In the 1960s, inflation drove down the “real price” value of bonds by some 36%, leaving bond investors in trouble.1 The old strategy of buying bonds, holding them to maturity and physically clipping the coupons for cash payments no longer gave investors the value they needed.

By then, MFS® had several decades of active management experience in equities. So, rather than watch investor outcomes be jeopardized, the firm decided to use the same ideas — thoughtful research and trading securities — to create better long-term value for fixed income investors. MFS decided to build an active fixed income department to solve the problem that traditional bonds had become and directly address investor needs.

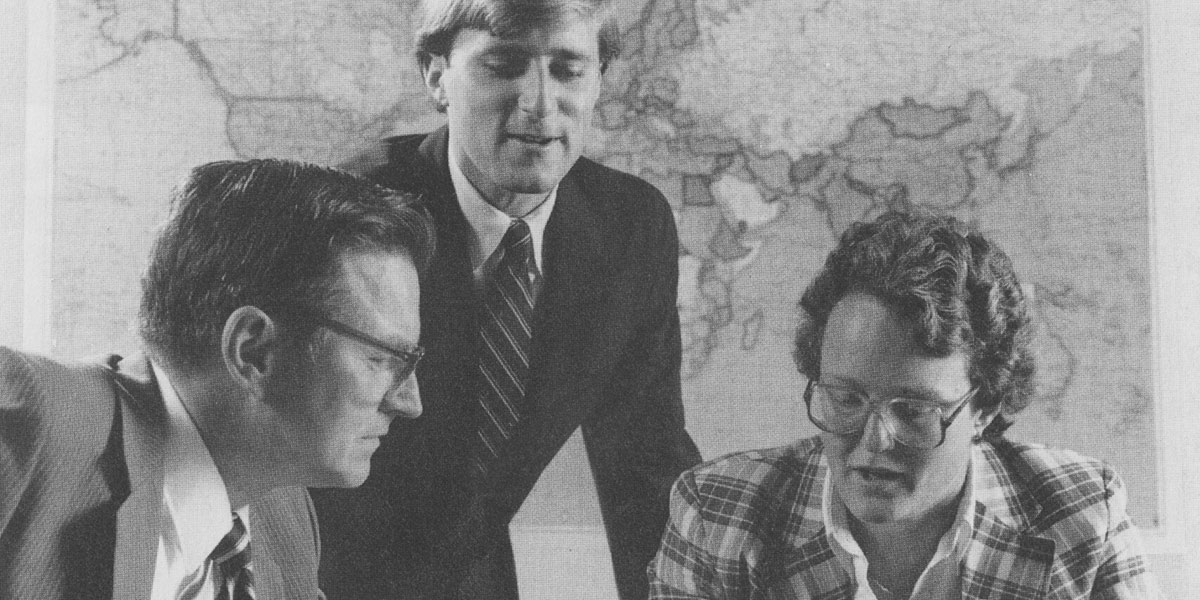

Though actively trading bonds wasn’t common practice at the time, MFS hired Keith Brodkin, a charismatic Bostonian, who had proven active fixed income expertise and was well known for his keen ability to swap one bond and buy another,2 saying that often “people are afraid of the risks that create opportunity.” Brodkin’s mindset was precisely what MFS needed, and the firm convinced him to join MFS in 1970 as an investment officer, specializing in fixed income securities.

By 1972, he was given the green light to develop and manage the firm’s new fixed income department and quickly hired Patricia Zlotin to join him. Women executives were considered novel at the time, but as Zlotin recalled in 2023, “MFS always focused on talent.” The team quickly proved the value of the fixed income department and how MFS could differentiate itself from rest of the industry. Instead of remaining behind closed office doors, they met institutional investors face-to-face to help them fully understand MFS’ approach. They demonstrated how money could be made by trading a major telephone company bond for a major airline company bond.

These meetings gave MFS a chance to show bond investors the real value of active management, and investors caught on. MFS continued pioneering innovative fixed income products* in the 1980s and 1990s, showing that what was top of mind for investors was also top of mind for MFS.

Beginning after a prolonged period of financial uncertainty in the late 1960s, the active fixed income revolution that started in a little office in Boston altered the industry and gave clients and investors another path to long-term value.

This article was first published in the United States by MFS Institutional Advisors, Inc. It is republished with modifications for the Canadian marketplace by SGLI Asset Management Inc. with permission. Nothing in this article constitutes an offer to sell or a solicitation to buy any product or service offered by MFS Institutional Advisors Inc. or SLGI Asset Management Inc. in this or any other jurisdiction in which such an offer or solicitation is unlawful.

Endnotes

1Ranasinghe, Dhara. (30 January 2017) Bond Markets Set for a Taste of the 60s as Inflation Picks Up. Reuters.com. (2013) Stock Market Crash of 1929. https://www.reuters.com/article/us-global-bonds-inflation/bond-markets-set-for-a-taste-of-the-60s-as-inflation-picks-up-idUSKBN15E1XG

2A. Keith Brodkin, 62, Mutual Fund Chief (6 February 1998). New York Times. https://www.nytimes.com/1998/02/06/business/a-keith-brodkin-62-mutual-fund-chief.html

MFS Investment Management Canada Limited is the sub-advisor to the Sun Life MFS Funds; SLGI Asset Management Inc. is the registered portfolio manager. MFS Investment Management Canada Limited has appointed MFS Institutional Advisors, Inc. to provide additional sub-advisory services.

The information provided is not intended to be investment advice. Investors should consult their own professional advisor for specific investment and/or tax advice tailored to their needs when planning to implement an investment strategy to ensure that individual circumstances are considered properly, and action is taken based on the latest available information.