A quick history lesson

Our story starts in 2016, at the annual conference of the Canadian Tax Foundation. During a tax roundtable, the Canada Revenue Agency (CRA) was asked a question. Is it acceptable, for a registered plan annuitant, to pay advisor fees pertaining to registered plans with funds held in a non-registered account (see 2016-0670801C6)? The CRA took the position that should advisor fees pertaining to a registered account be paid with non-registered funds, it would consider the increase in value of the registered account as an “advantage.” This also means that it’s subject to a 100% penalty (as described in subsection 207.01(1) of the Income Tax Act (ITA)). In its opinion, the goal of such a transaction was to maximize the savings in the registered plan, to benefit from its tax deferred status.

The CRA stated however that it would defer the application of this new position until January 1, 2018. The implementation was further deferred to January 1, 2019 (2017-0722391E5). And then indefinitely (2018-0779261E5, 2018-0785021C6), until the Department of Finance completed a review on this topic.

Finally, on August 26, 2019, the Department of Finance came up with a new policy by issuing a comfort letter. In it, the Department of Finance concurred with the CRA’s view. It specified that an advisor fee payment relative to a registered account from non-registered funds could potentially be considered an advantage. However, to everyone’s surprise, it stated the following:

“We have no tax policy concerns with respect to the payment of investment management fees directly by the annuitant/holder of the registered plan. It is not evident that plan holders are tax-motivated when entering into arrangements to directly pay the investment management fees of their financial service providers. Generally, the direct payment of fees results in either a net loss, or a negligible gain, for the plan holder.”

(see https://taxinterpretations.com/content/534227)

In conclusion, with this comfort letter, the Department of Finance gave the go-ahead for investors to pay their advisor fee for their Registered Retirement Savings Plan (RRSP) or Registered Retirement Income Fund (RRIF) with funds held outside these registered accounts.

But was this position really a victory for Canadian taxpayers?

In or out?

First, although it’s now possible to pay advisors fees pertaining to a RRSP/RRIF with non-registered money, you must keep in mind that these advisor fees are never tax deductible. Paragraph 18(1)(u) of the ITA prohibits the deduction of fees paid in respect of an RRSP, RRIF, or Tax-Free Savings Account (TFSA).

But how should advisor fees pertaining to RRSP/RRIF be paid? Should they be paid from funds held within the registered plan itself? Or should they be paid by using funds held outside the RRSP/RRIF? What’s optimal for a Canadian investor?

Imagine the following situation in which an investor holds two accounts. One is an RRSP worth $100,000 and one is a non-registered account worth the same amount. The investor has a choice between:

- charging the advisor fee equally in each account (Scenario 1) or

- charging the advisor fee pertaining to the RRSP only with the money held in the non-registered account (Scenario 2).

Which scenario would most benefit this investor?

Scenario 1: Advisor fee is charged equally in both accounts:

| RRSP | Non-registered account | Total | |

|---|---|---|---|

| Value of account at the start of the year | $100,000 | $100,000 | |

| Investment advisor fees (1%) | ($1,000) | ($1,000) | |

| Value of account after fees | $99,000 | $99,000 | |

| After-tax investment return | $5,940 | $3,792 | |

| Value of account at year end | $104,940 | $103,821 | |

| Tax payable on withdrawal (38%) | ($39,877) | ($0) | |

| After-tax value of accounts | $65,063 | $103,821 | $168,884 |

(Assumptions: 6% rate of return before advisor fee, return consisting of 2% interest income, 1% eligible dividend and 3% realized capital gains. The tax rates are assumed to be 38% for interest income, 19% for capital gains and 18% for eligible dividends).

Scenario 2: Advisor fee is charged only in the non-registered account:

| RRSP | Non-registered account | Total | |

|---|---|---|---|

| Value of account at the start of the year | $100,000 | $100,000 | |

| Investment advisor fees (1%) | ($0) | ($2,000) | |

| Value of account after fees | $100,000 | $98,000 | |

| After-tax investment return | $6,000 | $4,772 | |

| Value of account at year end | $106,000 | $102,773 | |

| Tax payable on withdrawal (38%) | ($40,280) | ($0) | |

| After-tax value of accounts | $65,720 | $102,773 | $168,493 |

(Assumptions: 6% rate of return before advisor fee, return consisting of 2% interest income, 1% eligible dividend and 3% realized capital gains. The tax rates are assumed to be 38% for interest income, 19% for capital gains and 18% for eligible dividends)

In scenario 1, if you consider the taxes payable on the investment income generated with the non-registered account, and latent taxes payable on the funds held in the RRSP, after a one-year period, an investor would have $168,884.

In Scenario 2, for the same one-year holding period, with the advisor fees paid solely by the non-registered account, the investor ends up with $168,493. That’s $391 less!

Taking taxes into consideration, for a one-year holding period, it seems to make sense to pay for advisor fees with monies held inside the RRSP/RRIF. This result makes intuitive sense. By paying advisor fees with the non-registered account, you basically increase the value of an account (the RRSP/RRIF) that is highly taxable at withdrawal to deplete an account this is lightly taxable at withdrawal (the non-registered account).

However, a counter to this would be that if the money that’s saved by the RRSP (in Scenario 2) compounds over many years, the investor might still come out ahead, even after accounting for the latent taxes payable by the RRSP. In other words, if you leave the money “saved” in the RRSP long enough, you may eventually come out ahead by paying the advisor fee with the non-registered account in year one.

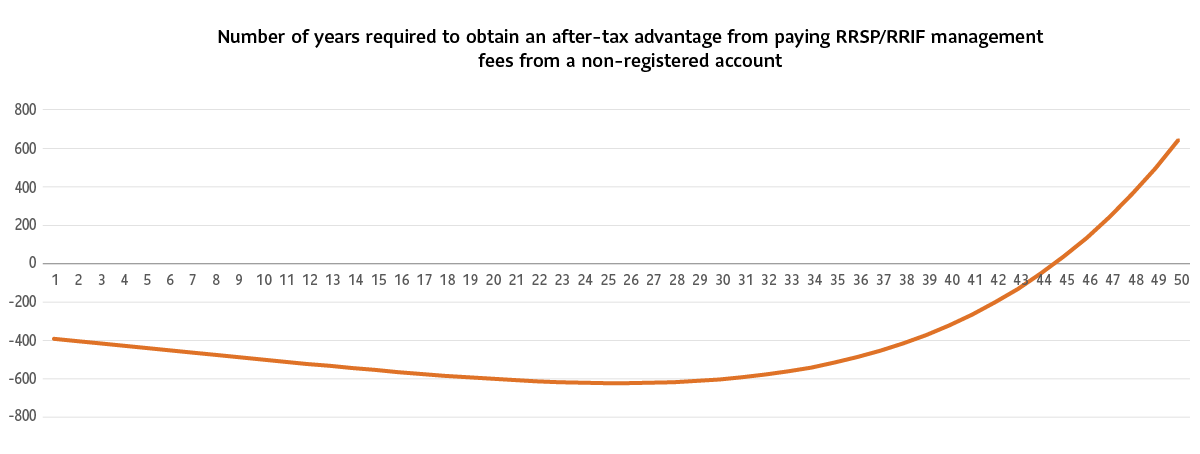

The question then becomes: how long would it take for an investor to recoup the disadvantage incurred in year one, by paying the advisor from the non-registered account?

(Assumptions: 6% rate of return before advisor fee, return composed of 2% interest income, 1% eligible dividends and 3% realized capital gains. The tax rates are assumed to be 38% for interest income, 19% for capital gains and 18% for eligible dividends. The tax rate of RRSP withdrawal is assumed at 38%).

This illustration shows that it would take over 44 years for an investor, who would’ve paid the advisor fee from their non-registered account in year 1, to come out ahead, taking taxes in consideration!

So, should you choose to pay your advisor fee from your non-registered account at age 60, you would need to live past age 104 for this initial transaction to benefit you.

Increasing the investor’s rate of return or changing the tax rate payable at RRSP withdrawal would somewhat change the calculation. A higher rate of return would, all else being equal, shorten the time needed to break even. A higher tax rate at withdrawal would increase the time required to break even.

Conclusion

Although it might seem attractive at first, paying the advisor fee with non-registered money is probably not a very good strategy for most investors. Even with optimistic rate of return expectations and a lower tax rate, it will rarely take less than 25 years to break even. For conservative investors, the time required to break even will often exceed 50 years.

Information contained in this article is provided for information purposes only. It’s not intended to provide or be a substitute for professional, financial, tax, insurance, investment, legal or accounting advice and should not be relied upon in that regard. It also does not constitute a specific offer to buy and/or sell securities. You should always consult your financial advisor or tax specialist before undertaking any of the strategies discussed in this article to ensure that all elements and your personal circumstances are taken into consideration in developing your individual financial plan. Information contained in this article has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy and SLGI Asset Management Inc. disclaims any responsibility for any loss that may arise as a result of the use of the strategies discussed.