Inflation continues to be top of mind for Canadian households. That’s no surprise as 2023 has seen rising prices for food, housing and other costs like gas and travel. To add to the worry, wages aren’t keeping pace. As a result, households have less purchasing power.

Is there an end in sight? Will prices stabilize? Could they even come down? Before we look at these questions, it’s important to understand the different way that prices of goods may react after a long period of inflation.

Inflation: Period when overall prices persistently rise.

Disinflation: Period when prices continue to rise, but at a slower pace.

Deflation: Deflation is the opposite of inflation. Overall prices persistently fall.

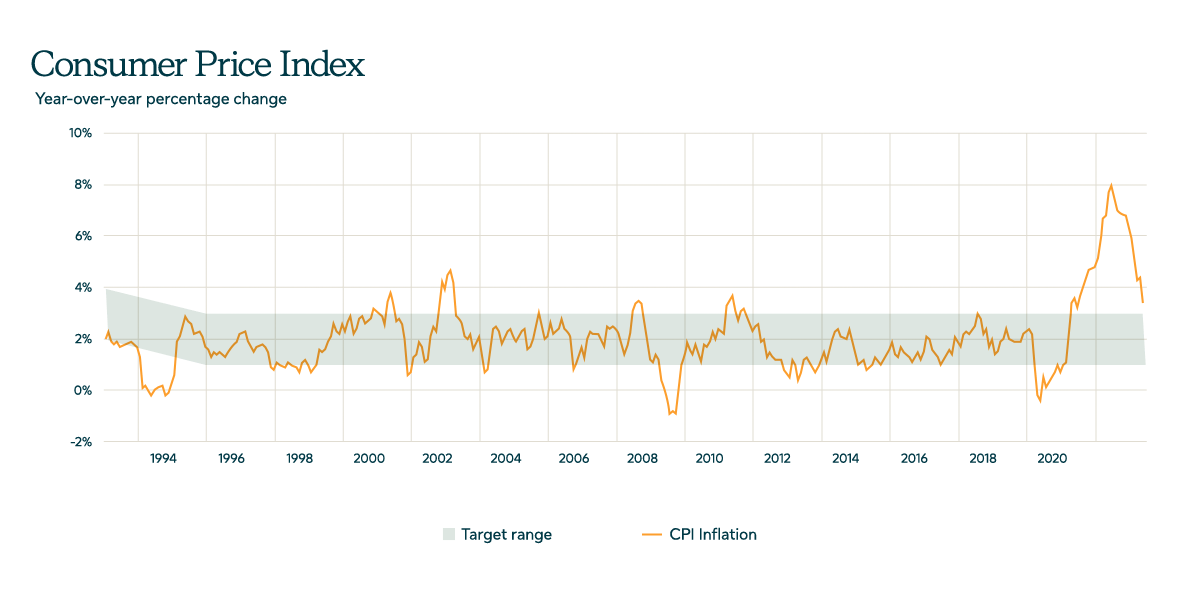

A period of inflation is often followed by a period of disinflation. This is when prices usually rise more slowly, and inflation stabilizes around the Bank of Canada’s (BoC) 2% target. For example, inflation peaked at 8.1% in Canada in June 2022.* It then gradually declined over several months. By mid-2023, inflation in Canada sat at just under 3%.

The dangers of a rapid decline

On very rare occasions, prices may go back down. This is called deflation. Canada has had very few periods of deflation. The only significant instance of deflation occurred during the Great Depression in the 1930s.

At first glance, paying less may seem like good news. However, the consequences of a prolonged period of deflation can be severe. Lower prices across the board can mean lower profits for businesses, which then be forced to cut salaries or jobs. The whole economy, including consumers, can suffer.

History shows that this type of negative cycle can be hard to break, and that’s exactly what happened during the Great Depression. The drop in expenses caused prices to fall by more than 20% over four years. This in turn led to a general decline in wages. The unemployment rate skyrocketed to 20% in 1931 and didn’t fall back below 10% consistently until 1940. In short, a rapid drop in prices isn’t necessarily good news.

Why maintain inflation at 2%?

Where does the BoC’s 2% target come from? To find out, let’s go back to the 1970s. A period of high inflation began towards the end of the decade. Inflation rose for several years, peaking at 12% in 1981. The BoC raised interest rates to bring inflation down, with its policy rate hitting a high of 22% in September 1981.

It took an entire decade for inflation to return to an acceptable level. Once that happened, in 1991 the BoC adopted an inflation-targeting policy. The central bank’s monetary policy set the inflation target at 2%, although the target range is actually 1% to 3%. That target wasn’t reached until 1995. However, inflation stayed within target until 2021.

Inflation in Canada from 1993 to 2023

Source: Bank of Canada

This strategy has a proven track record. The BoC believes that maintaining its 2% inflation target has four advantages:

- Price changes are stable and predictable

- Expansion and contraction cycles are less frequent

- The job market is more stable

- Borrowing rates for individuals and businesses fluctuate less and are much lower

How an advisor can help

Whether you’re an individual or a business owner, you may worry about the impact of inflation on your finances. An advisor can give you an outsider’s perspective, and help you plan for wherever inflation is headed. There are many ways an advisor can help. Here are just a few:

- Create a financial plan

- Ensure your finances are sound

- Manage your debt

- Plan your retirement

Read this article to learn about the value of working with an advisor.

* Source for statistics and historical data from the article: Bank of Canada.

Information contained in this article is provided for information purposes only. It is not intended to provide or be a substitute for professional, financial, tax, insurance, investment, legal or accounting advice and should not be relied upon in that regard. It also does not constitute a specific offer to buy and/or sell securities. You should always consult your financial advisor or tax specialist before undertaking any of the strategies discussed in this article to ensure that all elements and your personal circumstances are taken into consideration in developing your individual financial plan. Information contained in this article has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy and SLGI Asset Management Inc. disclaims any responsibility for any loss that may arise as a result of the use of the strategies discussed.