Data as of September 15, 2022

Source: Federal Reserve via St. Louis Fed

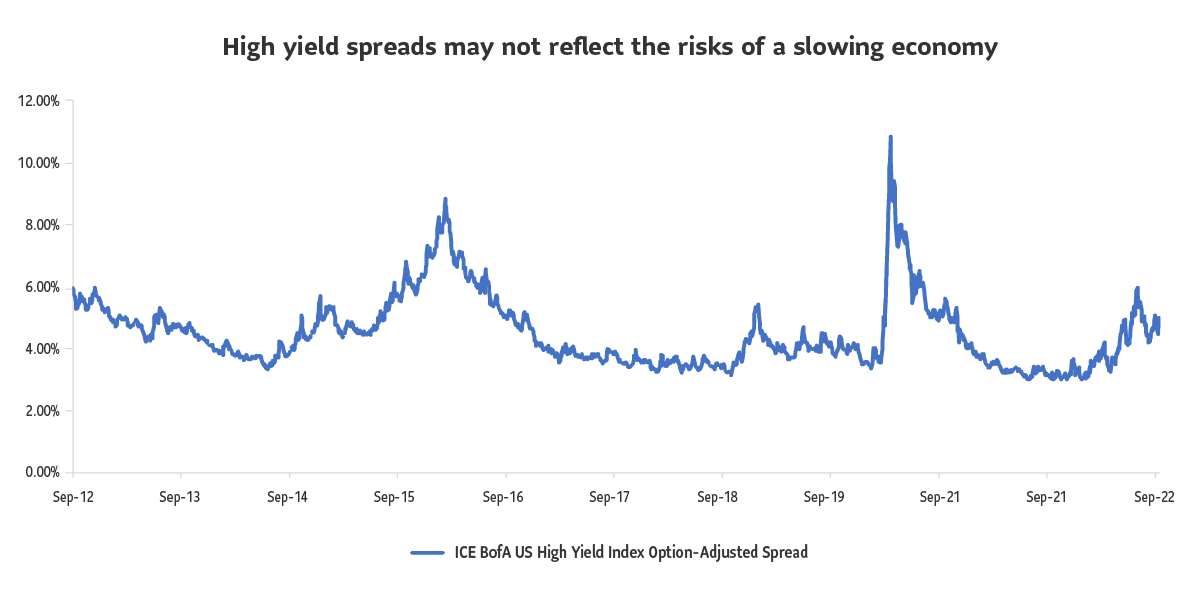

Spreads are the extra compensation demanded by investors to hold riskier investments compared to safer government bonds. Spreads are typically measured as the differences in yield between a risky investment and that of a safer debt instrument such as government bonds.

An overarching focus to try and stop inflation

The U.S. Federal Reserve’s 75 basis points (bps) interest rate hike in September 2022 is squarely aimed at stubborn inflation. While the U.S. inflation measured by CPI (Consumer Price Index) registered a high of 9.1% in June, subsequent reports of 8.5% in July and 8.3% in August are not seen as falling fast enough to meet the Fed’s target of 2% inflation. This is keeping the Fed on a path aggressive tightening resulting in higher interest rates.

Aggressive tightening is likely to take a toll on the economy

The path to the Fed’s 'soft landing' – controlling inflation without a major uptick to employment – seems to have narrowed. With inflation hardly budging, the Fed has penciled in higher interest rates for a longer period. The Fed now projects rates to rise to 4.4% by the end of 2022 and 4.6% in 2023, higher than its previous forecasts. As monetary policy acts with a lag, we believe the full effects of the Fed’s aggressive rate hikes will likely take hold in the form of significant economic slowing in the coming quarters. The Fed also cut its economic growth forecast to just 0.2% for 2022 and 1.2% in 2023.

Financial conditions are stiffening

The channels that transmit the Fed’s monetary policy – mortgage rates, the yield curve, and the U.S. dollar – are all currently working to curb demand. For instance, the U.S. 30-year mortgage rate hit 6.25% in mid-September, the highest since 2008. The U.S 2-Year Treasury note is now round 4%, the highest since 2007, and the U.S. 10-Year Treasury note is around 3.58%, the highest since 2011. This signals that financial conditions are tightening. We believe risk assets could come under pressure in these circumstances.

Reiterating our cautious stance towards credit

Given the tighter monetary policy, we believe riskier parts of credit such as high yield and emerging market debt could come under strain. We also believe some corners of the fixed income markets are not appreciating the risks of a downturn. For example, the spreads on junk bonds over U.S. Treasuries, as measured by ICE BofA US High Yield index is below the median spreads typically recorded at a time of tightening financial conditions. Within our Granite Managed Solutions, we continue to opportunistically add higher quality bonds and underweight riskier high yield and developing market debt.

This article contains information in summary form for your convenience, published SLGI Asset Management Inc. Although this article has been prepared from sources believed to be reliable, SLGI Asset Management Inc. cannot guarantee its accuracy or completeness and is intended to provide you with general information and should not be construed as providing specific individual financial, investment, tax, or legal advice.

The views expressed are those of the author and not necessarily the opinions of SLGI Asset Management Inc. Please note, any future or forward looking statements contained in this article are speculative in nature and cannot be relied upon. There is no guarantee that these events will occur or in the manner speculated. Please speak with your professional advisors before acting on any information contained in this article.