The U.S. equity market, as represented by the S&P 500 Index, made some extreme moves in early 2022 and was a good reminder to investors of how volatile markets could be.

Markets across the U.S. showed investors that stock prices don’t just always go up and that returns produced by concentrated positions could be volatile.

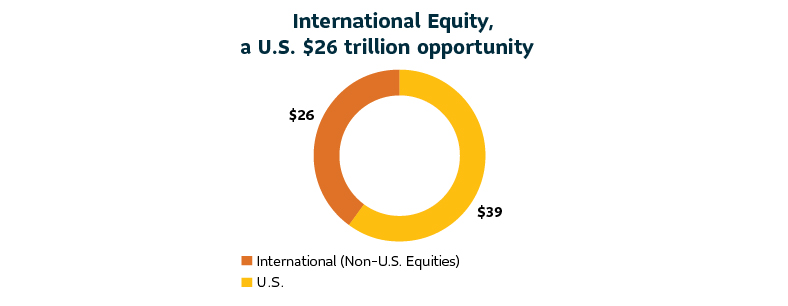

But looking through the S&P 500’s volatility, we see some timeless wisdom in investing: there is an ocean of opportunities in international markets outside the U.S., that if pursued actively could help smoothen returns within a broader investment portfolio.

Why international equities?

You may wonder why international equities now. Haven't U.S. equities done better than those of every other major economy in the recent past? Aren't U.S. companies the leaders and champions of innovation and growth?

With U.S. equity returns exceeding that of international equity returns for the past 10 years, these are obvious questions to ask. But a more important question to ask would be what additional benefits international equities can bring to your portfolio.

Since international equity returns are not perfectly positively correlated to U.S. equity returns, adding international equities to portfolios can help achieve diversification.

Let's take some historic examples where international diversification provided some valuable support to portfolio returns in the U.S.

Source: MSCI All Country World Index, as of February 2022

Source: MSCI All Country World Index, as of February 2022

Sustained periods of leadership

Remember the years following the millennium? U.S. stocks lagged international equities once during the Dotcom bubble and again during the period leading to the Great Financial Crisis. This was famously called the lost decade for U.S. equities. During the period between 2002 and 2007 both non-U.S. developed market equity and emerging market equity returns handily beat U.S. equity returns.

The longer-term equity returns record is also quite evenly balanced between U.S. and international equities. The MSCI EAFE index surpassed the S&P 500 index 24 of the past 51 calendar years and the MSCI EM index beat the S&P 500 index 15 of the 33 calendar years through 2021. History shows that while one region may dominate another in terms of equity returns over sustained periods, leadership between U.S. and international equities does indeed shift between the two.

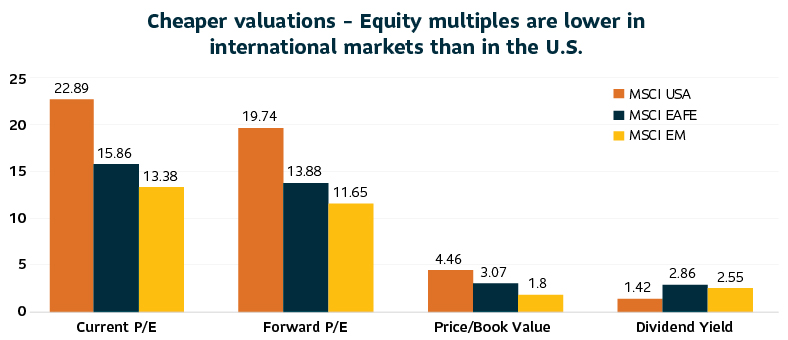

Cheaper valuations, strengthening fundamentals

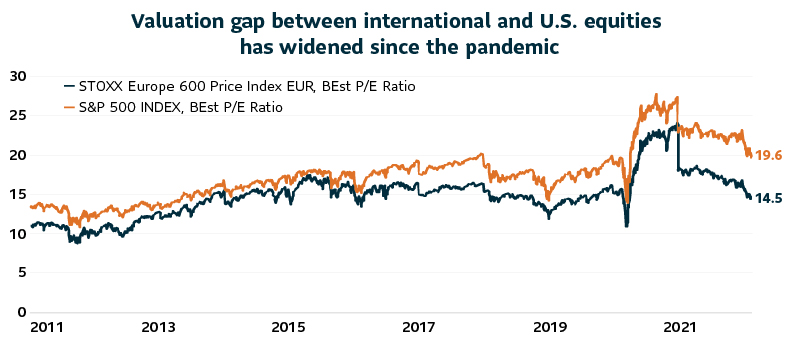

Firstly, valuations are quite favorable for international equities compared to their U.S. counterparts on a relative basis.

While U.S. valuations as measured by forward price-to-earnings have hovered at higher levels than their long-term average, international equity valuations have been trending closer to average levels (as of 2021, according to figures from FactSet). In fact, in Japan, the world's third largest equity market, valuations were below their long-term averages.

Further, the dividend yield for both MSCI EAFE and MSCI Emerging Markets indices, exceeded that of MSCI USA index by over a 100 basis points as of February 2022. That could potentially boost the income return component from international equities.

Source: MSCI, as of February 2022

Source: MSCI, as of February 2022

Source: Bloomberg, as of January 2022

Source: Bloomberg, as of January 2022

In 2021 international equities witnessed the fastest pace of earnings growth in three years and were seen closing in on the earnings growth of U.S. companies according to FactSet. What's more? Profit margins for international equities have also been catching up with those of U.S. equities and that should put the wind in the sails for international equities' performance.

Value sectors, less interest rate vulnerability

Secondly, with inflation increasing in much of the world, interest rates could inch up from their current rock-bottom levels.

Growth companies in fast-growing industries, whose profits are to be had in the distant future and are like long duration assets, dominate U.S. equity markets. Since long duration assets are more vulnerable to higher interest rates, U.S. equity markets are more likely to be impacted by a jump in interest rates.

However, companies in sectors such as industrials, energy and consumer discretionary, which tend to get a lift with improving economic conditions, dominate international equity markets. As an example, within the MSCI All Country World Index, foreign firms accounted for 12 of the 25 largest consumer discretionary firms. This sector composition will likely provide a natural tailwind for international equities in the medium term and potentially help diversify sources of return.

While the current outlook for international equities has been clouded by Russia's invasion of Ukraine, the effects of exogenous geopolitical shocks on portfolios are hard to quantify. Nonetheless, we believe a diversified allocation to international equities tapping into broader markets may produce positive outcomes in the long run.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Investors should read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by SLGI Asset Management Inc. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. This commentary is provided for information purposes only and is not intended to provide specific individual financial, investment, tax or legal advice. Information contained in this commentary has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy.

This commentary may contain forward-looking statements about the economy and markets, their future performance, strategies or prospects or events and are subject to uncertainties that could cause actual results to differ materially from those expressed or implied in such statements. Forward-looking statements are not guarantees of future performance and are speculative in nature and cannot be relied upon.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada and Sun Life Financial Trust Inc. SLGI Asset Management Inc. is the investment manager of the Sun Life Mutual Funds, Sun Life Granite Managed Solutions and Sun Life Private Investment Pools.

© SLGI Asset Management Inc. and its licensors, 2022. SLGI Asset Management Inc. is a member of the Sun Life group of companies. All rights reserved.