Mutual funds in Canada and North America: a century-old success story

Mutual funds are celebrating 100 years of existence in North America, and it’s an anniversary with special significance for Sun Life Financial.

Potential postal disruption. Prepare for possible mail delays due to Canada Post labour negotiations. You can use our mobile app or log in to my Sun Life to submit claims and/or check on your investments.

Mutual funds are celebrating 100 years of existence in North America, and it’s an anniversary with special significance for Sun Life Financial.

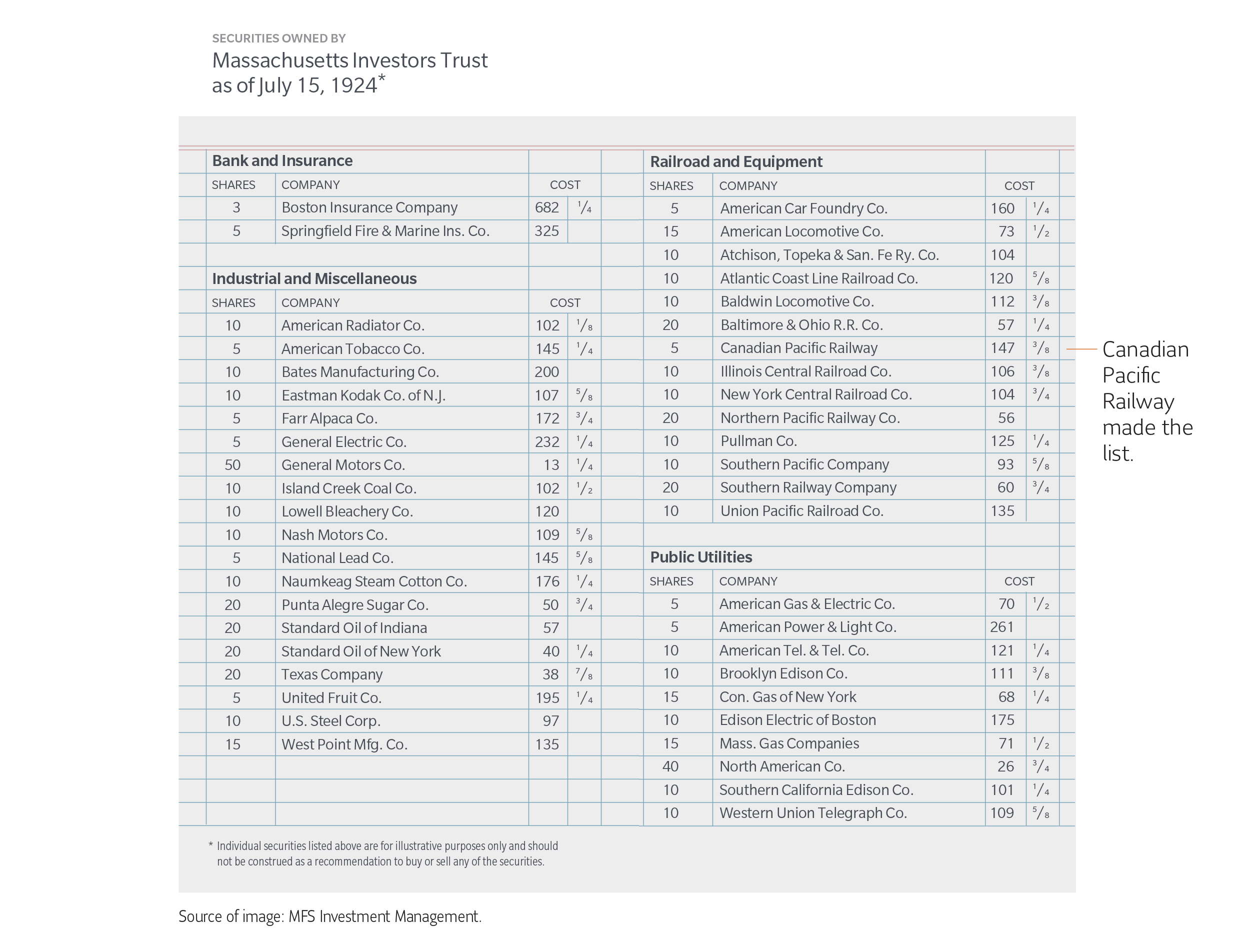

MFS Investment Management* (MFS), a Boston-based company owned by Sun Life Financial since 1982, established the Massachusetts Investors Trust in March 1924. This was the first open-ended mutual fund in North America.

Image of the original holdings in the MIT Fund

The creation of the mutual fund enabled the average U.S. investor access to equity markets for the first time in history. In 1924, the average annual salary in the United States wasn’t enough to buy one share in most public companies. Only the wealthy could afford to participate in public company ownership through the purchase of company stock. The mutual fund opened the door to investing for millions of everyday investors and also played a significant role for companies looking for funds to grow.

This financial innovation paved the way for Canadians’ access to mutual funds a few years later in 1932 and across the globe in the following decades.

MFS still exists today, and so does its fund – Massachusetts Investors Trust, as a $10,000 initial investment 100 years ago would be worth $57 million today.1

How mutual funds became a success-story in Canada

In Canada, mutual funds were first offered in 1932 in Montreal—during the Great Depression. This was revolutionary. It marked the first time that people with modest capital could invest in professionally managed and diversified investment products.

Since then, Canadians have used mutual funds as regulated instruments to access stock and bond markets around the world. Today, they continue to place their trust in investment funds to access markets and diversify their investments.

Mutual funds are still one of the most accessible investments for Canadians. By pooling the capital of thousands of investors in the hands of qualified investment professionals, people can benefit from lower costs and convenience. What’s more, investing in a mutual fund is often less risky than buying individual securities due to diversification benefits.

Mutual funds in Canada by the numbers

1932 Canada’s first mutual fund issued in Montreal2 |

4.9 million Canadian households invest in mutual funds3 |

$1.9 trillion Mutual fund assets in Canada - more than the 5 largest pension plans in Canada combined4 |

$28 million Paid in 1982 by Sun Life Financial to acquire MFS, which pioneered the 1st mutual fund in North America |

3,409 Mutual funds available in Canada5 |

110,000 Professionals are registered and authorized to sell mutual funds in Canada6 |

How the mutual fund sector contributes to the Canadian economy

Nearly 5-million Canadian households invest in mutual funds according to the Investment Funds Institute of Canada. In fact, mutual funds have more assets in Canada ($1.9 trillion) than Canada’s top five pension plans combined ($1.694 trillion).

The mutual fund sector plays an important economic role in employment, GDP, tax revenues and household wealth.

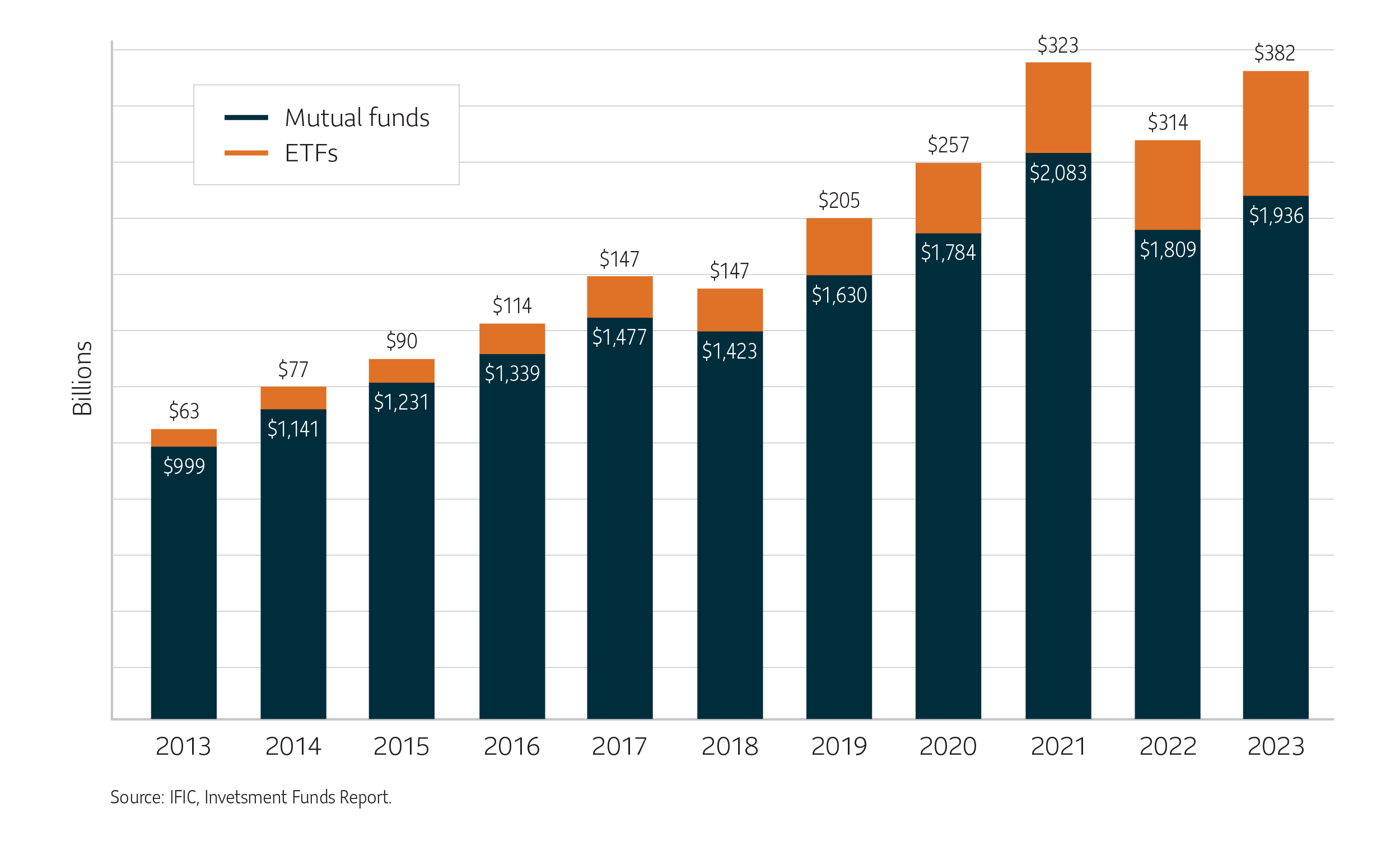

The investment product continues to evolve showcasing its value including the arrival in the early 2010s of - exchange-traded funds (ETFs):

Net assets of Mutual Funds and ETFs

A win-win transaction

Sun Life Financial acquired MFS in 1982 for $28 million “establishing a successful, enduring relationship for both companies”.11 When Sun Life Financial launched Sun Life Global Investments in 2010, it turned to MFS. For example, the first funds distributed by Sun Life Global Investments were funds sub-advised by MFS. Since then, the firm has grown. It now manages $56.4 billion in assets12 and works with 12 world-class sub-advisors.

Celebrating a century of industry first

Sun Life Global Investments is proud to give Canadians access to MFS mandates that would otherwise be out of reach. As a result, our company benefits from the active and disciplined mutual fund investment approach for funds that MFS manages as our sub-advisor.

MFS discovers market opportunities through three pillars:

The Sun Life MFS family of funds includes different mandates made up of Canadian bonds and Canadian, U.S., international and global equities, to help Canadian investors seize opportunities around the world.

To learn more about the Sun Life MFS Funds, visit this webpage.

1 Please note this fund is not available to Canadian investors

2IFIC, https://investorcentre.ific.ca/evolution-mutual-funds/

3 IFIC, https://www.ific.ca/en/articles/who-we-are-our-industry/

4 IFIC, as at December 31, 2023 + BPM

5 IFIC, as at December 31, 2022

6 IFIC, https://www.ific.ca/en/articles/who-we-are-our-industry/

7 IFIC, https://www.ific.ca/en/articles/who-we-are-our-industry/

8 IFIC, https://www.ific.ca/en/articles/who-we-are-our-industry/

9 IFIC, https://www.ific.ca/en/articles/who-we-are-our-industry/

11 https://www.mfs.com/en-us/institutions-and-consultants/about-mfs/our-history.html

12 As at December 31, 2023

13 In 1924, MFS Investment Management launched the Massachusetts Investors Trust, the first mutual fund in North America.

14 In 1932, the Canadian markets launched its first mutual fund, the Canadian Investment Fund Ltd. (CIF).

MFS Investment Management Canada Limited is the sub-advisor to the Sun Life MFS Funds; SLGI Asset Management Inc. is the registered portfolio manager. MFS Investment Management Canada Limited has appointed MFS Institutional Advisors, Inc. to provide additional sub-advisory services.

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by SLGI Asset Management Inc. or sub-advised by MFS Investment Management. These views are subject to change and are not to be considered as investment advice nor should they be considered a recommendation to buy or sell.

The information provided is not intended to be investment advice. Investors should consult their own professional advisor for specific investment and/or tax advice tailored to their needs when planning to implement an investment strategy to ensure that individual circumstances are considered properly, and action is taken based on the latest available information.