Just after the Stock Market Crash of 1929, the United States were firmly in grip of the Great Depression, a global economic crisis exacerbated by salesmen pushing unsubstantiated stock tips on behalf of firms that put profits over people. Investor confidence and trust had hit rock bottom. But MFS Investment Management’s actions during this difficult period showed the firm’s commitment to putting the needs of clients and end investors first.

This sense of stewardship drove two of MFS’ leading innovations in the early 1930s to restore confidence in the mutual fund industry: transparency through information sharing and the creation of an in-house research department that afforded comprehensive knowledge about the companies MFS owned.

It all started with someone who frequently told his colleagues that he was “no investment man,” but Merrill Griswold, the first chairman of Massachusetts Investors Trust (MIT)* — present-day MFS — understood people. In particular, he understood how to instill the confidence so many had lost after the market crash.1 He figured that to rebuild trust, frustrated investors needed to see how investment firms made decisions to buy, sell or hold securities on their behalf. So one of Griswold’s early initiatives was to create what he called “goldfish bowl” reports for shareholders which provided access to MIT’s sales charges, financial performance and portfolio changes. This unprecedented approach to transparency treated shareholders like partners and, more important, helped build stronger relationships with them.2,3

But sharing information was only half the battle. Griswold knew investors also needed to trust the investment process, which meant the firm had to know each business inside and out, and that level of knowledge and conviction could only come from doing its own research. So, in 1932, MFS created an in-house research department aimed at building in-depth knowledge of portfolio securities.

Dwight P. Robinson, a brilliant Harvard-educated analyst was recruited to lead and run the department.4 Not only was he MFS’ first director of research, but he was also the first director of research in the industry. Both Robinson’s appointment and his approach were groundbreaking, as he engaged in a detective-like process, redefining what the industry considered fundamental research and placing a strong emphasis on statistical analysis.5 Robinson’s research department was built out with MFS’ first advisory board, so that together they could carefully scrutinize all investment opportunities to make the best possible decisions.

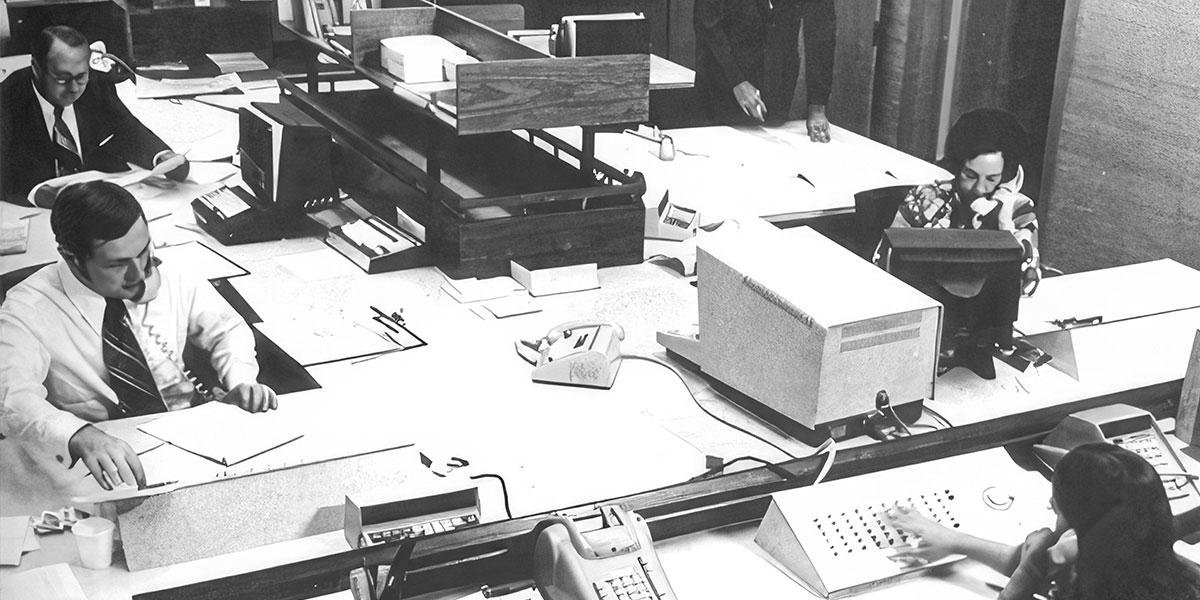

Early on, MFS recognized that being on-site and in person reveals just as much about a business as its balance sheet. Before committing any funds to an investment,6 there were visits to plants, factories and company headquarters, as well as meetings with senior management.

Robinson’s tactics of poring over financial statements and market reports and making analytical site visits continued with the next generations of MFS researchers. As David Antonelli, a research analyst who joined the firm in 1991 and went on to be equity CIO and vice chair, explained, “Our approach today remains a ‘bottom-up’ process that requires ‘kicking the tires’ of a company, regardless of market or location, and meeting with senior executives to ask ‘probing questions’ informed by expert, long-term investment analysis.”

What Robinson began not only catalyzed the building of MFS’ research department, it also became foundational to MFS’ active management philosophy — the necessity of understanding everything material about a portfolio company to determine whether or not it can create long-term value. Over the past 100 years, MFS’ teams of expert researchers have analyzed countless prospects, from early microwave technology in the US, to the viability of a grocery store chain in the UK to a Finnish cell phone innovator.7

A department that started with one fund in 1932 grew into a global research platform, fueled by the same purpose with which it began. “We really believe in our hearts and our souls,” said present-day MFS President and Head of Global Distribution Carol Geremia, “that we need to understand everything that we own with other people’s money. That’s why we committed to active management . . . and that’s why we have built the research platform that we have . . . because we want to get to the best information, the best idea that we possibly can, before we make an investment decision.”

This article was first published in the United States by MFS Institutional Advisors, Inc. It is republished with modifications for the Canadian marketplace by SGLI Asset Management Inc. with permission. Nothing in this article constitutes an offer to sell or a solicitation to buy any product or service offered by MFS Institutional Advisors Inc. or SLGI Asset Management Inc. in this or any other jurisdiction in which such an offer or solicitation is unlawful.

1Griffeth, Bill. The Mutual Fund Masters. (1995) Probus Publishing. Page 20, 25.

2Wilson, Julia A. A Story of Progress: On the Twenty-Fifth Anniversary of Massachusetts Investors Trust. (1949) Massachusetts Investors Trust. Boston. Page 14.

3Wilson, page 14.

4Wilson, page 6.

5Wilson, page 13.

6Wilson, page 13.

7Wilson, page 9.

MFS Investment Management Canada Limited is the sub-advisor to the Sun Life MFS Funds; SLGI Asset Management Inc. is the registered portfolio manager. MFS Investment Management Canada Limited has appointed MFS Institutional Advisors, Inc. to provide additional sub-advisory services.

The views expressed in this commentary are those of the authors and are subject to change at any time. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by SLGI Asset Management Inc. or sub-advised by MFS Investment Management. These views are subject to change and are not to be considered as investment advice nor should they be considered a recommendation to buy or sell.

The information provided is not intended to be investment advice. Investors should consult their own professional advisor for specific investment and/or tax advice tailored to their needs when planning to implement an investment strategy to ensure that individual circumstances are considered properly, and action is taken based on the latest available information.