Key tactical changes

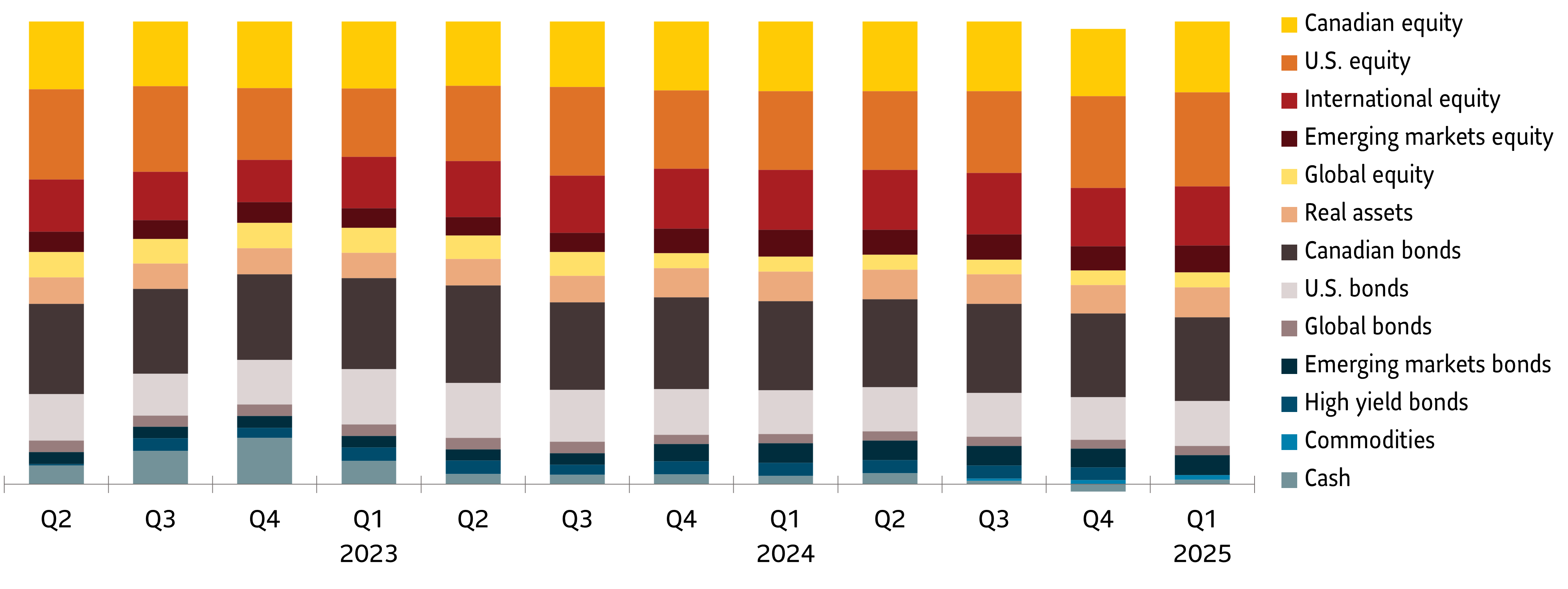

- Reduced equity exposure (particularly U.S. stocks) to neutral following April 2 (Liberation Day): If trade tensions escalate, there could be further downside in markets. We continue to actively monitor the tariffs situation and will change positioning as necessary

- Remain tactically overweight in gold with an added allocation after the recent sell-off: Gold may be an inflation hedge and a stabilizer to counter volatility. Year-to-date (as of April 11, 2025) spot gold is up about 19% in Canadian dollar terms.1

2025 started relatively calmly. But sentiment shifted drastically in early April following the U.S. administration’s April 2 (Liberation Day) announcements on steep tariffs, targeting countries across the world. This sparked extreme short-term volatility – on both the up and downside - for stocks and bonds.

U.S. stocks largely lagged global peers in the first quarter (Q1) of 2025 due to extended valuations coming into the year and increasing earnings uncertainty due to potential tariffs. Over the quarter, there was an unexpected rotation – U.S. stocks, U.S. bond yields and the U.S. dollar fell while European equities and bond yields rose. AI-related tech stock valuations moderated, partly on reports that Chinese start-up, DeepSeek AI, could offer much cheaper AI versus tech giants.

On April 3, stock markets plunged on global tariff concerns. Both the benchmark S&P 500 Index and Canada’s S&P TSX Composite Index fell around 10% each over two days. International and emerging equities also suffered. Heightened volatility continues as the potential impact of tariffs play out with a possible full-scale trade war with the U.S. and China.

In Q1, the benchmark U.S. 10-year Treasury yield fell by 30 basis points (bps) in Q1 but has since spiked from a year-to-date low of 4% on April 4 to 4.6% as of April 11. The increase is attributed to selling by hedge funds to meet margin calls, and additionally by global holders such as China and Japan.

Similarly, Canadian 10-year yields fell 25 bps to 2.97% in Q1. After falling to 2.88% on April 4, they briefly surged to 3.3% on April 11, being pulled up by the move in U.S. Treasuries. Markets seem to be getting nervous that U.S. government bonds may be losing their traditional haven status.

Looking forward, we expect heightened volatility to continue. The economic outlook for the U.S (and much of the world) remains highly uncertain with significantly weakened sentiment. The U.S. Federal Reserve is closely watching inflation, which could rise, and is likely ready to cut interest rates if needed. Tariff uncertainty is already impacting corporate capital investment plans and Q1 earnings announcements could provide some clarity albeit limited given the heightened uncertainty.

We are monitoring key indicators on consumer spending and confidence as well as central bank and fiscal policy decisions. The increase in longer-duration U.S. bond yields is concerning and we are closely watching the U.S. dollar. Diversification is now more vital than ever as tariff news may continue to shock both equity and bond markets.

1Source: XAU USD gold spot price as of April 11, 2025.