Volatile bonds face their first bear market in a generation

Bonds sway alongside stocks in an uncertain environment of rising credit, liquidity, and interest rate risk.

Bonds sway alongside stocks in an uncertain environment of rising credit, liquidity, and interest rate risk.

When market volatility hits, equities typically suffer first. During such moments, investors usually take cover under the protection offered by fixed income, perceived to be less volatile. But not so this time. The market volatility of mid-2022 has been so intense that even higher quality bonds have wilted under the weight of uncertainty.

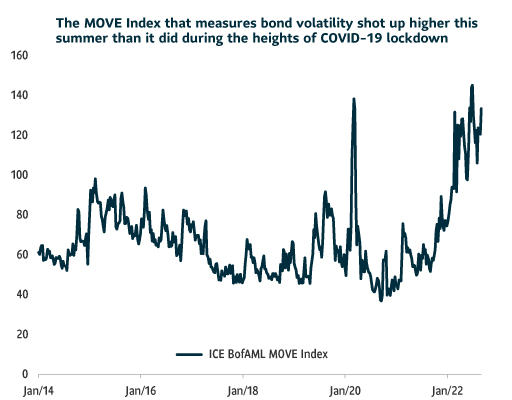

While equity markets are known for their volatility, bond market swings surpassed stocks’ ups and downs this summer. In fact, measured by the MOVE index, bonds were more volatile this summer compared to early 2020, when COVID-19 shuttered the global economy.

Data as of September 01, 2022

Source: Bloomberg

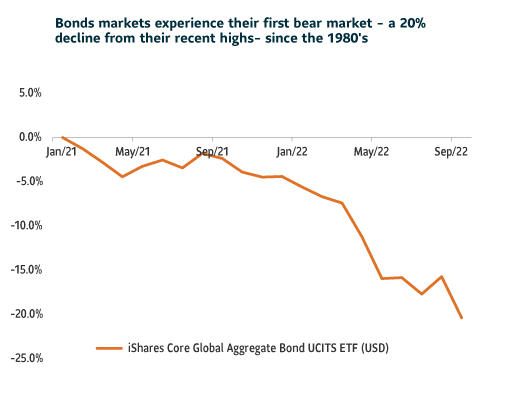

As a result, bond markets suffered a 20% decline from their highs set in early 2021. That’s a bear market – defined as an asset losing 20% from its recent highs. The safest corners of bond markets had last seen a bear market in the 1980’s. Data from the Federal Reserve Bank of New York shows that 10-year U.S. Treasury securities (Treasuries), considered to be one of the safest investments, dodged a bear hug during the past selloffs in 1994, 2003 and in 2013. They finally succumbed to a bear market in 2022.

The risks that pulled bond markets down look like they may persist. With inflation remaining far above the U.S. Federal Reserve’s target rate of 2%, Fed Chair Jerome Powell has indicated that monetary policy, that influences interest rates, will be used to fight price pressures. Tighter monetary policy from the Fed could pose three distinct risks for bonds.

Given these risks, fixed income markets may continue to experience ups and downs for a while. While volatile markets may be unnerving for investors, they may also open the opportunity to invest in underperforming asset classes that could outperform in the long run.

Within our Granite Managed Solutions, we have a preference for the higher quality parts of the market such as Canadian bonds and have been gradually and opportunistically adding to our exposure over the year as yields have become more attractive. On the other hand, we are underweight the higher risk bond components such as high yield bonds and emerging market debt.

This article contains information in summary form for your convenience, published SLGI Asset Management Inc. Although this article has been prepared from sources believed to be reliable, SLGI Asset Management Inc. cannot guarantee its accuracy or completeness and is intended to provide you with general information and should not be construed as providing specific individual financial, investment, tax, or legal advice.

The views expressed are those of the author and not necessarily the opinions of SLGI Asset Management Inc. Please note, any future or forward looking statements contained in this article are speculative in nature and cannot be relied upon. There is no guarantee that these events will occur or in the manner speculated. Please speak with your professional advisors before acting on any information contained in this article.