Investment buy or sell recommendations are generally guided by a client’s unique financial objectives and circumstances. Sometimes, tax can also be a key motivator. This is because capital losses incurred on the sale of investments can offset against capital gains realized in the current year. In that case, any excess net capital loss available can be carried forward to a future year or carried back to any of the three previous taxation years.

While the intention may be to benefit from realizing a capital loss in the year, one may accidently trip over the complex superficial loss rules. This can cause unintended results. The capital loss that was triggered may not be available for use now, or in the future. Or, it may be transferred to somebody else.

The superficial loss rules

The superficial loss rules serve to prevent realization of losses where there is no perceived change in beneficial ownership.

The following five questions can help guide as to whether or not there is a superficial loss:

- Has a capital loss been realized on the disposition of a particular property? Yes or No?

- Has the same or an identical property been acquired? Yes or No?

- Was the same or an identical property acquired or the rights to that same or an identical property acquired within 30 calendar days before or after the disposition? Yes or No?

- Is the same or an identical property still owned or the right to own continues 30 days after the disposition? Yes or No?

- Who acquired or has the right to acquire the same or an identical property? There’s no simple yes or no answer, but we’ll address this shortly.

If the answer to questions 1, 2, 3 and 4 is “yes,” then the superficial loss rules likely apply.

The superficial loss and stop loss rules within the Income Tax Act are extensive. This article focuses on just certain aspects of some of these rules.

The answer to question 1 can be readily determined when a property is disposed of. The realization of a capital loss is the starting point for the potential application of the superficial loss rules.

Let’s dig a little deeper to better understand the impact of the answers to questions 2 through 5.

What is an identical property?

The Canada Revenue Agency (CRA) has provided guidance1 on the meaning of an identical property, stating they are:

“properties which are the same in all material respects, so that a prospective buyer would not have a preference for one as opposed to another. To determine whether properties are identical, it is necessary to compare the inherent qualities or elements which give each property its identity. Such a determination is a question of fact which must be decided on the basis of the relevant details in each situation.”

“Shares of two different classes of the capital stock of a corporation are not identical if they do not have the same interests, rights and privileges, … Furthermore, it should be noted that the right or privilege of conversion or exchange attached to the Class X shares constitutes a right to acquire a property and that such a right is deemed to be a property that is identical to the Class Y shares for the purpose of the definition of ‘superficial loss’ …. Therefore, the existence of a right or privilege of conversion or exchange attached to shares of the capital stock of a corporation may, in some circumstances, result in a taxpayer’s loss from a disposition of a share being considered a “superficial loss.”2

For example, an index fund tracking the S&P/TSX Composite Index of a financial institution would generally be considered identical to an index fund tracking the S&P/TSX Composite Index of another financial institution.3 However, a unit of a Sun Life mutual fund trust wouldn’t be considered an identical property to a unit of a Sun Life segregated fund. This is due to a segregated fund’s insurance properties.

There are many considerations to determine whether a property is an “identical property” within the meaning of the Income Tax Act (Canada) (ITA). It’s also open to interpretation by the CRA. We recommend consulting with a qualified tax advisor when a capital loss has been incurred related to the disposition of a property, and consideration is being given to purchasing the same property or an identical property.

What’s the meaning of 30 days before and 30 days after disposition?

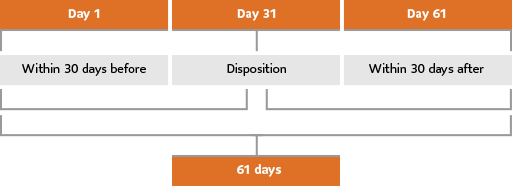

The 30-day rule, as depicted in the chart below, is an important timeframe to keep in mind for a realized capital loss.

The settlement date of the disposition, not the transaction date, is the relevant date for each trade executed for income tax purposes. Settlement date is, presently, the trade date + 1 business day (commonly referred to as T+1) for securities, mutual funds and exchange traded funds. For example, if a trade was executed on June 1, 2024, the settlement date would be June 2, 2024.

For example, assume you sell 100 shares of ABC with a trade date of June 13, 2024. This trade will settle on June 14, 2024. To avoid triggering the superficial loss rules, you must not acquire any new ABC shares that settle:

- on or after May 17, 2024, and

- before or on July 16, 2024.

When a capital loss has been realized on the disposition of capital property and an affiliated person (defined below) has acquired the same or an identical property or has a right to acquire the same or an identical property,

- within 30 days before property was disposed of, or

- within 30 days after the property was disposed of,

and

- the affiliated person continues to hold the property 30 days after the disposition (i.e., on the 61st day depicted in the chart, above),

the superficial loss rules will apply.

Who acquired or has the right to acquire the same or an identical property?

The "who" is an affiliated person.

The purchase by any affiliated person can, potentially, trigger the superficial loss rules.

Because it’s more straight forward, we’ll begin with who is NOT an affiliated person - parents, grandparents, siblings and children and grandchildren. Affiliated persons include4:

- the individual and himself/herself;

- an individual and their spouse or common-law partner (CLP);

- a corporation and the person who controls the corporation, and their spouse/CLP;

- a partnership and the majority-interest partner, and their spouse/CLP; and

- a trust and the majority-interest beneficiary, and their spouse/CLP.

Let’s consider an example:

- Ann and Jason are married,

- Ann sold (i.e., trade settled) 100 shares of XYZ Company on Day 31 and realized a capital loss,

- Jason purchased (i.e., trade settled) 100 shares in XYZ Company on Day 20, and

- Jason continued to own the 100 shares in XYZ Company on Day 61 (being 30 days after Ann’s disposition)

Will the superficial loss rules apply? Let’s consider questions outlined earlier:

- Has a capital loss been realized on the disposition of a particular property? Yes

- Has the same or an identical property been acquired? Yes

- Was the same or an identical property acquired or there’s a right to acquire within 30 days before or after the disposition? Yes

- Is the same or identical property still owned or the right to own continues 30 days after the disposition? Yes

- Who acquired or has the right to acquire? Jason, an affiliated person

Based on these answers, the superficial loss rules apply. The capital loss realized by Ann on the disposition of her shares of XYZ Company is deemed nil.

Will Ann ever be able to claim the capital loss? We’ll return to this example later.

Once it’s been determined that the superficial loss rules apply, the next step is to figure out if the loss is:

- suspended (i.e., the loss may be used at a future date) or

- denied (i.e., the loss will never be recognized).

Denied

A loss is denied if the same or an identical property is purchased within or transferred to a registered account, such as a Registered Retirement Savings Plan (RRSP), Registered Retirement Income Fund (RRIF), Tax-Free Savings Account (TFSA), Registered Education Savings Plan (RESP), etc.

Be wary of transfers in-kind. For example, an investment held in a non-registered account is transferred to a registered account, such as an RRSP, where the transferor is the annuitant. If the investment’s value at the time of the transfer was below its adjusted cost base (ACB), the capital loss would be denied due to the superficial loss rules.

An alternative strategy might be to dispose of the security held in the non-registered account. And then buy it in the registered account, at a later date. This would likely have to occur more than 30 days after the disposition, to reduce the risk of the application of the general anti-avoidance rules within the Income Tax Act.

Suspended

A loss is suspended when the same or an identical property is purchased by or transferred to an affiliated person, other than in connection with a registered account.

The loss will be suspended until the same or an identical property is ultimately disposed of by the affiliated person.

Who gets to recognize the loss depends on who acquired (by way of a purchase or transfer) the same or an identical property:

- If the affiliated person is the spouse or CLP or the person who disposed of the property, (remember you are affiliated with yourself) the loss is effectively recognized by the purchaser or transferee. This is because the loss that was originally denied is added to the cost base of the property acquired.

- If the affiliated person is a corporation, trust, partnership, person who controls a corporation, trust or partnership or their spouse or CLP or the individual and their spouse or CLP, the loss will be recognized by the original owner or transferor.

Let’s revisit the above example:

Ann sold 100 shares of XYZ Company. Then, she realized a capital loss. On his end, Jason purchased 100 shares of XYZ Company. He continued to hold the property 30 days after Ann’s disposition.

Let’s further assume that Ann realized a $5,000 capital loss. On his end, Jason purchased 100 shares at a cost of $15,000.

Adjusted cost base (ACB) of Jason’s shares: |

|

|---|---|

Purchase price |

$15,000 |

Ann’s denied capital loss increased Jason ACB: |

$5,000 |

ACB of 100 XYZ Company shares |

$20,000 |

Jason sold the 100 shares of XYZ Company the following year for $25,000. In that year, Jason will report a capital gain on disposition of $5,000. Ann’s loss is deemed nil and is effectively transferred to Jason. The capital gain that he may have otherwise reported (i.e., proceeds of $25,000 – purchase price of $15,000 = $10,000) is reduced by the amount of Ann’s loss.

Where the number of shares purchased is less than the number of shares disposed, the amount of the loss denied is prorated.5

Although these rules are somewhat punitive and the impact may lead to an unexpected result, some circumstances exist where the rules can be used to benefit a family unit. Working with the client and a qualified tax advisor to navigate these complex rules is recommended.

A few key questions to think about when the client has unrealized losses in any of their non-registered investment portfolios include:

- Has a capital gain been realized in the current taxation year? (Capital losses are offset against capital gains realized or capital gains dividends (e.g., via mutual fund year-end distributions) received in the same calendar year. Any excess remaining is the “net capital loss.”)

- Have capital gains been realized in any of the past three taxation years? (Net capital losses can be carried back to any of the three prior taxation years to offset capital gains realized in those years. To do so, use Form T1A, Request for Loss Carryback.)

- Is a capital gain anticipated in the future? (Net capital losses can be carried forward indefinitely to offset future capital gains realized.)

- If the client has a spouse or CLP, can they answer “yes” to any of the three preceding questions? (If so, there may be an opportunity to employ the superficial loss rules to their advantage.)

- Is consideration being given to invest in the same or identical property within 30 days of a disposition within an affiliated account? (If so, can the acquisition be delayed beyond 31 days from disposition or invested using an alternative vehicle, yet not presently considered the same or an identical property from an income tax perspective? A segregated fund contract or a corporate class mutual fund would be considered as an alternative vehicle. They could be invested in the same or similar funds.

- Have you considered trade settlement and holidays when calculating the 30-day period?

- If the superficial loss rules have been triggered in a transaction involving a corporation, partnership or trust, and the loss is suspended, can the substituted property be disposed of in the same taxation year? (The capital loss is suspended until the same or identical property is disposed of..)

Information contained in this article is for information purposes only. It is not intended to provide or be a substitute for professional financial, tax, insurance, investment, legal or accounting advice and should not be relied upon in that regard. It also does not constitute a specific offer to buy and/or sell securities. You should always consult your advisor or tax specialist before undertaking any of the strategies contained in this article to ensure that all elements of your personal circumstances are taken into consideration in developing your individual financial plan. Information contained in this article has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy and SLGI Asset Management Inc. disclaims any responsibility for any loss that may arise as a result of the use of strategies discussed.

1 A definition of identical properties is included in CRA’s interpretation bulletin IT-387R2 (Consolidated) – Meaning of “Identical Properties”, General, paragraph 1.

2 CRA’s interpretation bulletin IT-387R2 (Consolidated) – Meaning of “Identical Properties”, Convertible Shares, paragraph 7.

3 CRA TI 2001-0080385, Identical Properties – Indexed Based Investors, November 22, 2001.

4 ‘Affiliated persons’ is defined in S.251.1 of the Income Tax Act. The definition provided here represents only a portion of the definition.

5 CRA’s administrative position, which can be subject to change.