: 2016 MFS Active Management Sentiment Study. Data represent 300 US advisors surveyed.

Q [Full cycle]: First, what is your definition of a full market cycle?

Q [Tolerance]: How long are you willing to tolerate the underperformance of external asset managers before initiating the search for a replacement manager?

Based on short-term pressures, investors and their advisors could be buying actively managed strategies at their peak just after a period of outperformance or selling low just after a period of underperformance. This intolerance for underperformance could eclipse an active manager's potential to tap into good entry points for investment at market inflection points. Still, while the effects of the misalignment are troubling, this is an opportunity to course correct.

Rethink, revisit, reassess

Here's where the solution begins. We believe advisors and intermediaries need to rethink the way they identify and measure active skill for their clients and reassess what truly drives successful investment outcomes.

Consider that 68% of retail advisors surveyed use a period of five years or less to select active managers, while 79% use that same timeframe to measure the performance of, and decide whether to retain, active managers. Moreover, more than three-quarters of retail advisors and professional buyers consider manager underperformance relative to their peers or benchmark cause for manager review/replacement.5

To change that performance paradox, we need to reset expectations for how active management expects to deliver over a full market cycle. As part of the process, investment professionals need to keep the hire/selection criteria for their active managers the same as their measurement/retention criteria. While the selection process might include a deeper dive on a manager's investment process, portfolio construction and even culture, the periodic evaluation criteria often focus more on short-term performance. This is where we need to step back and measure what matters, not what's easy.

Also, set definite standards and time frames over which to expect outperformance and accept underperformance. Look for a solid process, not personalities. Most important, review evaluation standards with clients and be sure to set a context for measurement — that is, at what point in the market cycle you hired and/or replaced a manager. During periods of increasing volatility, underperformance could reflect active risk management, which sometimes means going against the grain in an effort to mitigate risk.

Identifying skill: Understand what impacts the outcome

Advisors and intermediaries are tasked not only with finding active skill, but also aligning it with client objectives. This requires truly understanding what drives investment outcomes. We believe that for clients with long-term objectives, a long-term investment philosophy tops the list.

But how do you identify who is truly long-term, beyond looking at an active manager's stated philosophy? What are the key metrics? We believe the best reflection of an active manager's long-term philosophy and active skill is a long holding horizon. In fact, one study showed that funds with longer holding horizons have generated better risk-adjusted returns than funds with shorter holding horizons, outperforming them by 2.4%–3.8% annually.6

Holding horizon matters because we believe it shows that an active manager has done robust research, identified what they believe are strong long-term fundamentals and thus built conviction in their investment thesis. That conviction isn't just active share or concentration, but rather a willingness to commit client capital long term based on what they believe is an analysis advantage — insight that the market could potentially reward.

As we consider holding horizon and the value of a long-term view, we hear more about sustainability, responsible investing and this growing trend of ESG — environmental, social and governance factors. We believe these should not be separate outcomes, but rather, exactly what you should expect when you hire a skilled active manager with a long view, because that manager should know what they own on your behalf. Active managers should be doing their fundamental research, and, in addition to assessing financial factors, they should be engaging with companies to understand which E, S or G factors could put them at risk, all as part of their process of evaluating the future success of the business. We believe this is the active skill needed to drive responsible ownership and sustainable investing for clients.

Correcting the misalignment between investors and asset managers will take time. But it's time to recognize the value and impact of achieving that active alignment. For advisors and intermediaries, reassessing the way you identify active skill, rethinking the way you measure it and recognizing the value of a long-term philosophy could support better long-term value creation for clients and potentially help with their investment outcomes.

Methodology

About the MFS active management sentiment study3

For the past three years, MFS Investment Management® has partnered with CoreData Research, an independent third party market research provider, to conduct this survey of advisors, institutional investors and professional buyers in North America, Latin America, Europe and the Asia-Pacific region. The 2016 survey results represented here include the views of 125 professional buyers across the United States, Canada, the United Kingdom, Germany and Switzerland and 500 retail advisors across the US, Latin America and Italy.

Endnotes

1 Alpha is a measure of the portfolio's risk-adjusted performance. When compared to the portfolio's beta, a positive alpha indicates better-than-expected portfolio performance and a negative alpha worse-than-expected portfolio performance. Beta is a measure of the volatility of a portfolio relative to the overall market. A beta less than 1.0 indicates lower risk than the market; a beta greater than 1.0 indicates higher risk than the market. It is most reliable as a risk measure when the return fluctuations of the portfolio are highly correlated with the return fluctuations of the index chosen to represent the market.

2 MFS believes skilled active managers show one or more of the following behaviors:

3 They demonstrate conviction through low portfolio turnover and high active share. They add value in volatile markets. They integrate research and reward collaborative thinking. 3 2016 MFS Active Sentiment Study

4 ibid

5 ibid.

6 Source: "Holding Horizon: A New Measure of Active Investment Management," Lan, Chunhua; Moneta, Fabio and Wermers, Russ, American Finance Association Meetings 2015 Paper. Short horizon funds, on average, hold stocks for 1.91 years, whereas long-horizon funds hold stocks for 6.85 years. Universe is US actively managed equity mutual funds, which was created through the intersection of Thomson Reuters mutual fund holdings database and the Center for Research in Securities Prices (CRSP) mutual fund database. Final sample was 2,969 equity funds.

Disclaimer by MFS Investment Management:

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice from the Advisor.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.

Issued in the United States by MFS Institutional Advisors, Inc. (“MFSI”) and MFS Investment Management. Issued in Canada by MFS Investment Management Canada Limited. No securities commission or similar regulatory authority in Canada has reviewed this communication. Issued in the United Kingdom by MFS International (U.K.) Limited (“MIL UK”), a private limited company registered in England and Wales with the company number 03062718, and authorized and regulated in the conduct of investment business by the U.K. Financial Conduct Authority. MIL UK, an indirect subsidiary of MFS, has its registered office at One Carter Lane, London, EC4V 5ER UK and provides products and investment services to institutional investors globally. This material shall not be circulated or distributed to any person other than to professional investors (as permitted by local regulations) and should not be relied upon or distributed to persons where such reliance or distribution would be contrary to local regulation. Issued in Hong Kong by MFS International (Hong Kong) Limited (“MIL HK”), a private limited company licensed and regulated by the Hong Kong Securities and Futures Commission (the “SFC”). MIL HK is a wholly-owned, indirect subsidiary of Massachusetts Financial Services Company, a U.S.-based investment advisor and fund sponsor registered with the U.S. Securities and Exchange Commission. MIL HK is approved to engage in dealing in securities and asset management-regulated activities and may provide certain investment services to “professional investors” as defined in the Securities and Futures Ordinance (“SFO”). Issued in Singapore by MFS International Singapore Pte. Ltd., a private limited company registered in Singapore with the company number 201228809M, and further licensed and regulated by the Monetary Authority of Singapore.

Issued in Latin America by MFS International Ltd. For investors in Australia: MFSI and MIL UK are exempt from the requirement to hold an Australian financial services license under the Corporations Act 2001 in respect of the financial services they provide to Australian wholesale investors. MFS International Australia Pty Ltd (“MFS Australia”) holds an Australian financial services license number 485343. In Australia and New Zealand: MFSI is regulated by the SEC under U.S. laws and MIL UK is regulated by the U.K. Financial Conduct Authority under U.K. laws, which differ from Australian and New Zealand laws. MFS Australia is regulated by the Australian Securities and Investments Commission.

Disclaimer by Sun Life Global Investments (Canada) Inc:

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the fund's prospectus. Mutual funds are not guaranteed, their values change frequently and past performance may be repeated.

This article was first published in the United States by MFS Institutional Advisors, Inc. on February 2018 and is distributed in Canada by Sun Life Global Investments (Canada) Inc., with permission. This commentary contains information in summary form for your convenience. Although this commentary has been prepared from sources believed to be reliable, Sun Life Global Investments (Canada) Inc. cannot guarantee its accuracy or completeness and is intended to provide you with general information and should not be construed as providing specific individual financial, investment, tax, legal or accounting advice and should not be relied upon in that regard and does not constitute a specific offer to buy and/or sell securities.

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by Sun Life Global Investments (Canada) Inc. or sub-advised by MFS Institutional Advisors, Inc and MFS Investment Management. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. Information presented has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy. This document may contain forward-looking statements about the economy and/or markets; their future performance, strategies or prospects. Forward-looking statements are not guarantees of future performance, are speculative in nature and cannot be relied upon. They involve inherent risks and uncertainties so it is possible that predictions, forecast, and projections will not be achieved. A number of important factors could cause actual events or results to differ materially from those expressed or implied in this document. Please speak with your professional advisor before acting on any information contained in this document.

© Sun Life Global Investments (Canada) Inc., 2019.

Sun Life Global Investments (Canada) Inc., MFS Institutional Advisors Inc. and MFS Investment Management Canada Limited are all members of the Sun Life Financial group of companies.