Be the change. Invest better.

Be the change our world needs by investing better. You can bring purpose to your portfolio with sustainable infrastructure investing.

Be the change our world needs by investing better. You can bring purpose to your portfolio with sustainable infrastructure investing.

The news isn’t new. We are failing our environment – and society as a whole. Our climate is changing. Food, clean water, and energy supplies are all under strain. This will only worsen exponentially in the coming decades as the population (along with demand) continues to rise. What are we, as good citizens of a world in crisis, to do?

In addition to the environmental crisis, a rising population and urbanization have put a deepening strain on traditional global infrastructures. Traditional infrastructure has long been seen as central to the global economy. Examples are oil and gas pipelines as a means of power, industrial production, and transport, such as roads, railway lines, and air and seaports, amongst others.

Parallel to the environmental crisis and strain on global infrastructures are low interest rates and emerging inflation. The latter was brought about by the perfect storm that ensued from the COVID-19 pandemic. Key factors in this perfect storm are:

Current low interest rates, relatively subdued return expectations, and rising inflation are of particular concern to near-retirees and retirees. Somehow, this demographic must ensure that their retirement income will keep pace with the increasing costs of goods and services.

With low interest rates, emerging inflation, and aging infrastructure, governments around the globe are, again, prioritizing infrastructure to help stimulate the economy. However, given the urgent need to address climate change and resource shortages, nations are shifting from a focus on traditional, often fossil fuel-based, infrastructures, to green, sustainable ones. Examples are electric vehicle charging capability, lower carbon energy sources, and improved water treatment facilities, to name a few.

| Traditional Infrastructure | Sustainable Infrastructure |

|

|

This presents a new, threefold opportunity for investors seeking income and long-term capital growth. Investing in sustainable infrastructure can:

Let’s dive more deeply into how sustainable infrastructure came about and what sustainable infrastructure assets are.

Among the greenhouse gasses that have led, and are continuing to lead, to climate change, carbon emissions remain the most concerning. Climate change is increasing the frequency and severity of extreme weather and natural disasters, such as hurricanes, flooding, rising sea levels, and forest fires. To address these devastating events, scientists, research bodies, and global leaders have held conferences and crafted political statements. We’ve heard about them in the news. Earlier examples are the Kyoto Protocol and Paris Agreement, and most recently, COP26. As a result, most major economies have committed to reducing the carbon they produce.

However, it isn’t as easy as just turning off the greenhouse gas switch. We need to transition the current economy towards a lower-carbon economy. This will necessitate the transformation of existing critical infrastructure, in addition to pioneering innovative new solutions. This has led to a growing movement toward the adaptation of traditional infrastructure to incorporate sustainable measures. The International Institute for Sustainable Development (IISD) is an independent think tank that helps investors make informed decisions about infrastructure financing.

|

|

|

|

|

|

|

|

|

|

|

|

Population growth, industrialization, and urbanization have led to resource scarcities in water and food. This is a serious problem that is also driving growth in sustainable infrastructure. Approximately 2.2 billion people, mostly in the developing world, do not have access to safely managed drinking water2. Further, the UN currently estimates that almost 690 million people are hungry and if recent trends continue, this number will surpass 840 million by 2030.3

Moreover, the environmental threats posed by climate change are playing a large role in the growth of sustainable infrastructure and have implications on environmental stability. To meet the Paris Agreement, at least [a projected] US $65 trillion will need to be invested in clean, renewable energy and carbon reducing technology by 20504. And the International Panel on climate change (IPCC) has stated that to avoid climate catastrophe, global carbon emissions “must be halved by 2030 and at net zero by 2050”5. As a result of these looming deadlines, specific regulation is driving sustainable infrastructure growth. For example, in 2018, the Canadian federal government enacted the Greenhouse Gas Pollution Pricing Act. The act increases fuel charges over time and mandates an output-based carbon pricing system on emissions for facilities6.

1. Return potential in your portfolio

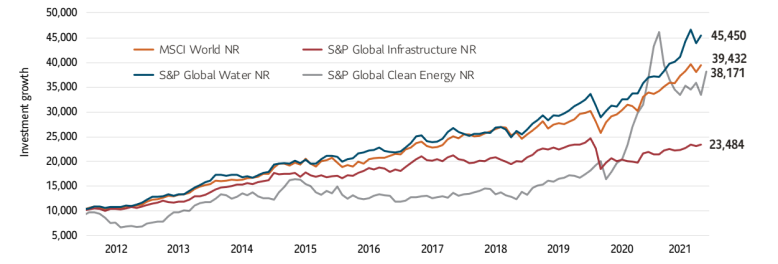

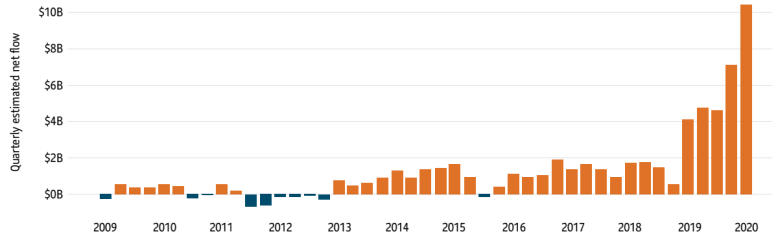

There is a misconception that investing in sustainable infrastructure means sacrificing return. In fact, from 2019-2021, all of the sustainable indices outperformed the S&P Global Infrastructure Index. In addition, over the course of 2021, global sustainable funds saw record inflows with exponential growth. The charts below illustrate the growth in sustainable infrastructure investments.

Exhibit 1: Sustainable indices outperform.

Growth of $10,000 over 10 years

Source: Morningstar Direct as of September 30, 2021.

Values shown are in Canadian dollars. Index performance is for illustrative purposes only and is not intended to be representative of the performance of any actual or future investment managed by Sun Life Global Investments. It is not possible to invest directly in an index. Returns are calculated in the currencies noted and assume reinvestment of all income and no transaction costs or taxes for the periods indicated. Actual returns would be different due to fees and expenses associated with investing which are not applicable to an index.

Exhibit 2: Global sustainable assets saw record inflows in the first quarter of 2020.

Source: Morningstar Direct, as of 3/31/2020. ESG Integration Impact, and Sustainable Sector funds as defined in Sustainable Fund U.S. Landscape Report, 2018. Includes liquidated funds; does not include funds of funds. Note: past performance is not a guarantee of future performance. Values shown are in U.S. dollars

2. It may help meet increasing demand to transition toward an ecosystem supporting sustainable food, clean water, and clean energy production

When large corporations and other entities invest in sustainable infrastructure, it can help fund new technologies and green initiatives that support increasing demand for sustainably produced food, clean water, and clean energy production. An example of a green initiative is the Thames Tideway tunnel project, which is funded by a consortium of institutional investors. The project will upgrade London England’s 150-year-old sewer system to cope with the city’s growing population. The goal is to keep the Thames river clean from spills and other pollutants7 .

3. It may help mitigate the effects of climate change

A key benefit of sustainable infrastructure investing is that it could help mitigate the effects of climate change over time. As mentioned, climate change increases the frequency and severity of extreme weather and natural disasters. In turn, this affects the health and well-being of people and the stability of the economy as infrastructures are damaged. Mounting insured losses in Canada have reached over CAD$ 5 billion in the past five years. Adapting traditional infrastructures to become more sustainable could help protect populations from hurricanes, flooding, rising sea levels, and forest fires and the costs associated with large scale cleanup and repairs. It will also reduce carbon emissions.8

Sustainable infrastructure can help protect populations from:

4. Job creation

If you invest in sustainable infrastructure, you’re helping to support the creation of much-needed employment. A growing world needs more jobs; new jobs are created with new technologies, construction, and the manufacturing of new products in support of clean infrastructure. “Studies have shown that for every US$ 1 billion of construction work, 6,000 [human]-years of employment are created”9. In addition, as a framework for these sectors, administrative jobs are created in terms of policymakers, planners, procurement, regulation, and governance. An example of the economic opportunity is Canada’s spike in green employment. ECO Canada’s latest data for the environmental sector shows four consecutive quarters of increased job postings and two consecutive quarters wherein job postings surpassed pre-pandemic levels. This represents approximately 67,230 jobs out of one million from April to June 2021 – a mere three-month period10.

5. Stimulates economies long-term

Worldwide debt has reached epic proportions and could worsen still. A Cambridge study predicts that the global economy could see a loss of almost US$ 27 trillion in the next five years11. Further, government funding is not enough to keep up with the demand for sustainable infrastructure. The World Economic Forum estimates “a [US] $15 trillion deficit in sustainable infrastructure funding by 2040”12. Therefore, with infrastructure’s strong, long-standing connection to healthy economies, green investing could help stimulate economies over the long-term.

6. Supply chains become more “local”

Largely, sustainable infrastructure projects occur close to home. As an example, in Canada, the stages in green infrastructure projects – from ideation to completion – generally happen within a province. This means these projects will harness the power of local resources, end-to-end. Local resources include environmental and technical consultants, such as water resource and civil engineers, landscape architects, and specialty trades13. A key benefit of end-to-end local resources being employed is that supply chains aren’t as easily disrupted and can better adapt when negative world events occur. Consider how COVID-19 has adversely affected global supply chains during lock-downs.

How can you access the sustainable infrastructure investment opportunity?

Introducing Sun Life KBI Sustainable Infrastructure Private Pool

Be the change. Invest better. Bringing purpose to your portfolio. Sun Life KBI Sustainable Infrastructure Private Pool presents an opportunity to invest in the development of roads, buildings, clean energy, and clean water infrastructure with due consideration to economic, social, and environmental implications. You can participate in the change the world needs and invest for a better future. Additionally, Sun Life KBI Sustainable Infrastructure Private Pool provides a means of hedging against the effects of inflation while providing stable income for those seeking alternative sources of income in their portfolio.

Highlights

Inception |

November 15, 2021 |

Risk profile |

Medium |

Fund objective |

Long-term capital appreciation and inflation protection, while also generating stable income |

Benchmark |

S&P Global Infrastructure Index |

# of holdings |

Concentrated portfolio targeting approximately 30-60 stocks |

Sustainability |

Built directly into the Pool’s investment objective |

Benefits

| Superior growth opportunities: | Stable income and inflation protection: |

Sustainability: |

|

|

|

KBIGI's Core Themes

Increase supply & access |

Decrease demand & waste |

Improve & assure quality |

Build & repair infrastructure |

|

|

|

|

|

|

|

|

|

|

|

|

Sun Life KBI Sustainable Infrastructure |

|||

Who is the sub-advisor KBI?

KBI Global Investors (North America) Ltd. (KBI) is part of KBI Global Investors Ltd. Group, headquartered in Dublin, Ireland. Founded on the principle of responsible investing, they’re a specialist investment management boutique with world-class expertise and a history of innovation. Established in 1980, KBI has managed global equity portfolios for more than 35 years and sustainability-focused strategies for more than 30 years.

Sun Life KBI Sustainable Infrastructure Private Pool portfolio managers:

Colm O’Connor

Industry experience

18 years

Noel O’Halloran

Industry experience

29 years

Martin Conroy, CFA

CFA Industry experience

17 years

To learn more about how to integrate Sun Life KBI Sustainable Infrastructure Private Pool into your portfolio, speak to your advisor.

1 IISD, “What is sustainable infrastructure?” Web page referenced October 2021.

2 WHO/UNICEF, 2019 as referenced on un.org November 2021.

3 United Nations, “Global Issues: Food 2020”.

4 International Renewable Energy Agency (IRENA), “Global energy transformation: A roadmap to 2050 (2019 edition)”; page 8.

5 Climate One, “What the 2030 climate deadline really means”; March 13, 2020.

6 Government of Canada Justice Laws, “Greenhouse Gas Pollution Pricing Act”; Act assented to June 6, 2019; web page referenced November 2021.

7 Tideway London. Web page referenced November 2021. This is an example of a green initiative, but may not be a green initiative that Sun Life KBI Sustainable Infrastructure Private Pool specifically invests in.

8 Delphi Group, “Investing in Green Infrastructure: A Win-Win for Economic Recovery”; July 16, 2020.

9 Nasdaq; guest contributor Mohammad Raafi Hossain, Founder and CEO of Fasset, “Going Green: The Benefits of Sustainable Infrastructure Investments and Technology’s Role”; October 1, 2020.

10 Environmental Careers Organization (ECO) Canada; October, 2021.

11 University of Cambridge Judge Business School; May 19, 2020.

12 World Economic Forum, April 11, 2019. While the article does not specify a deficit in US dollars, it references “…leaders of the international community [gathering] in Washington DC;” therefore, Sun Life Global Investments is assuming the funds are in US dollars.

13 Loc. cit. Delphi Group, reference footnote #8.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Investors should read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in security value and reinvestment of all distributions and do not take into account sales, redemption, distribution or other optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Series F is available only to eligible investors who have fee-based accounts with their dealers.

This document is provided for information purposes only and is not intended to provide specific individual financial, investment, tax or legal advice. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by SLGI Asset Management Inc. or any of the sub-advisors to those funds. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell.

Information contained in this document has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy. This document may contain forward-looking statements about the economy, and markets; their future performance, strategies or prospects. Forward-looking statements are not guarantees of future performance and are speculative in nature and cannot be relied upon.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada and Sun Life Financial Trust Inc. SLGI Asset Management Inc. is the investment manager of the Sun Life Mutual Funds, Sun Life Granite Managed Solutions and Sun Life Private Investment Pools.

© SLGI Asset Management Inc. and its licensors, 2022. SLGI Asset Management Inc. is a member of the Sun Life group of companies. All rights reserved.