Here are some ways you can avoid the pitfalls of market volatility.

The importance of withdrawal rates

It’s vital to know how much money you’ll need in retirement. But it’s just as important to know how much of your savings you can withdraw each year.

Being prepared for your golden years will help you stay calm when markets are volatile. And rebalancing your portfolio from time to time helps ensure that you won't run out of money down the road, no matter how much the market fluctuates.

It’s common for investors’ goals to change over time. Initially, most investors want their portfolios to grow in value. Later on, they want to preserve the capital they’ve accumulated over the years.

That's why it's important to determine how much of your savings you should withdraw annually once you retire. If you withdraw too much, you could outlive your savings.

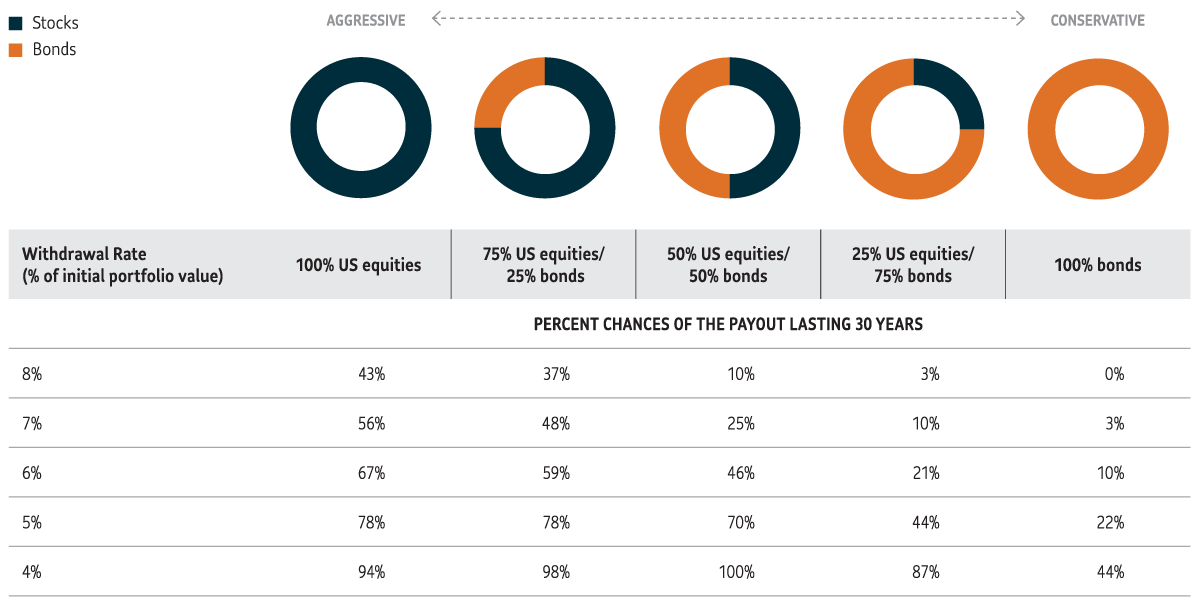

To prevent this from happening, you need to make sure that your savings grow while they’re invested. This means that your portfolio needs to be properly diversified, as diversification mixes a wide variety of investments within a portfolio. A person who invests only in bonds will not achieve the same returns as someone whose portfolio is diversified.

A good example

Let's look at someone who invests all their savings in bonds. If this person withdraws 4% of the savings they invested each year, odds are less than 50% that their savings will last more than 30 years. On the other hand, consider a person who invests 50% of their savings in bonds and 50% in stocks. At a 4% withdrawal rate, this investor likely won’t have to worry about running out of money. The following table gives a few more examples:

Allocation and Withdrawal Rates are Key to achieving goals

An appropriate asset allocation and prudent withdrawal rate may help you meet your retirement income and estate planning goals.

For illustrative purposes only. The scenarios depicted are hypothetical in nature and are not intended to reflect the actual returns of any product managed by Sun Life Global Investments or any market or index.

The importance of rebalancing

A knowledgeable investor won’t stick with the same asset mix throughout their lifetime. The mix will shift as time goes on.

Rebalancing can help your portfolio stay in line with your goals. “Working with your advisor to rebalance your portfolio is part of sound portfolio monitoring,” comments Chhad Aul, Chief Investment Officer and Head of Multi-Asset Solutions, SLGI Asset Management Inc. “Adjusting your investments as your risk tolerance and/or market conditions change can help you ensure that you have the appropriate portfolio to meet your investment objectives.”

For example, people starting out in their career typically choose a more aggressive portfolio. But as they near retirement, they will need to adjust the mix so they are not exposed to risk if the stock market drops dramatically. A portfolio could lose more than its initial value if the value of its holdings takes a tumble.

An advisor can review your investment portfolio at least annually. An advisor can help you make any adjustments that are needed. These adjustments are based on your needs as an investor and the state of the markets.

In short, having a suitable asset mix and a prudent withdrawal rate can help you meet your retirement income goals. And it can keep your portfolio aligned with your level of comfort with risk.

Important information

Chart source: MFS Research.

Data source: Journal of Financial Planning, September 2012. Data for stock returns are monthly total returns to the S&P 500 Index, and bond returns are total monthly returns to high-grade corporate bonds. Both sets of returns data are from January 1926 through December 2009, as published in the Ibbotson SBBI 2010 Classic Yearbook from Morningstar. Inflation adjustments were calculated using annual values of the CPI-U, as published by the US Bureau of Labor Statistics at www.bls.gov. Updated January 2018 by Wade Pfau, Professor at The American College and Principal at McLean Asset Management as published on Forbes.com, latest data available.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Investors should read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The information contained in this document is provided for information purposes only and is not intended to represent specific individual financial investment, tax or legal advice nor does it constitute a specific offer to buy an/or sell securities. While the information contained in this document has been obtained from sources believed to be reliable, SLGI Asset Management Inc. cannot guarantee its accuracy, completeness or timeliness. Information in this document is subject to change without notice and SLGI Asset Management Inc. disclaims any responsibility to update it.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada and Sun Life Financial Trust Inc.

© SLGI Asset Management Inc. and its licensors, 2022. SLGI Asset Management Inc. is a member of the Sun Life group of companies. All rights reserved.