A smaller-than-expected rate increase underscores a high interest rate environment

In the fight against elevated inflation, the Bank of Canada (BoC) boosted its key interest rate by 50 basis points (bps) in October over a widely expected 75 bps hike. The lower than expected increase comes as the central bank tries to balance the fight against inflation over predictions of slowing growth. The BoC also seems to be waiting to see the effects of its prior rate raises so far this year.

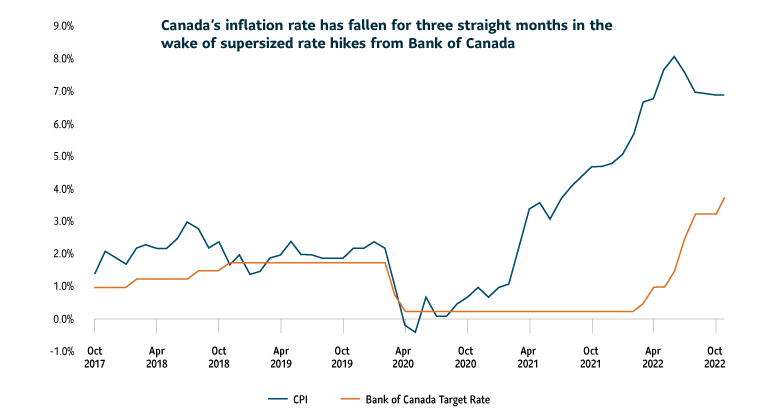

Since March 2022, the BoC has raised rates six times by a total of 350 bps. This takes the rate to 3.75%, the highest since 2008. While the rapid tightening has helped to knock inflation down from its peak of 8.1% in June to 6.9% in September, inflation is still far above the central bank’s upper target of 3%. On the other hand, the rapidly rising rate environment is prompting fears of an economic slowdown.

Spiking borrowing costs cloud prospects for an interest-rate sensitive economy

The BoC estimates Canada’s economic growth to slow to 0.9% in 2023 and 2% in 2024. This is down from its previous projections of 1.8% and 2.4% growth for those years. Canada’s economy is more sensitive to rising interest rates as a highly levered housing sector and elevated household borrowing translate to rising debt service costs. We believe this could limit the central bank’s ability to continue to aggressively hike rates.

Leaning on high quality bonds to weather a downturn and diversify

While fixed income experienced its worst performance in decades in 2022, we believe high quality bonds may now be positioned to better weather a possible economic slowdown over the next few quarters. As central banks approach their limits to lift rates from current levels, bonds could make a comeback. For instance, Canada’s 2-year bond recently staged a comeback with its yield slipping a 27 bps to 3.88% following the BoC’s smaller hike on October 26, 2022.

We currently favor Canadian investment grade (IG) bonds in our Granite portfolios. We believe the Canadian IG sector, with higher exposure to Federal, Provincial and Municipal securities over corporate securities, can better withstand slower economic growth. Additionally, we believe our bond exposure could offer strong diversification to pro-cyclical Canadian equities, in which we currently maintain a neutral weight.