Maybe this doesn’t sound like you at all. Maybe you are of the true risk versus reward mentality and are comfortable taking on more risk for the possibility of a higher return potential. Regardless of your comfort level with investing, target risk funds are a great way to get in the market.

Target risk asset allocation funds, like Sun Life Granite Managed Portfolios, establish and maintain a specific level of risk in each portfolio over time. Once you have determined your specific financial needs with your advisor, you can choose from five differentiated solutions that range from conservative to growth. Each solution holds a mix of mutual funds and other investments, serving as a complete investment portfolio.

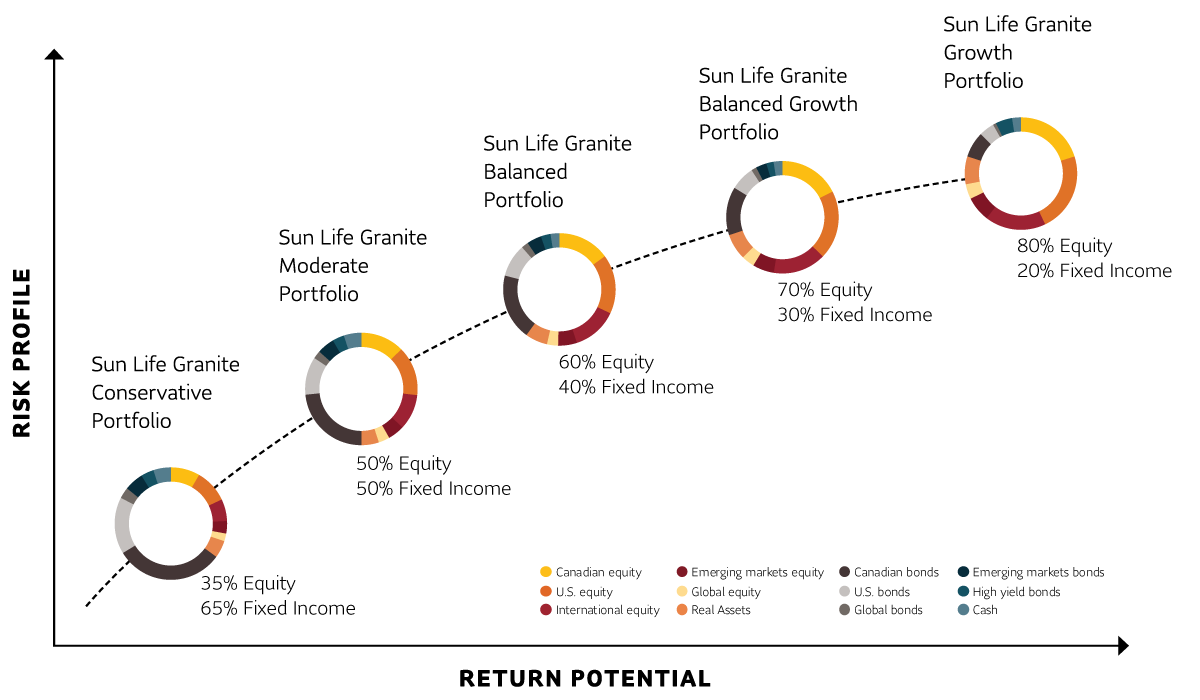

How your risk profile can change your asset allocation

As life happens, your risk profile may change along the way, in which case so may your preferred asset mix. Maybe you find yourself nearing retirement and choose to take a more conservative investment approach. By focussing on preservation over growth, you can potentially reduce risk against market volatility or potential losses in a time when you need it the most.

Or maybe you find yourself on the other end of the spectrum – a young professional with a longer time horizon. You have some disposable income that you want to invest, and your appetite for risk is higher. Unlike many retirees, you could be looking for higher growth potential in the years when you can survive potential losses.

The chart below shows how Sun Life Granite Managed Portfolios are designed to meet varying risk profiles. As the exposure to equities in the portfolios increases, so does the level of risk – but also the return potential.

Investment choices to meet your client's needs

Sun Life Granite Managed Portfolios