During a period of rampant speculation in the 1920s, MFS Investment Management (MFS) created a new and groundbreaking investment vehicle — the open-end mutual fund — designed to give investors of modest means a transparent, affordable path to financial success.

During the mid-1920s, business was booming in the United States as the stock market began its steady climb toward all-time highs.1 The Roaring Twenties was marked by a feverish optimism, new innovations and the question “what will they think of next?”2,3 Hearing so many get-rich-quick success stories, many people began wondering how they, too, could get rich quick.4

But there were many hidden dangers for regular American families lurking below the surface of the U.S.’ largely unregulated stock market.5 The closed-end funds of the time, which were the most popular “pooled investments,” often engaged in troubling practices that put Americans’ hard-earned money in jeopardy.6 Some investment managers would intentionally prey on the ignorance of unsophisticated investors and sell what are called speculative securities, which seemed quite attractive on the surface but were known to be, or at least suspected to be, either highly risky or, ultimately worthless.7 They also refused to disclose their holdings, making it nearly impossible for people to know what the holdings were actually worth.8

And since these closed-end funds didn’t give investors direct ownership of their assets, small investors who actually managed to buy into one and then wanted to sell their shares would have to find other investors to buy them instead of selling the shares back to the fund itself. Given the lack of regulations in the market, the buyers of their shares had little incentive to pay a fair price.9 Not only that, many closed-end fund managers either borrowed money to purchase speculative stock,10 or in some cases, would purchase shares of other speculative closed-end funds.11

Knowing the terrible harm these funds could cause, Edward Leffler, one of the early trustees of MFS, envisioned a more transparently managed and ethical investment vehicle — a fund that could issue additional shares if new investors wanted to buy into the product and,12 more importantly, would guarantee its shareholders the right to sell their shares back to the fund at any time.13 Leffler also wanted shareholders to be able to sell their shares back to the fund for a fair price (i.e., the underlying value of the fund’s stock holdings),14,15 which was not the case for closed-end funds — sell prices often differed from the market value,16 making them incredibly expensive if sold at a premium. Leffler’s investment vehicle would give regular Americans an accessible path to financial security for themselves and their families.

Throughout his career selling individual securities, Leffler had witnessed firsthand from sitting at kitchen tables with his customers that “there was no sound investment vehicle” to help ordinary people “get somewhere financially.”17 He was determined to introduce a more durable and democratic investment platform that would not only stand the test of time but change lives.

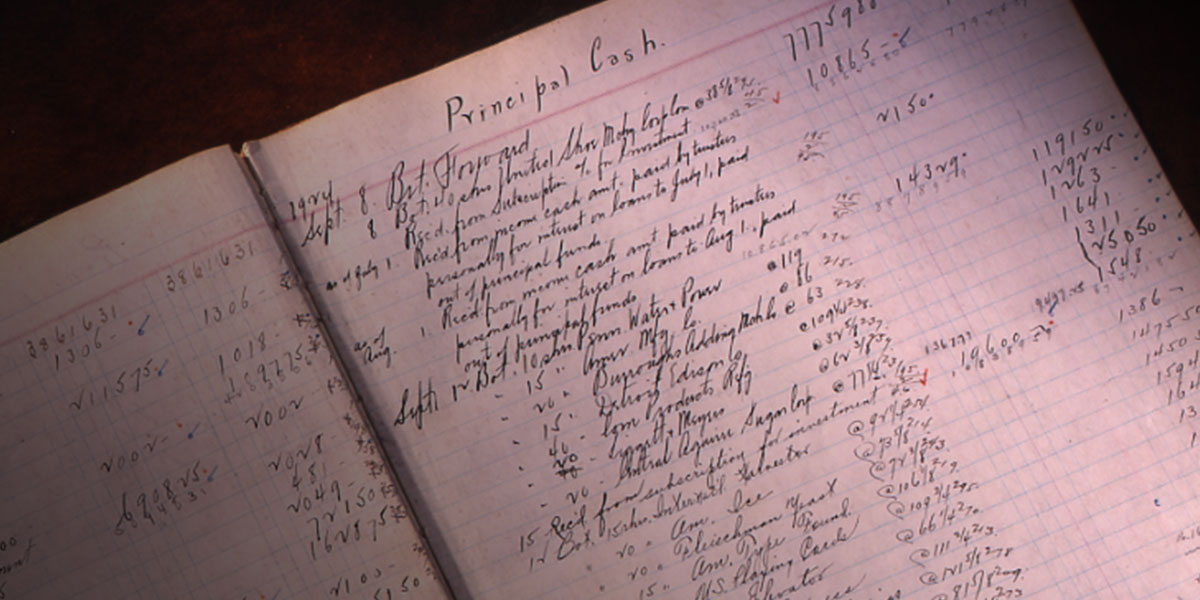

As Leffler’s on-demand redemption policy was a revolutionary idea, he knew he needed help shaping it into an actual, viable product.18 But for three years,19 his radical idea was rejected at every turn. Then he visited the small Boston brokerage firm of Learoyd, Foster & Co.20 Charles H. Learoyd and Hatherly Foster Jr. were immediately interested in transforming Leffler’s idea into a sophisticated investment vehicle.21 So, the three established the Massachusetts Investors Trust (MIT)* fund on March 21, 1924.22

No one knew what to make of how different MIT was to the short-term thinking that dominated the mid-1920s. Not only was it affordable, as it wasn’t sold at a premium beyond its actual market value, but it even provided small shareholders professional active management.23 Instead of buying the risky holdings in closed-end funds, an investor could own shares in secure and established companies, like railroads and utilities, for a sum within reach for many ordinary people.24 MIT offered average investors the kind of liquidity protections that no one had dared to offer them before.25

MIT was not only MFS’ first fund but also the U.S.’ first open-end mutual fund, a groundbreaking product that created the modern mutual fund industry and enabled the financial security of millions of people.26

Today, a full century after its founding, MIT lives on — a radical innovation that birthed a $56.2 trillion industry and changed the way we live.27

The Massachusetts Investors Trust is a mutual fund qualified for sale in the United States and is not available for purchase by Canadian investors. This article was first published in the United States by MFS Institutional Advisors, Inc. It is republished with modifications for the Canadian marketplace by SGLI Asset Management Inc. with permission. Nothing in this article, including the mention of specific securities, constitutes an offer to sell or a solicitation to buy any product or service offered by MFS Institutional Advisors Inc. or SLGI Asset Management Inc. in this or any other jurisdiction in which such an offer or solicitation is unlawful.

1Richardson, Gary, Komai, Alejandro, Gou, Michael, and Park, Daniel. (2013) Stock Market Crash of 1929. https://www.federalreservehistory.org/essays/stock-market-crash-of-1929

2Certell.org. Stock Market Crash of 1929. https://vimeo.com/235944184, time stamp 7:15-7:25.

3Certell.org. Stock Market Crash of 1929. https://vimeo.com/235944184, time stamp 4:00-4:10.

4Roye, Paul F. (2001) Speech by SEC Staff: The Exciting World of Investment Company Regulation. https://www.sec.gov/news/speech/spch500.htm.

5WALL STREET: The Prudent Man. (1959) Time Magazine. http://content.time.com/time/subscriber/article/0,33009,811169-1,00.html

6Gremillion, Lee. Mutual Fund Industry Handbook: A Comprehensive Guide for Investment Professionals. (2005) The National Investment Company Service Association (NICSA) and Acadient Incorporated. John Wiley & Sons. Hoboken, NJ. Page 16.

7Pontecorvo, Giulio. Investment Banking and Security Speculation in the Late 1920s. (Summer, 1958) The Business History Review. Vol. 32.2 Page 171.

8Mutual Fund Industry Handbook, page 16.

9MFS Turns 75, MFS Perspective, 1999. Vol 5, No. 1.; Allen, David Grayson. Investment Management in Boston: A History. (2015) University of Massachusetts Press. Boston. Page 144.

10Rottersman, Max and Zweig, Jason. An Early History of Mutual Funds. (1994) Friends of Financial History. Museum of American Financial History. Vol. 51. Page 12.

11Friends of Financial History, page 17 (PDF 19); Mutual Fund Industry Handbook, page 16.

12Allen, D. (2015). Investment Management in Boston: A History. University of Massachusetts Press. Page 139.

13MFS Perspective, page 14.

14MFS Perspective, page 14.

15Wilson, Julia A. A Story of Progress: On the Twenty-Fifth Anniversary of Massachusetts Investors Trust. (1949) Massachusetts Investors Trust. Boston. Page 10; Silberman, H. Lee. 50 Years of Trust: Massachusetts Investors Trust, 1924–1974. (1974) Massachusetts Financial Services, Inc. Boston. Page 2; MFS History & Quotes page 1.

16De Long, J.Bradford, Shleifer, Andrei. The Stock Market Bubble of 1929: Evidence from Closed-end Mutual Funds. (September 1991) The Journal of Economic History. Vol.51.3. Pages 677-678.

17https://www.sec.gov/news/speech/spch500.htm

18Allen, D. (2015). Investment Management in Boston: A History. University of Massachusetts Press. Page 139.

19Friends of Financial History, Page 17.

20Friends of Financial History, Page 19.

21Grow, Natalie R. The “Boston-type open-end fund”: Development of a national financial institution 1924-1940. (1977) Harvard University. (Unpublished doctoral dissertation or master's thesis). Page 74.

22Wilson, Julia A. A Story of Progress.

23Robinson, Dwight P. Massachusetts Investors Trust: Pioneer in Open-End Investment Trusts. (1954) The Newcomen Society in North America. New York. Page 12.

24Blake, Rich. Massachusetts Miracle. (2001) Institutional Investor. New York. Vol 35, Issue 12. Pages 58 to 64.

25MFS Perspective, Page 14.

26Bogle, John C. Before the United States Senate Governmental Affairs Subcommittee on Financial Management, the Budget, and International Security. (2004). https://www.hsgac.senate.gov/imo/media/doc/012704bogle.pdf

27https://www.grandviewresearch.com/industry-analysis/mutual-fund-assets-market-report

MFS Investment Management Canada Limited is the sub-advisor to the Sun Life MFS Funds; SLGI Asset Management Inc. is the registered portfolio manager.

The information provided is not intended to be investment advice. Investors should consult their own professional advisor for specific investment and/or tax advice tailored to their needs when planning to implement an investment strategy to ensure that individual circumstances are considered properly, and action is taken based on the latest available information.