Measuring volatility is an integral part of market analysis. Volatility not only helps to explain factors that influence markets, it also helps to manage risk. For instance, investors who expect volatility to rise in the future, may reduce their exposure to markets by selling stocks beforehand.

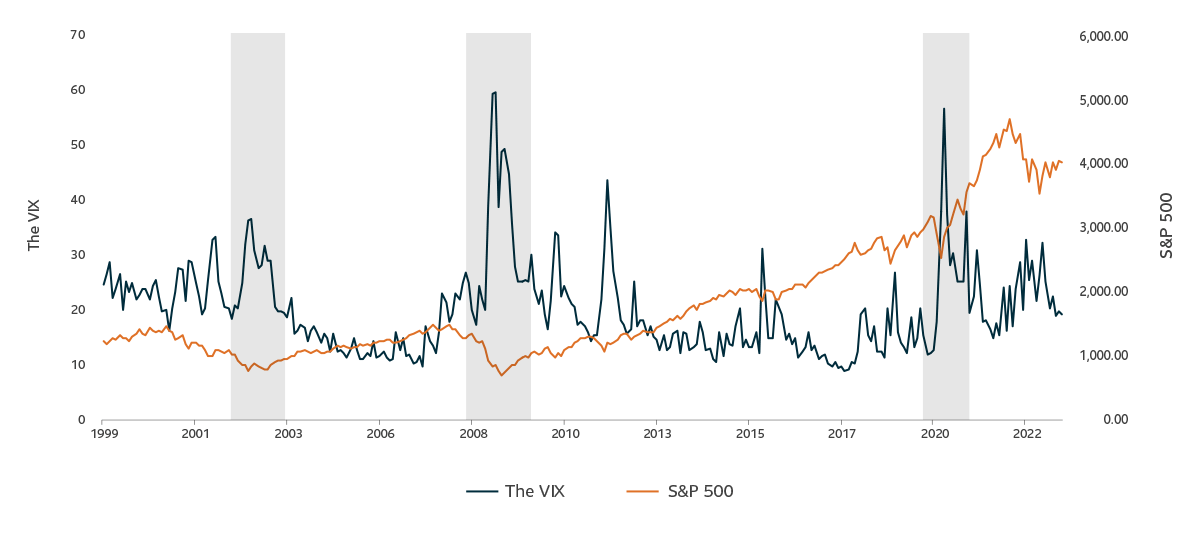

Equity market volatility is measured in a few ways. The Chicago Board Option Exchange’s Volatility Index (the VIX) is a widely used indicator that measures the implied volatility of the S&P 500 Index. In other words, the VIX helps to measure expectations about how much the S&P 500 index will swing over the next 30 days.

When uncertainty and fear dominate equity markets, the VIX rises. But during times of optimism and stability, the VIX tends to be low. Because of how it indicates the stock market’s level of calmness, the VIX is commonly known as the ‘fear index’ or the ‘fear gauge.’ Without getting into the VIX’s math, here is a quick guide as to what various VIX levels indicate.