Reading headlines about recessions, and what comes next, can be frightening. And whether you’re in your prime savings years, or near retirement, a drop in the value of your investment portfolio may worry you.

It may be tempting to take your investments out of the markets and wait for the storm to pass.

However, giving in to panic could cost you more than keeping your money invested. If you get out of the markets temporarily, you crystalize your losses. You also risk missing out on a rally. Markets may rebound as they start to look forward to an economic recovery.

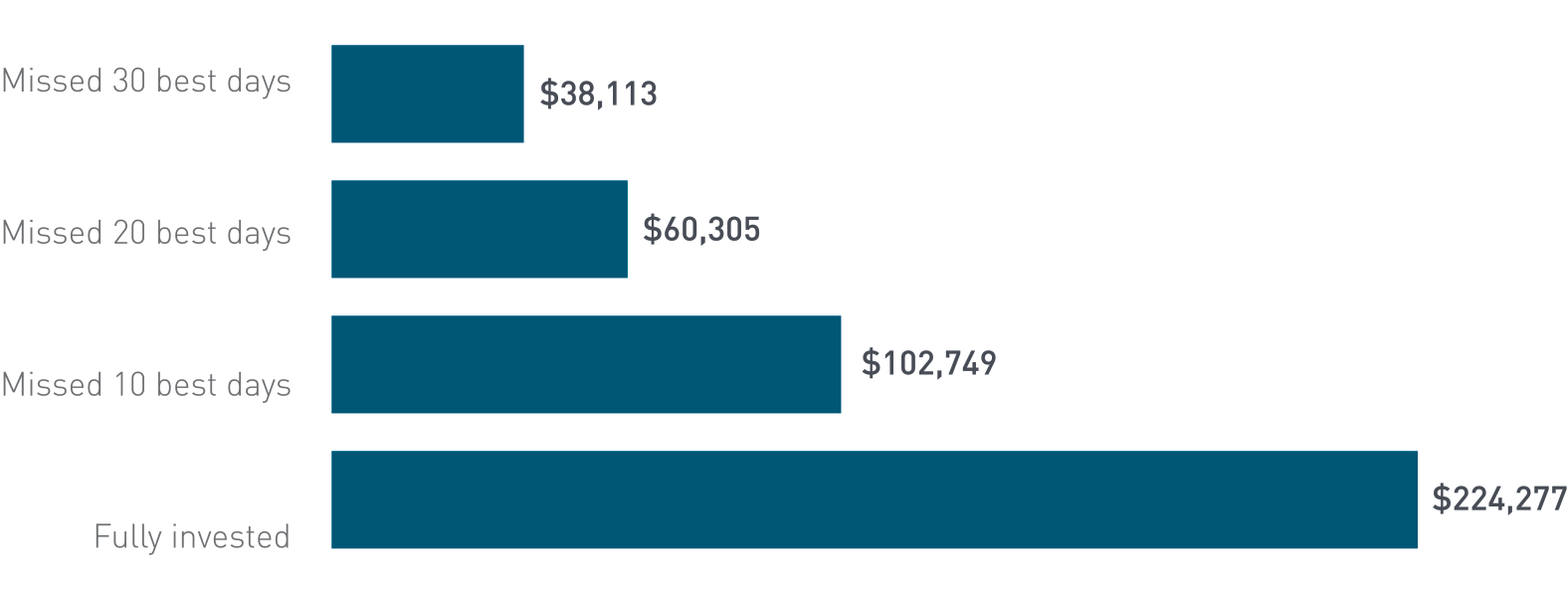

Based on market index data, we know that a $10,000 investment made 20 years ago could now be worth over $60,000, but only if you stayed invested in the market.1 Missing the 10 best days in the market during those 20 years would have reduced it to around $30,000.1

Missing the best days can hurt

Growth of $10,000 in the S&P 500 Index, 20 years ending 12/31/21