At the start of 2023, inflation in Canada started to ease a bit. But this drop was after months of rising inflation, hitting a 39-year high in June 2022 of 8.1%. Blame the pandemic that fueled supply shortages and rising demand which pushed up the cost of many products. Consider the fact: the average listed residential rental in Canada soared by more than 17% between March 2020 to December 2022. A renter who paid CAD$2,000 for housing at the start of the pandemic paid nearly CAD$2,350 in December of 20221. This shows how inflation dented household budgets in Canada.

But what effect does inflation have on your investments? The short answer: it can pose a “stealth” threat as it relentlessly eats away at your savings and investment income. To help you understand more, in this article we’ll look at what inflation is, what causes it and the potential impact on your finances.

1 Source: Rentals.ca - National Rent Report

Inflation – silently eroding your purchasing power

Simply put, the inflation rate refers to the pace at which the cost of goods and services increase over time. An increase in inflation can be caused by many things, including supply shortages and rising demand like we saw with lumber. Or it may be a sharp rise in production costs, including raw material and wages. These rising costs are often passed on to consumers. For example, when the price of oil rises there is an almost immediate increase at the gas pump.

To calculate Canada’s inflation rate, Statistics Canada created the Consumer Price Index (CPI). It assesses the cost of over 700 products every month, including food, clothing, housing and education. The components of the CPI constantly fluctuate. And in the 42-year-period from December, 1980 to December, 2022 Canada’s average annual inflation rate was 2.89%2. Or perhaps more aptly, as the Bank of Canada (BoC) puts it, the value of money fell by 2.89% annually.

This means, on average, something that costs $100 this year would cost $102.89 the next year. Sure, if you’re working, your wages may rise to keep pace with inflation. But if you’re retired and on a fixed income your purchasing power (the amount of goods and services you can purchase) declines steadily over time.

Inflation has been more than double the average recently, so more than ever, consumers are paying closer attention to prices and trying to get more for their dollar.

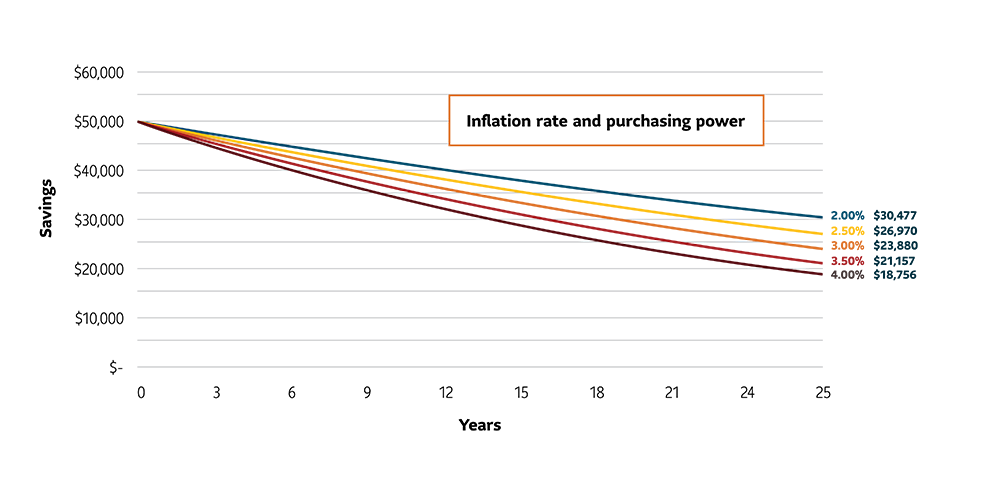

Inflation and your purchasing power*

Source Sun Life Global Investments. Inflation rates used are hypothetical*.

2Source: Bank of Canada Inflation Calculator

We’ve looked at how inflation erodes your purchasing power. But how will your investments hold up to inflation? The short answer? It depends on what investments you’re holding.

Let’s start with bonds, and how they react to inflation. Among the most widely held bonds, are those issued by governments. These are high quality and backed by a low default rate. Hence, they are called investment grade bonds, and must carry a BBB credit rating or higher.

These bonds are owned for both the income they produce and their lower risk profile. To that end, they are often held by institutions, pension plans and investment managers to lower risk in their portfolios. For example, traditionally, to offset the risk inherent in equites, a balanced mutual fund would hold 40% in bonds and 60% in stocks.

Nevertheless, returns on bonds can be negatively affected by inflation in a couple of ways. First, depending on the interest rate, if you received an annual payment of $200 a year on your bond, you would be able to buy less and less each year with it. Secondly, these bonds can be hurt when interest rates rise. This may occur when inflation is running above the BoC’s 2% inflation target. To slow inflation, it could force the bank to raise its key lending rate.

It sounds counterintuitive, but when interest rates rise bond prices fall. Bonds with longer maturity dates (such as a 20-year bond) are particularly vulnerable to rising rates. Why is this? Let’s say your 20-year, $10,000 bond comes with coupon rate of 5% - the coupon rate is the annual income you can expect to receive. The problem is if interest rates jump, new 20-year bond issues coming to market might have a higher coupon rate. If so, new buyers would obviously opt for the higher coupon. This in effect would reduce your bond's value with it now selling at a discounted price.

Alternatively, there are classes of bonds that are indexed to inflation. Two of the most widely held, include floating rate bonds and treasury inflation-protected securities (TIPS).

Unlike most bonds that have a fixed interest rate, these types of bonds carry a variable coupon rate. For example, the interest rate on a floating rate bond is tied to a benchmark rate, such as the U.S. Federal Reserve’s key overnight rate. When the Fed rate rises, so will the interest paid on a floating rate bond.

Inflation and stock portfolios

Like bonds, the impact of inflation in your stock portfolio depends on how it is invested. Let’s begin by looking at dividend-paying stocks, a source of income for many investors. They are usually paid on a quarterly basis, from a company’s cash flow or profits. And often range from 1 to 10%.

How are dividend payouts affected by inflation? Some companies, such as a utility, may perform well in an inflationary environment because they can pass rising costs on to consumers. This allows them to increase their dividend payouts. For example, if inflation is running at 3%, and a company increases its dividend to 5% you could come out ahead.

The opposite would be true if rising costs triggered by inflation force a company to cut its dividend. So again, how inflation affects dividend income comes down to what dividend-paying stocks are included in a portfolio. That’s why dividend fund managers put great effort into analyzing a company before they invest. They want to determine whether the dividend being paid is sustainable and whether it may increase over time.

Inflation affects growth and value stocks differently

Growth and value investing are two common styles of investing. To understand why inflation affects these stocks differently, remember that inflation erodes the value of money over time. The important issue then is over what time frame is a company’s profitability being calculated. Or more succinctly: profits today could be worth more than potential inflation-eroded profits in the future.

Let’s begin with value stocks. By definition, these stocks trade at a discount to the market. However, when buying a value stock, the investment manager believes there is a reason that a company might return to, or increase profitability. And the manager anticipates that this may occur over a comparatively short period of time.

With growth stocks, the opposite is often true. In this case, the investment manager may buy a growth company like Apple that is forecasting profits well into the future. Or it may be a company with strong cash flows, even though it could be losing money or have low profits. The assumption being that it might be profitable at some point in the future.

As a result, when inflation and interest rates rise, growth stocks tend to fall. This is because the present value of future earnings is being discounted at a higher rate of inflation.

In low inflation rate environments, growth stocks have typically outperformed value stocks. And in 2022, with the world emerging from the pandemic, value stocks gained ground during rising rates – and inflation. In investing, however, past performance is not an indication of future performance.

Inflation hedges: commodities and property

As we’ve noted, what is held in a portfolio will go a long way to determining how it stands up to inflation. To that end, when inflation is rising, investment managers may invest in companies such as a utility. Or it could be a company manufacturing an essential product and can pass rising costs on to consumers.

They may also invest in specific asset classes, including infrastructure and real assets. These have traditionally performed well in an inflationary environment. For example, the Canada Pension Plan is broadly diversified. At the end of March 2022, it held 23% of its $539 billion portfolio in what it terms real assets, including real estate, infrastructure, energy and resources2.

2 www.cppinvestments.com Fiscal 2022 annual report

Real estate investment trusts (REITs), which trade like equities, have traditionally been seen as an option to hedge inflation. This is because physical assets such as a house often grow with or above the rate of inflation. This, in part because supply often outstrips demand for both personal and rental use. Moreover, if an individual buys a house at a fixed interest rate, inflation becomes an ally. This is because as wages rise with inflation, the fixed cost of the loan becomes more manageable.

Commodities typically rise when inflation accelerates. This was the case in 2022 when commodities returned 22%3 - the top performing asset class. Another example is energy prices, which generally move in the same direction as inflation. Energy was a rare outperformer among the 11 sectors of S&P 500 index in 2022. In a year when the S&P 500 fell almost 19%, the energy sector in the index soared 59% offering some much-needed respite in an inflationary environment4.

3Source: Market Insider

4Source: wsj.com

Offsetting inflation requires a plan

As we’ve shown here, inflation can erode your purchasing power. But as we’ve also noted, it’s what’s in a portfolio that matters when inflation increases. That’s why the best advice is to meet with an advisor. They have the ability assess your finances and suggest strategies that may help offset the risk that inflation poses.

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by SLGI Asset Management Inc. These views are subject to change at any time and are not to be considered as investment advice nor should they be considered a recommendation to buy or sell.

Information contained in this document has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy. This document may contain forward-looking statements about the economy, and markets; their future performance, strategies or prospects. Forward-looking statements are not guarantees of future performance and are speculative in nature and cannot be relied upon.