How to estimate when your money will double – The rule of 72

With investors facing increasing market volatility and persistent inflation, it's easy to forget that investing is a long-term game

Potential postal disruption. Prepare for possible mail delays due to Canada Post labour negotiations. You can use our mobile app or log in to my Sun Life to submit claims and/or check on your investments.

With investors facing increasing market volatility and persistent inflation, it's easy to forget that investing is a long-term game

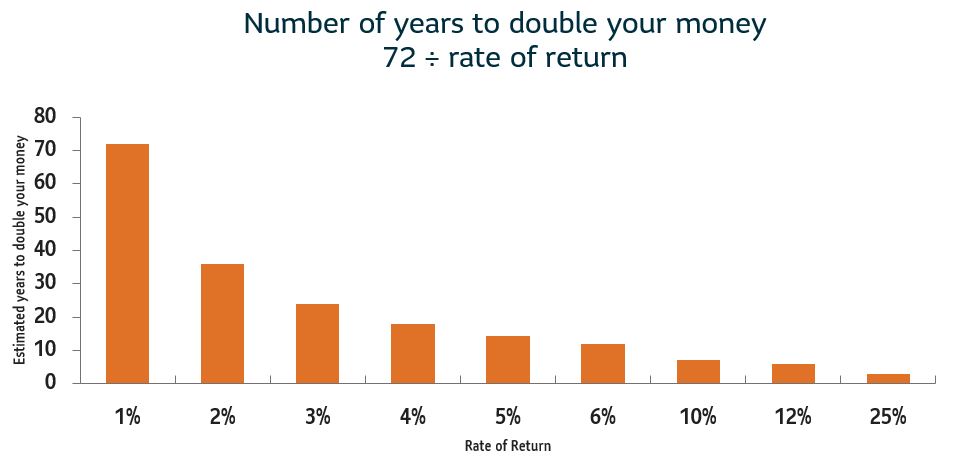

With investors facing increasing market volatility and persistent inflation, it's easy to forget that investing is a long-term game. And with many retirees living well into their 90s, they may also want to know how their money may grow over time. Through the markets ups and downs, there are principles that don't change for all investors, whether risk-averse or risk tolerant. One of those principles is the rule of 72 - a simple formula.

It essentially calculates how long it will take to double your money if you earn an x% after-tax compound annual rate of return. Conversely, the formula can also be used to calculate the rate of return that must be earned to double your money in X years.1

*If you know one of these two variables, you can calculate the other.

1Source: https://www.investopedia.com/terms/r/ruleof72.asp

All investments carry a certain amount of risk, including the possible loss of the principal amount invested.

These examples are for illustrative purposes only and are not intended to predict the returns of any investment choices. Rates of return will vary over time, particularly for long-term investments. There is no guarantee the selected rate of return can be achieved.

Information contained in this article is provided for information purposes only. It is not intended to provide or be a substitute for professional, financial, tax, insurance, investment, legal or accounting advice and should not be relied upon in that regard. It also does not constitute a specific offer to buy and/or sell securities. You should always consult your financial advisor or tax specialist before undertaking any of the strategies discussed in this article to ensure that all elements and your personal circumstances are taken into consideration in developing your individual financial plan. Information contained in this article has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy and SLGI Asset Management Inc. disclaims any responsibility for any loss that may arise as a result of the use of the strategies discussed.