Over the last year, you’ve likely felt the effects of inflation. No doubt your grocery bill, among other expenses, have gone up. In general, the cost of living in Canada has been going steadily up over the past few years.

In Canada, the Consumer Price Index*—the most well-known indicator of inflation—rose 6.8% on an annual average basis in 2022. That was following gains of 3.4% in 2021 and of 0.7% in 2020. The increase in 2022 was a 40-year high, the largest increase since 1982. To put that in perspective, inflation averaged about 2% a year over the last 20 years. Not surprising, StatsCan says this was largely due to COVID-19 related supply chain issues, among other factors. It’s no wonder this higher than average number is on everyone’s mind – and in the media.

Are you feeling the effects of inflation now? Then you’re likely worried about what it means for your savings and retirement plan. Understanding how inflation can affect your future will empower you to make better decisions today.

What does inflation mean?

Inflation is an overall increase in prices and the cost of living. Over time, the prices of some goods (i.e. bread) increase, while others may decrease (i.e. computers). Inflation measures the average increase in prices.

What is inflation affecting the most in Canada?

The main areas that experienced the effects of inflation in 2022 were:

- day-to-day basics (i.e. transportation),

- food, and

- shelter.

Source: StatsCan, Consumer Price Index: Annual review, 2022.

How does inflation affect your money?

Simply put, when inflation goes up, the value of your money goes down.

Inflation is like a leaky tap. It may not look like a lot of water is coming out. But it's amazing the impact it can have over time.

Let’s say you put $50,000 under your mattress today. If inflation averages 3% per year – and you pull it out to spend after 10 years, it would only be worth $37,000 at present value – because of inflated costs of goods and services. If you wait 20 years, it would only be worth $27,000 at present value, and so on.

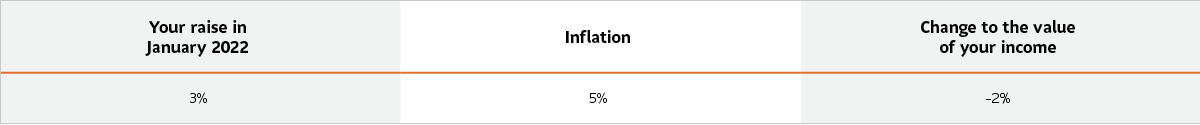

Let’s break it down another way. Let’s say you received a 3% raise at the start of 2023. Then, the cost of living goes up by 5% this year. In the end, the purchasing power of your income is less, so the value of your income is less this year than it was last year.

While many people’s income will adjust to inflation over time, not everyone’s will. Especially people on a fixed income – like those in retirement. Many people in retirement have a fixed income which does not adjust to inflation.

How is inflation a risk for your retirement?

One of the biggest risks to retirement savings is inflation. Depending on your circumstances – like your age and when you need your savings – inflation may be a bigger risk to some, and less of a risk to others.

Unfortunately, just because you’re retired doesn't mean the cost of property taxes, gas, groceries, etc. will all cease to rise. Inflation is a powerful force, especially over a long period of time. And higher costs of living mean you’ll pay more for things you need in retirement. This isn’t great timing when you’re likely not earning an income. But there’s a lot you can do to help protect your retirement savings from inflation.

What does inflation mean for your investments?

Inflation is only one factor in investing that you and your advisor need to consider when planning your retirement. A diversified portfolio,* including investments with growth expected to be higher than inflation, is a great way to combat the effects of inflation.

How can you protect yourself from inflation?

No one can predict the future of inflation. However, there are a few things you can do now to give you the peace of mind you need:

- Budget and keep track of your spending. A budget can let you see your spending habits and help you find ways to save.

- Make a plan. A financial plan is a good way to help prepare for a risk like inflation. Historically, we’ve experienced periods of both high and low inflation and interest rates. A good plan accounts for a range of possibilities.

- Stick with your plan. A plan is only good if you follow it. And it’s a good habit to revisit your plan as your needs change and evolve. You’ll want to build flexibility into your plan and check in often.

How can an advisor help?

When it comes to planning for the risk of inflation, an advisor can:

1. Assess your finances and suggest strategies that may help offset the threat of inflation.

An advisor can work to:

- understand what your risks, and

- build a diversified investment portfolio that helps meet your goals.

2. Help you understand products that provide income that may increase each year (accounting for inflation).

For example, a payout annuity or Guaranteed Investment Funds (GIFs) that offer inflation protection, can help maintain your purchasing power.

- How much retirement income can you get from an annuity? Find out with our Annuity Illustrator.

3. Determine your sustainable spending rate.

This is the amount you can spend in retirement while maintaining your lifestyle. This approach helps you enjoy your retirement knowing your savings will last – factoring rising inflation.

How does it work?

- You’ll set a percentage of income you can withdraw each month.

- Each year your sustainable spending rate will increase slightly to keep the pace with rising costs. This helps give you a level purchasing power to protect against inflation.

4. Check in and reassess your plan, adjusting as unknowns become clear or your needs change.

If you have a plan in place – it likely already considers the risk of rising inflation. If you don’t have one – that’s ok! It’s never too late to start. An advisor can help.

*Definition of terms:

- Consumer Price Index (CPI) is where Statistics Canada publishes changes in prices as experienced by Canadian consumers.

- A diversified portfolio includes various assets like stocks, fixed income, and commodities. These assets may react differently to the same economic event. The value of one may rise while the value of another may fall. This lowers your overall risk because no matter what happens in the market, some assets will still have gains.

This content is provided for information and illustrative purposes only and is not intended to provide specific financial, tax, insurance, investment, legal or accounting advice and should not be relied upon in that regard and does not constitute a specific offer to buy and/or sell securities. Information contained in this document has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy.