How important is timing entry into the market when investing your money?

Cet article se penche sur trois approches pour planifier quand investir.

Potential postal disruption. Prepare for possible mail delays due to Canada Post labour negotiations. You can use our mobile app or log in to my Sun Life to submit claims and/or check on your investments.

Cet article se penche sur trois approches pour planifier quand investir.

It’s a great feeling to have some money set aside to invest. Whether saving for a vacation or for retirement, you are one step closer to reaching your financial ambitions. Did you know that when you make your investments can make a big difference to their growth?

This article looks at three ways to approach the timing of investments to your portfolio:

Let’s take a closer look at each approach using illustrative scenarios. In each example, the individual invested the same amount of money into the same fund. Their goal is to buy as many fund units as possible at the best possible price.

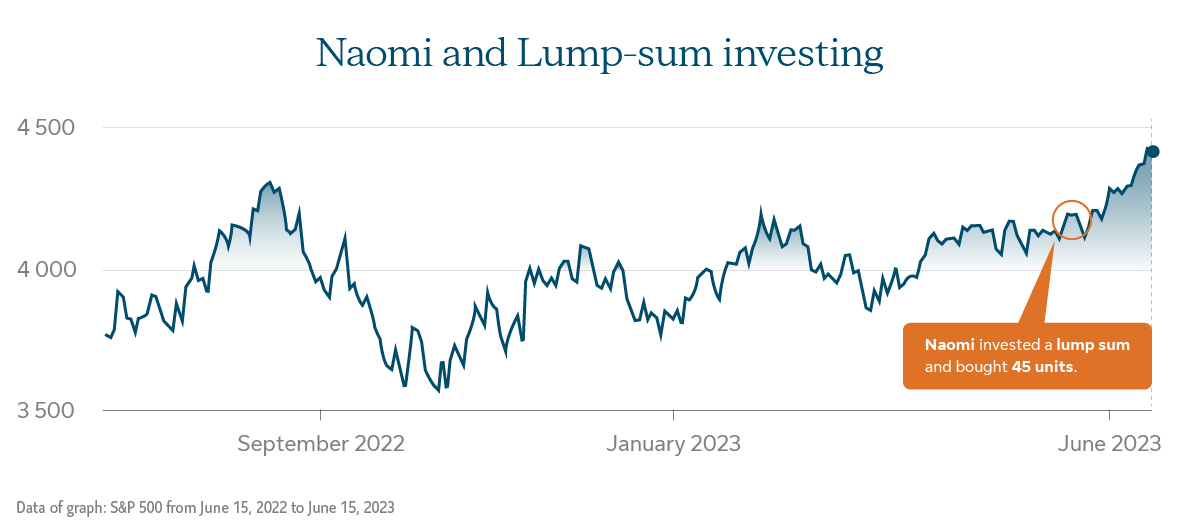

Lump-sum investing scenario

Naomi decides to invest her $2,600 tax refund all at once immediately. By doing so, she thinks it will start to grow her portfolio as soon as possible. She acquires 45 units of ABC mutual fund (ABC) at $57.78 per unit.

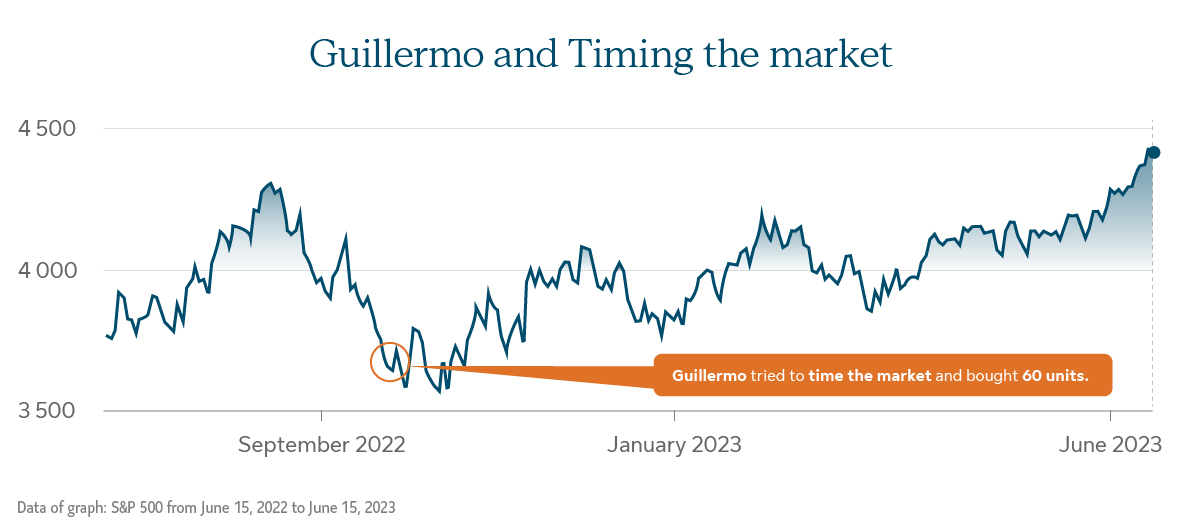

Market timing scenario

Guillermo tries to predict when his chosen funds are at their lowest, to maximize his return. He aims to time his entry to the market on a dip. His goal is to buy shares at the lowest cost so he can hold more units. Guillermo invests $2,600. This enables him to purchase 60 units of ABC at $43.33 per unit.

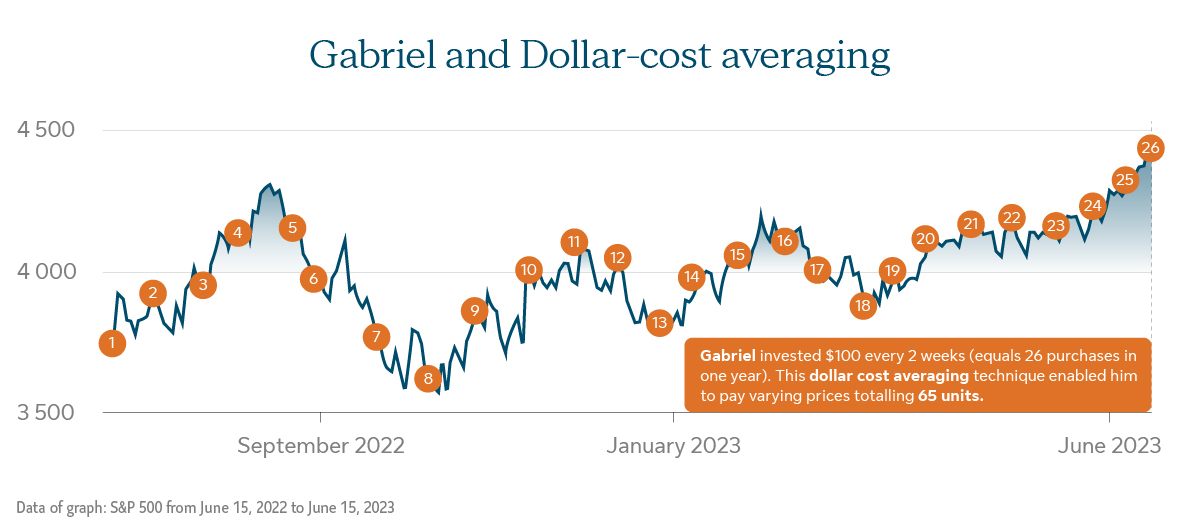

Dollar-cost averaging scenario

Gabriel opts for a dollar-cost averaging approach. He invests a total of $2,600 in his registered retirement savings plan (RRSP) but divided it into $100 every two weeks when his employer pays him. With the first deposit, he buys two units of ABC. Two weeks later, the stock market falls and so does the unit price of ABC. This time, his $100 deposit allows him to purchase 2.5 units of ABC. With market fluctuations and consistent investments over a longer time period, the $2,600 in total that he invests allows him to buy 65 fund units in one year, at an average cost of $40 per unit.

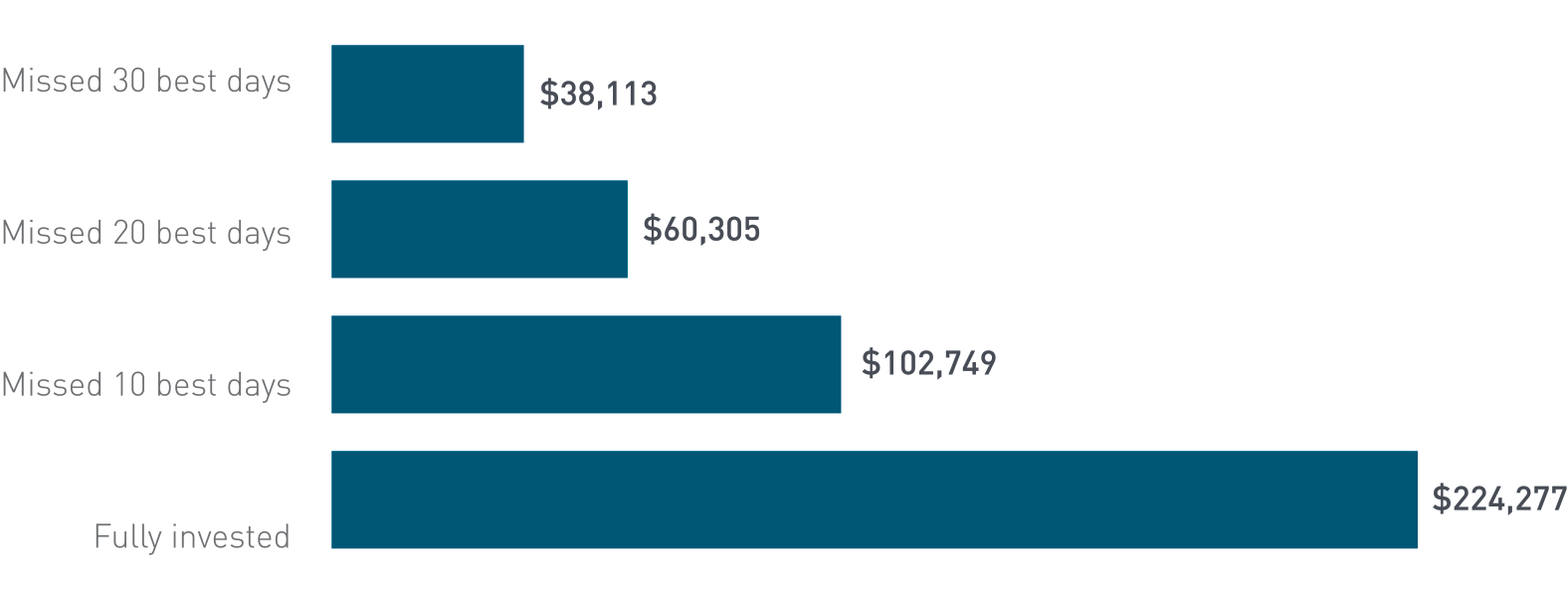

Consistent investing usually beats trying to time the market

It’s tempting to believe that timing the market is the best way to invest your money. In hindsight, it looks easy. But this technique comes with a big risk, namely missing out on the best days of the market. It can also be time-consuming and stressful to research and take the time to plan that investment.

Based on market index data, we know that a $10,000 investment made 20 years ago could now be worth over $60,000, but only if you stayed invested in the market.1 Missing the 10 best days in the market during those 20 years would have reduced it to around $30,000.1

Missing the best days can hurt

Growth of $10,000 in the S&P 500 Index, 20 years ending 12/31/24

For illustrative purposes only. Returns have been rounded to the nearest whole number for simplicity. Past performance is no guarantee of future results. It is not possible to invest in an index. Actual returns would be different due to fees and expenses associated with investing which are not applicable to an index. Source: FactSet and S&P US. Daily data as of December 31, 2004 through December 31, 2024. Analysis ranks all daily returns for the index and assumes that investors that are not fully invested on the best days miss out on those returns. If index return the following day does not fall into a range that meets the definition of best days, then the growth of the hypothetical investment resumes.

This disadvantage may be countered using the dollar-cost averaging approach, which allows you to stay invested in the markets at all times. The important thing is to consider your investment time horizon, financial objectives, and risk profile. That’s where an advisor can help you to find the best solution for your unique needs.

An advisor can also help you pick the right investment approach.

Learn more about our line up of funds at Sun Life Global Investments.

1Source: FactSet and S&P US. Daily data as of December 31, 2004, through December 31, 2024.

For illustration purposes only.

Information contained in this article is provided for information purposes only. It is not intended to provide or be a substitute for professional, financial, tax, insurance, investment, legal or accounting advice and should not be relied upon in that regard. It also does not constitute a specific offer to buy and/or sell securities. You should always consult your financial advisor or tax specialist before undertaking any of the strategies discussed in this article to ensure that all elements and your personal circumstances are taken into consideration in developing your individual financial plan. Information contained in this article has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy and SLGI Asset Management Inc. disclaims any responsibility for any loss that may arise as a result of the use of the strategies discussed.