By Jason Zhang, CFA, Portfolio Manager, SLGI Asset Management Inc.

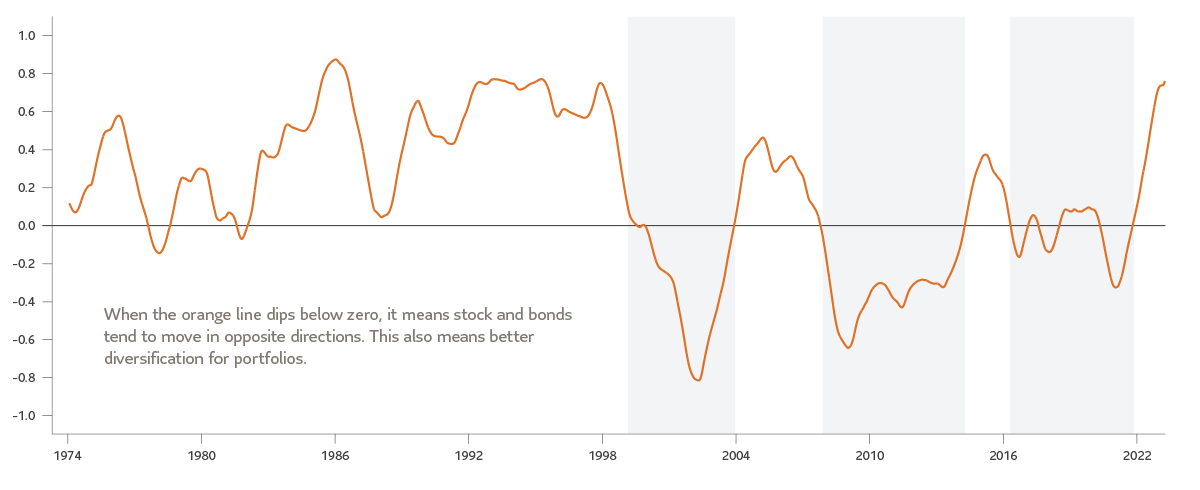

For over two decades, stock and bond prices mostly tended to move in opposite directions – meaning when one performed well, the other did not. This relationship between the two asset classes, called “negative correlation,” is at the heart of balanced strategies. This also includes asset allocation portfolios that comprises diverse asset classes.

Typically, when stock markets are volatile, bonds act as a safe haven to smooth out the ride. But, during the bear market of 2022, investors were shocked when the correlation between stock and bond prices turned positive and the prices of both fell together.

The last time stock and bond prices sank together was during the high inflationary period of the 1970s and 80s. This was when central banks tightened monetary policy to rein in inflation, and the dramatic increase in interest rate levels across developed economies pressured both stock and bond prices.

The top line in the chart below shows the correlation, smoothed over time, between stock prices and bond prices. That correlation turned highly positive during 2022, a situation that global investors had not seen for more than two decades.

Correlation between stock and bond prices

Source: The stock and bond prices correlation has been calculated as the correlation between the S&P 500 Index and the Bloomberg US Long Treasury Total Return Index smoothed over eight quarters.

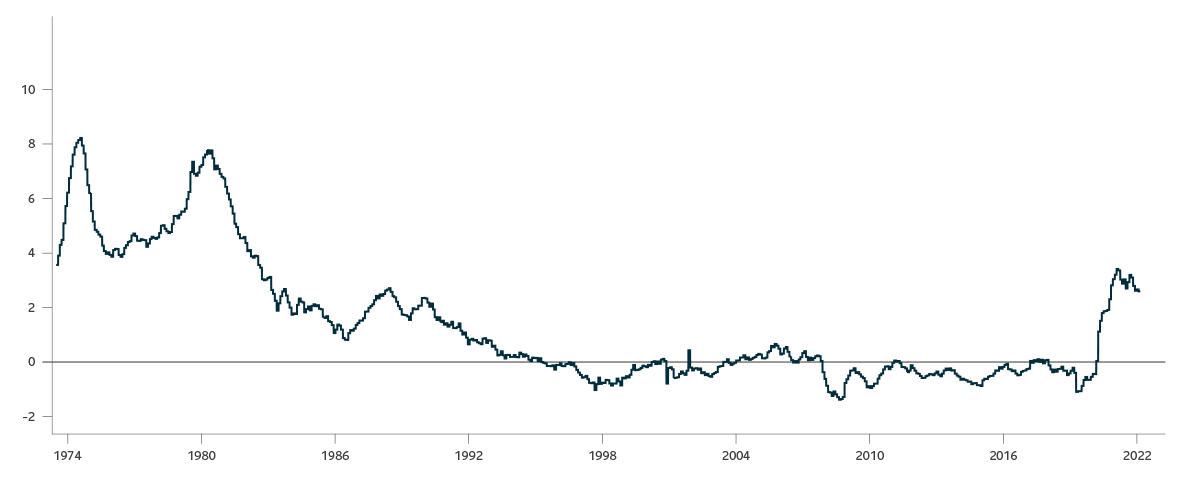

Core personal consumption expenditure (PCE) inflation relative to 2% target

Source: Federal Reserve Bank of St. Louis

In March, the negative stock-bond correlation made a strong comeback. One may wonder what caused the sudden change. The ongoing U.S. banking crisis has consumed a few regional banks and revealed some vulnerabilities in the asset-liability mismatch, which is a common practice in the banking industry.

Even though it’s too early to conclude that the recent banking disaster won’t evolve into a systemic issue, we expect the U.S. banking industry to act cautiously and reduce lending activities. The resulting tightening in available credit to the real economy will speed up the timeline of a meaningful economic slowdown, if not a full-on recession.

Recently, investors’ widespread anxiety caused them to react differently to stocks and bonds. Almost immediately, stocks fell due to worries about their growth outlook. But at the same time, investors quickly dialed back their expectations on how much more the U.S. Federal Reserve, and other major central banks, could push ahead with tighter monetary policy. So, bond prices rallied as interest rate expectations fell. This helped bond and stock prices to be negatively correlated again in recent weeks.

To be clear, it’s unlikely that we will stay firmly in the regime of “stock down, bonds up,” or vice versa, for that matter. In fact, we do not expect this negative correlation to last long as inflation dynamics remain highly uncertain in the intermediate term.

While peak inflation is behind us, returning to the 2% inflation “sweet spot” will likely be a bumpy ride. That’s because some components pushing prices up can prove to be quite persistent. A structural imbalance in labour markets, flaring geopolitical tensions, and a global commitment to decarbonize our economies are just a few of the contributing factors. Until investors shift their focus to economic growth uncertainties in a relatively stable inflation environment, stocks and bonds will more likely be positively correlated than negatively correlated.

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by SLGI Asset Management Inc. These views are subject to change at any time and are not to be considered as investment advice nor should they be considered a recommendation to buy or sell.