Uncertainty and unknowns: the main causes of volatility

What exactly is volatility? Broadly speaking, it has to do with investor uncertainty. Investor uncertainty about what will happen next causes stock markets to rise and fall.

What exactly is volatility? Broadly speaking, it has to do with investor uncertainty. Investor uncertainty about what will happen next causes stock markets to rise and fall.

So, volatility can be seen as a measure of uncertainty. That's why it often occurs when markets are down. Investors will try to anticipate what the markets will do next.

The problem is that they don't have all the information to know what will happen for certain.

Currently, inflation is one factor causing uncertainty in the stock markets. It is unclear when inflation will return to its 2% target – and it could take a while.

Moreover, central banks have been raising interest rates to bring down inflation below the 2% target. No one knows exactly when interest rate rises will end. Or when interest rates will come back down to a level that central banks want and that are ideal for economic growth. And how low will rates go? Again – no one knows!

These unknowns lead to more uncertainty -- and to market volatility.

Want to learn more about inflation? Watch this video.

Fears of a recession are compounding this uncertainty.

It’s hard to say if we’ll see a recession in 2023. We could even be in a recession right now, but economic indicators haven’t officially confirmed this yet.

And if there is a recession, how long will it last? What will the effects be? On the economy? On jobs? All these unknowns are yet more uncertainties that amplify volatility.

Interested in learning more about volatility? Watch this video.

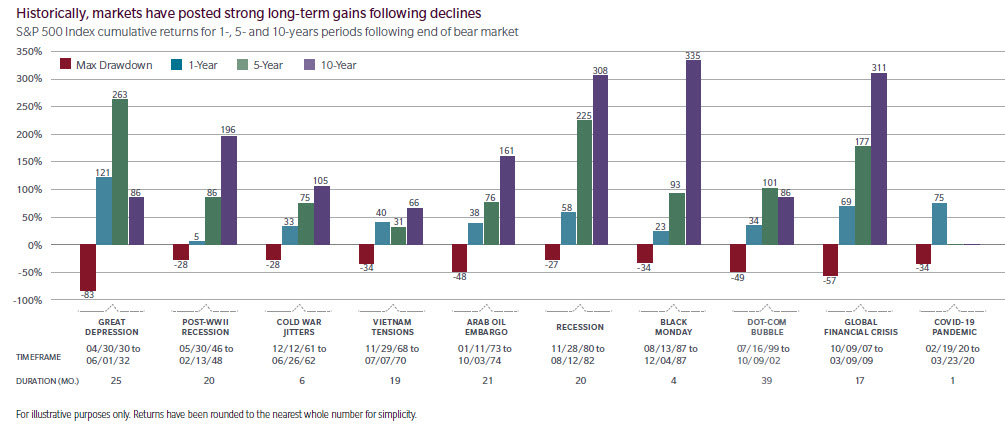

How can you keep calm in a situation like this? It’s important to remember that throughout history, markets have always recovered after a decline.

In the aftermath of the Great Depression in the early 1930s, the markets recovered within 25 months. The recession that followed World War II ended in 20 months.

More recently, there was the Black Monday market collapse in 1987, with markets recovering in four months. And after the COVID-19 stock market crash, markets recovered after one month.

The following chart shows how stock markets perform following steep declines at various points in history.

Source: FactSet, based on daily data from January 3, 1928 to March 31, 2020.

In an environment like this, the danger is that investors will want to cash in their investments, such as stocks, when the value of their investments is low. An investor who does this runs the risk of missing the market rebound. The best way to avoid this risk is to stay invested, despite bad news and volatility.

Reviewing your financial plan with your advisor is a good idea in times like this. Does your plan meet your long-term investment goals? Is it a good fit with your risk tolerance? The current period of volatility could be an opportunity to rebalance your portfolio to better reflect your situation.

Are you concerned about market volatility and economic instability? This article addresses 4 questions you should ask your advisor when markets are volatile.

The information contained in this document is provided for information purposes only and is not intended to represent specific individual financial investment, tax or legal advice nor does it constitute a specific offer to buy an/or sell securities. While the information contained in this document has been obtained from sources believed to be reliable, SLGI Asset Management Inc. cannot guarantee its accuracy, completeness or timeliness. Information in this document is subject to change without notice and SLGI Asset Management Inc. disclaims any responsibility to update it.

SLGI Asset Management Inc. is the investment manager of the Sun Life family of mutual funds. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the fund’s prospectus. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Sun Life Assurance Company of Canada is the issuer of accumulation annuities (insurance GICs), payout annuities and individual variable annuity contracts (segregated fund contracts). Any amount that is allocated to a segregated fund is invested at the risk of the contract owner and may increase or decrease in value. Sun Life Financial Trust Inc. is the issuer of guaranteed investment certificates.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada and Sun Life Financial Trust Inc. all of which are members of the Sun Life group of companies.