Transfer of a foreign retirement plan to a Canadian RRSP: tax rules to consider

Find out which rules are applicable when transferring a foreign retirement plan into an RRSP on a tax-deferred basis.

Potential postal disruption. Prepare for possible mail delays due to Canada Post labour negotiations. You can use our mobile app or log in to my Sun Life to submit claims and/or check on your investments.

Find out which rules are applicable when transferring a foreign retirement plan into an RRSP on a tax-deferred basis.

In a world where cross-border mobility is important, many Canadians have benefited from abroad work opportunities in recent years. Some of these Canadians may have accumulated rights in a foreign retirement plan while working outside the country. Coming back to Canada, many may have left such pension plans in a foreign jurisdiction.

The Income Tax Act (ITA) allows Canadian residents, under certain conditions, to transfer foreign retirement plans to a Canadian Registered Retirement Savings Plan (RRSP).

In this article, we discuss the rules applicable when transferring a foreign retirement plan, including a U.S. retirement plan, into an RRSP on a tax-deferred basis. We’ll also talk about the potential benefits and drawbacks of doing such a transfer.

Note that it’s essential that an investor seek advice from a qualified tax advisor, planner, and/or legal advisor before acting on any of the information included in this article.

Foreign pension plans and the Income Tax Act

There’s no specific provision within the ITA that allows a Canadian resident to do a direct transfer of a foreign retirement plan into Canadian RRSPs.

However, paragraph 60(j) of the ITA allows, under certain conditions, to do an indirect transfer into an RRSP of amounts that qualify as a superannuation or pension benefit from a foreign pension plan.

When determining whether benefits withdrawn from a foreign retirement plan will qualify under paragraph 60(j), a taxpayer should consider the following:

If all of these criteria are met, paragraph 60(j) ITA will allow the taxpayer to claim an offsetting deduction, if the RRSP contribution is made in the year the pension benefit is received or within 60 days after the end of that year. The amount of the deduction is limited to the lesser of the amount contributed and the amount of the benefit included in income. No RRSP contribution room is required; the deduction is over and above an individual's regular RRSP deduction limit.

If the requirements above are satisfied, the RRSP contribution can be designated as a "transfer" on Line 14 of Schedule 7, in the Canadian taxpayer's return for the year.

Note that when funds are withdrawn from a foreign pension plan, taxes are generally withheld in the foreign jurisdiction. The applicable foreign withholding tax rate varies, depending on:

Often, the first step for an investor would be to contact the foreign retirement plan administrator to confirm the withholding rate applicable in their situation.

A foreign tax credit will often be available to a Canadian resident to help minimize the risk of double taxation risk. (See section, Foreign Tax Credit.).

Even if it’s is possible to transfer the foreign retirement plan into a Canadian RRSP under the I/TA, you must also consider any restrictions imposed by foreign countries. Some countries impose restrictions on the ability to withdraw pension benefits. The investor should therefore confirm with the foreign retirement plan administrator and with their tax advisor whether any restrictions could prevent them from withdrawing their pension benefits and contributing them to a Canadian RRSP.

Hypothetical case scenario

(For this example, all values are in Canadian dollars)

An investor holds $100,000 in a foreign retirement plan and wishes to transfer the plan to a Canadian RRSP:

Provided that the investor has sufficient income and owes sufficient income tax in Canada, in 2021, they may be able to claim a foreign tax credit, in their Canadian income tax return, to offset some or all of the taxes withheld in the foreign jurisdiction.

As for the foreign tax credit, it cannot be carried forward into future years.

(See comments in section on Foreign Tax Credit.)

The combination of a foreign withholding tax and Canadian income tax associated with the inclusion of the foreign pension plan in income has the potential for double taxation. But Canadian taxpayers can generally claim a foreign tax credit, in their Canadian income tax return, to reduce or eliminate this potential for double taxation.

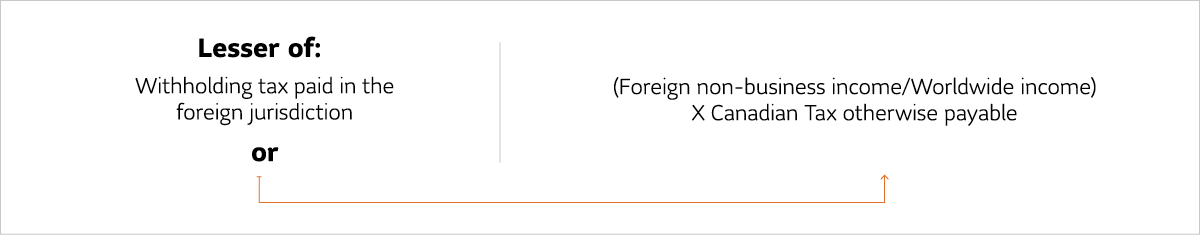

A foreign tax credit may not necessarily equal the foreign withholding tax. The following formula determines the size of the federal foreign tax credit that can be claimed:

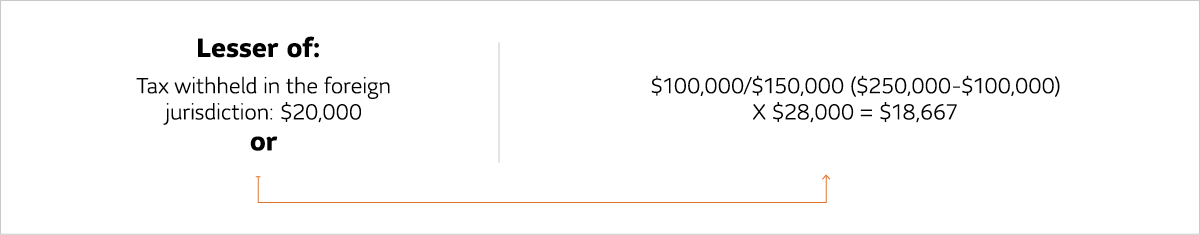

So imagine a situation where an individual wants to transfer $100,000 (in Canadian dollars) from a foreign retirement plan. The foreign plan administrator will generally withhold some taxes. Let's assume a withholding rate of 20% for this example. Imagine also that this Canadian taxpayer will earn a $150,000 salary during the year (increasing their total gross Canadian income from worldwide sources to $250,000) and contributing $100,000 to their RRSP (thus obtaining a deduction of $100,000). This taxpayer's total federal tax bill for the year would be $28,000.

Using these parameters, the foreign tax credit that the Canadian taxpayer could claim would be the lesser of:

In this situation, the Canadian taxpayer would only be able to claim $18,667 in Foreign Tax Credit in their Canadian tax declaration, and not $20,000.

Note that foreign tax credit available in Canada, must be used in the year in which the Canadian resident receives the income from the foreign retirement plan. Unused foreign tax credit applicable to non-business foreign income cannot be accumulated and may not be carried forward in future years. To ensure that there is a strategy in place to allow the investor to claim a full foreign tax credit , it's important to consult with a qualified tax advisor.

If an investor worked in the United States, they may have participated in:

It may be possible to transfer these plans into a Canadian RRSP on a tax- deferred basis, using the procedure mentioned above. 401 (k) and 403(b) plans are transferable under par 60(j)(i) of the I/TA, and IRAs are transferrable under par 60(j)(ii).

There are a few things to note however with the transfer of U.S. retirement plans:

Note that Roth IRAs aren't considered foreign pension plans nor foreign retirement arrangements, so a deduction under paragraph 60(j) of the ITA cannot be claimed in connection to withdrawals from these plans.4 Therefore, you cannot contribute lump sum withdrawals from a Roth IRA plan to your RRSP without using available RRSP contribution room.

Would it be worthwhile for a Canadian resident to transfer sums held in a Roth IRA into a Canadian RRSP? Or even to transfer them into a Canadian TFSA?

More precisely, what is the tax treatment, in Canada, for a Roth IRA held by a Canadian resident?

Under the Canadian Income Tax Act, a Roth IRA isn't considered a registered plan, and income and distributions should therefore be taxable for Canadians.

However, Article XVIII of the Canada-United States Tax Convention (1980), commonly referred to as the Canada-US Tax Treaty, may apply to either defer or relieve taxation in Canada.5 The Fifth Protocol to the Canada-US Tax Treaty specifies that under the new subparagraph 3(b) of Article XVIII, a Roth IRA is considered a "pension" for purposes of the Convention as long as no contribution is made to the Roth IRA by or on behalf of the individual, while the individual is resident in Canada.

So, if no contribution is made, it while the holder is a Canadian resident, the Roth IRA will continue to be subject to Article XVIII of the Convention. Under paragraph 7, the individual can elect to defer Canadian taxation with respect to the income accrued within it.

Thus, Canadian residents are exempt from taxation on accrued income and distributions from a Roth IRA, provided that:

Any individual resident in Canada who wishes to defer taxation in Canada on income accrued in a Roth IRA should file a onetime irrevocable Election for each Roth IRA that they own.

Once an Election is made, there's no requirement to make another Election for subsequent years.

If an Election has been filed and no contribution has been made to the Roth IRA while the holder is resident in Canada, there is no requirement on the part of the holder of the Roth IRA to include information relating to the Roth IRA in the Form T1135, Foreign Income Verification Statement.

In conclusion, while it might be tempting for a Canadian to repatriate sums held in a Roth IRA, by doing so, a Canadian resident taxpayer could lose a tax sheltered instrument equivalent to a Tax Free Savings Account (TFSA) provided a proper election is made.

For a spouse or a common-law partner who is the beneficiary of a foreign pension plan, an IRA, and a 401(k), the amount received may be taxable as income under paragraph 56(1)(a)(i) of the Income Tax Act. It is possible however to contribute the proceeds of such a plan into a Canadian RRSP by following the procedure outlined in a previous section.6

A person that is the beneficiary of a foreign pension plan, an IRA, and a 401 (k), other than from a late spouse or common-law partner, must also include the value in their income under paragraph 56(1)(a)(i) /TA. If they have sufficient RRSP contribution room, this inheritance, or a portion of it, can be contributed in an RRSP to lessen the impact of this income inclusion.

Here are some considerations for consolidating a foreign retirement plan with an RRSP:

While there are good reasons to transfer a foreign retirement plan into an RRSP, there are many issues to consider and tax implications to be aware of before proceeding. This strategy might not be right for everyone. In some cases, it may be best to leave the foreign retirement plan in place, and receive an income stream from it in retirement.

It is thus important to seek advice from a qualified professional tax advisor, advisor, and/or legal advisor with cross-border experience before making any decision.

Definitions

Individual Retirement Account (IRA). Often called a Traditional IRA, this is a tax-advantaged account that individuals can use to save and invest for retirement.7 It is comparable to an RRSP.

401(k). A tax-advantaged, defined-contribution retirement account offered by many employers to their employees. It is named after a section of the U.S. Internal Revenue Code. Workers can make contributions to their 401 (k) accounts through automatic payroll withholding, and their employers can match some or all of those contributions.8 They are similar to a Defined Contribution Pension Plan.

403(b). Similar to a 401 (k), the 403(b) is a retirement account for certain employees of public schools and tax-exempt organizations. Participants include teachers, school administrators, professors, government employees, nurses, doctors, and librarians.9

Roth IRA. An individual retirement account that allows qualified withdrawals on a tax-free basis provided certain conditions are satisfied. They are funded with after-tax dollars and the contributions are not tax-deductible. Money can be withdrawn tax-free.10 They are similar to a TFSA.

| Type of plan | Traditional IRA11 | 401(k)12 | 403(b)13 | Roth IRA14 |

| Who Can Contribute | Individuals with earned income, without an age limit.15 | Individuals can contribute part of their compensation to a 401 (k) on a pre-tax basis. May be matched by the employer. There is no age limit for contributing to this type of plan.16 | Similar to a 401 (k). Available to certain employees of public schools, employees of certain tax-exempt organizations and certain religious organizations.17 | Individuals of any age with earned income, without an age limit. You can contribute to a Roth IRA only if your income is less than a certain amount.18 |

| Contribution limits | 2022 maximum of $6,000 (US), or 100% of earned income; plus if age 50 or over, additional contribution of $1,000 (US). 19 | 2022 maximum employee contribution for people aged 49 and under is $20,500 (US) with an additional contribution of $6,500 (US) those 50 and over. Employers can contribute additional amounts.20 | 2022 maximum employee contribution for people aged 49 and under is $20,500 (US) with an additional contribution of US$6,500 those 50 and over. Employers can contribute additional amounts.21 | 2022 maximum of $6,000 (US) or 100% of earned income; plus if age 50 or over, additional contribution of $1,000 (US). 22 |

| Tax deductibility of contributions | Yes, in most cases. Based on adjusted gross income of family and participation in other types of plans. 23 | Not deductible by individual however contribution is not included in taxable income in the U.S. until withdrawn from plan.24 | Not deductible by individual however contribution is not included in taxable income in the U.S. until withdrawn from plan.25 | Not deductible.26 |

| Taxation of growth | Growth not taxed in the U.S. until withdrawn. If contribution was deductible, will be taxable when withdrawn.27 | Growth and contribution amount not taxed in the U.S. until withdrawn.28 | Growth and contribution amount not taxed in the U.S. until withdrawn.29 | Growth not taxed in the U.S. provided funds not withdrawn until age 59 ½, or if you have had the account for a period of 5 years, or such time as you become disabled.30 |

| Rollover to Canadian RRSP available under Canadian Income Tax Act | 60(j)(ii) rollover of a foreign retirement arrangement. | 60(j)(i) rollover of a foreign pension plan. | 60{j){i) rollover of a foreign pension plan. | Tax-deferred rollover to a RRSP not permitted. |

| Transfer of funds to an RRSP | Within taxation year or within 60 days after the end of the year. | Within taxation year or within 60 days after the end of the year. | Within taxation year or within 60 days after the end of the year. | Not applicable. |

| Age at which income must be taken from the plan | Distribution may begin at age 59 ½. Distributions made prior to age 59½ may be subject to an additional 10% tax. Required Minimum Distributions (RMD) have to begin by April 1st of the year in which you turn 72.31 | Distributions may begin at age 59 ½ or upon termination of employment. Distributions made prior to age 59½ may be subject to an additional 10% tax. Required Minimum Distributions (RMD) have to begin by April 1st of the year in which you turn 72.32 | Distributions may begin at age 59 ½ or upon termination of employment. Distributions made prior to age 59½ may be subject to an additional 10% tax. Required Minimum Distributions (RMD) have to begin by April 1st of the year in which you turn 72.33 | No mandatory age in which plan must be collapsed. No Required Minimum Distributions (RMD).34 |

1Paragraph 126, Income Tax Act (Canada). See also Canada Revenue Agency's Income Tax Folio 55-F2-C1. Foreign Tax Credit.

2 https://www.irs.gov/retirement-plans/plan-distributions-to-foreign-persons-require-withholding

3https//www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions

4Income Tax Folio S5-F3-C1, Taxation of a Roth IRA. 'Income Tax Folio 55-F3-C1, Taxation of a Roth IRA.

5Income Tax Folio S5-F3-C1, Taxation of a Roth IRA.

62011-0409121E5. See also IT-528, par. 26.

7https//www.irs.gov/taxtopics/tc451

8https//www.irs.gov/retirement-p1ans/401 k-plans

9https//www.irs.gov/retirement-plans/retirement-plans-fags-regarding-403b-tax-sheltered-annuity-p1ans

10https//www.irs.gov/retirement-plans/retirement

11https://www.irs.gov/taxtopics/tc451

12https://www.irs.gov/retirement-plans/401k-plans

13https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-403b-tax-sheltered-annuity-plans

14https://www.irs.gov/retirement-plans/roth-iras

15https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits

16https://www.irs.gov/retirement-plans/401k-plans#:~:text=401(k)%20Plans&text=A%20401(k)%20is%20a,can%20contribute%20to%20employees'%20accounts.

17https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-403b-tax-sheltered-annuity-plans#:~:text=A%20403(b)%20plan%20must,all%20employees%20of%20the%20organization.

18https://www.irs.gov/retirement-plans/amount-of-roth-ira-contributions-that-you-can-make-for-2021

19https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits

20https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits

21https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits

22https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits;https://www.irs.gov/retirement-plans/amount-of-roth-ira-contributions-that-you-can-make-for-2021

23https://www.irs.gov/retirement-plans/ira-deduction-limits

24https://www.irs.gov/retirement-plans/plan-sponsor/401k-plan-overview#:~:text=Two%20of%20the%20tax%20advantages,of%20the%20Internal%20Revenue%20Code.

25https://www.irs.gov/retirement-plans/plan-sponsor/401k-plan-overview#:~:text=Two%20of%20the%20tax%20advantages,of%20the%20Internal%20Revenue%20Code.

26https://www.irs.gov/retirement-plans/ira-deduction-limits

27https://www.irs.gov/retirement-plans/traditional-iras#:~:text=A%20traditional%20IRA%20is%20a,that%20gives%20you%20tax%20advantages.&text=Generally%2C%20amounts%20in%20your%20traditional,(withdrawal)%20from%20your%20IRA.

28https://www.irs.gov/retirement-plans/401k-plans

29https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-403b-tax-sheltered-annuity-plans#:~:text=A%20403(b)%20plan%2C,their%20salary%20to%20the%20plan.

30https://www.irs.gov/taxtopics/tc451#:~:text=Contributions%20to%20a%20Roth%20IRA,IRA%20when%20it's%20set%20up.

31https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

32https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

33https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

34https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

Information contained in this article is for information purposes only. It is not intended to provide or be a substitute for professional financial, tax, insurance, investment, legal or accounting advice and should not be relied upon in that regard. It also does not constitute a specific offer to buy and/or sell securities. You should always consult your advisor or tax specialist before undertaking any of the strategies contained in this article to ensure that all elements your personal circumstances are taken into consideration in developing your individual financial plan. Information contained in this article has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy and SLGI Asset Management Inc. disclaims any responsibility for any loss that may arise as a result of the use of strategies discussed.