1,2 Canadian Banking Sector: Market Volatility Continues, but Funding Is Stable and Unrealized Losses Appear Manageable, Morningstar DBRS, March 20, 2023.

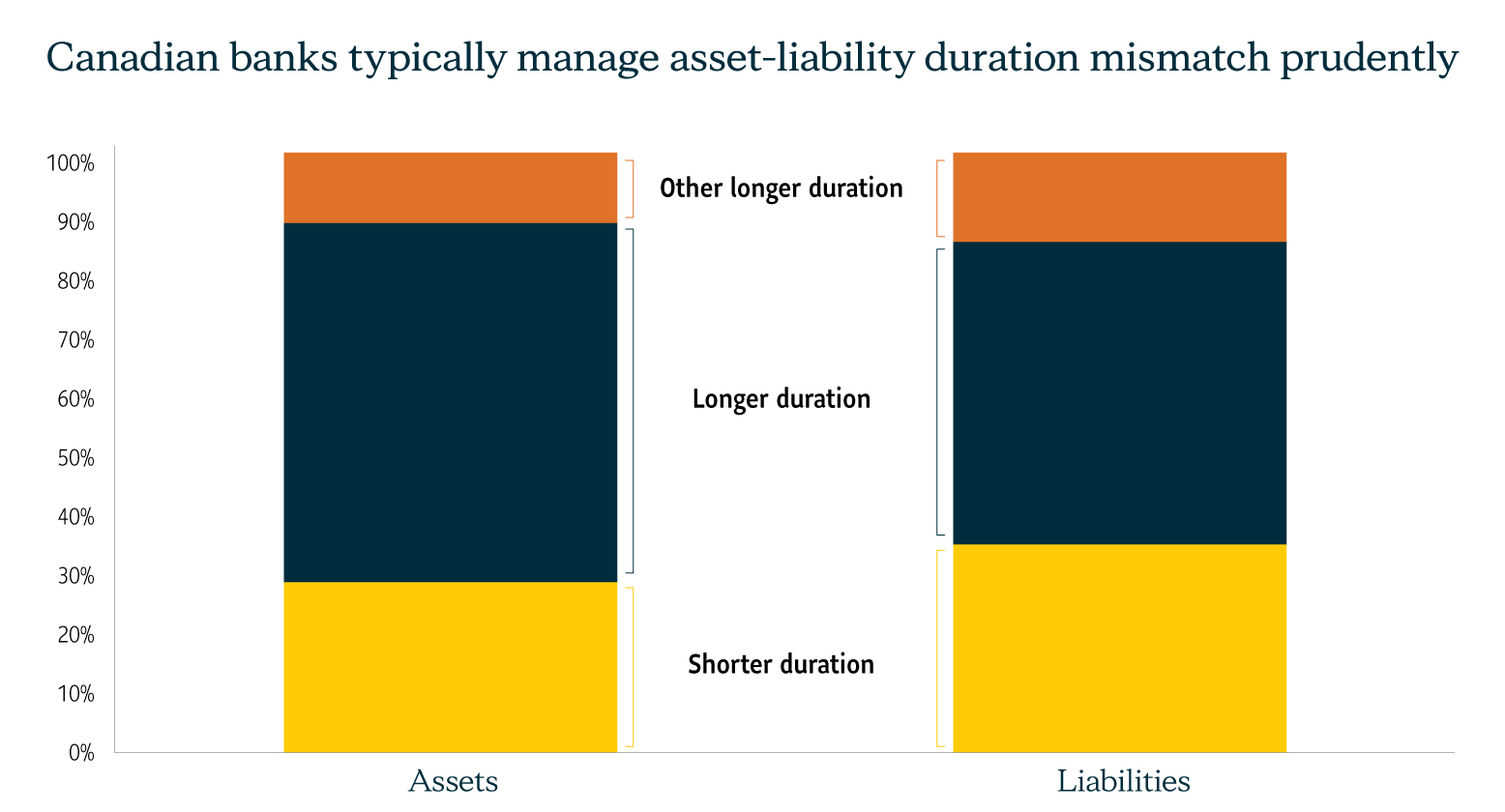

*Shorter duration assets include cash and cash equivalents, Canadian Federal, Provincial, Municipal or School Corp securities, less expected credit losses and other securities less allowance for expected credit losses.

Short-duration liabilities include government & financial institutions demand and notice deposits, individuals demand and notice deposits and other demand and notice deposits.

Longer duration assets include non-mortgage loans and mortgages less allowance for expected credit losses. Longer duration liabilities include fixed term deposits, subordinated debt, and obligations related to borrowed securities and assets sold under repurchase agreements. Shareholder’s equity is classified as longer duration. Interests in associates and joint ventures, deferred tax assets and other assets are classified under other longer duration assets. Other longer duration liabilities include mortgages and loan payables.

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by SLGI Asset Management Inc. These views are subject to change at any time and are not to be considered as investment advice nor should they be considered a recommendation to buy or sell.