- Inflation in Canada and the U.S. spiked in early 2022 soaring to levels last only seen in the 1980s

- Skyrocketing inflation is hitting consumers hard and central bankers are preparing to hike interest rates

- A nuanced approach with a focus on differentiated alpha sources and diversification can help traditional balanced portfolios continue producing risk-adjusted returns in a rising interest rate scenario

- Real assets such as infrastructure, real estate, commodities, and resource-based equities that can withstand inflation better could also help protect portfolios

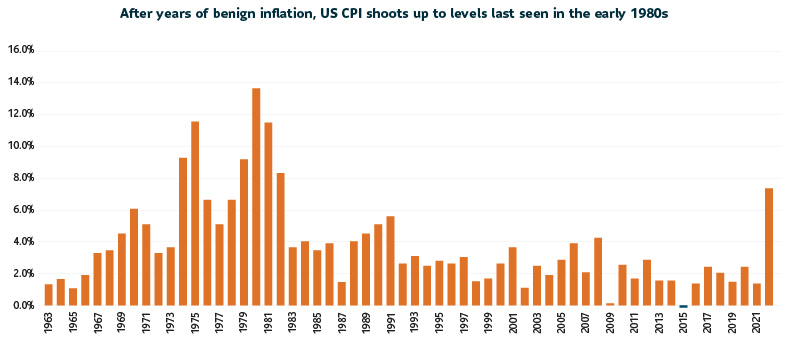

Inflation is raging across North America. The U.S. consumer price index (CPI) hit 7.5% in January 2022, a 40-year high. Not far behind was Canadian CPI at 5.1% for January 2022.

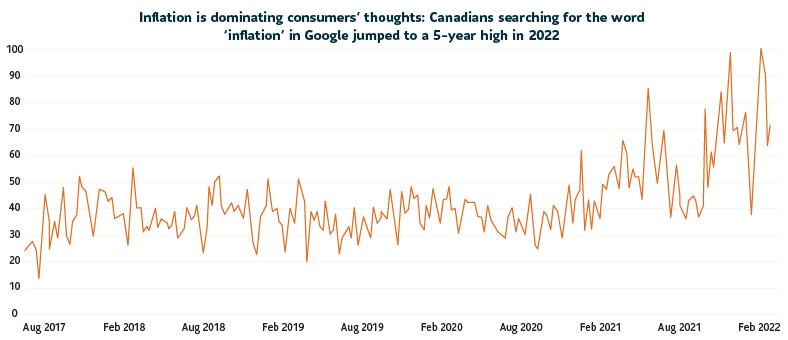

Inflation is showing up in all kinds of places and items across the U.S. and Canada. It is painful to fill the tank with gas, buy groceries and find an apartment for rent these days. No wonder it dominates the list of Canadian households’ worries.

A bar graph showing US CPI for the period between 1963 and 2021

A bar graph showing US CPI for the period between 1963 and 2021

Source: U.S. Bureau of Labor Statistics

Source: Google Trends

Today’s inflation, however, did not shoot up overnight. It was two years in the making.

When fiscal and monetary stimulus unleashed to fend off COVID-19’s devastating effects two years ago triggered price rises in early 2021, it was considered “transitory.” Rising prices were primarily attributed to goods inflation originating from supply chain disruptions at Asia’s far flung manufacturing clusters and to poor year-over-year comparables. It was supposed to level off.

But it didn’t. As the economy gained steam through spring and winter, progressively absorbing work force and driving down unemployment, wages rose in tandem.

By the time monetary authorities in the U.S. and Canada woke up to the fact, price gains had taken hold.

To be fair, the generous monetary and fiscal stimulus of the past two years created jobs and kept consumers and businesses alive. It helped Canada fully regain the three million jobs lost to the pandemic and then some. The stimulus helped drive down U.S. unemployment from 14% in March 2020 to a 3.9% in January 2022.

However, despite rising jobs and accelerating wages, gloom is setting in. Amidst a 40-year high in inflation, the index of Consumer Sentiment, measured by University of Michigan, sank in February 2022 to 62.8. This is its lowest level since 2011.

With consumers gloomy, can investors be far behind? The answer depends on how persistent inflation will be over the following months.

Inflation – Flexible or sticky?

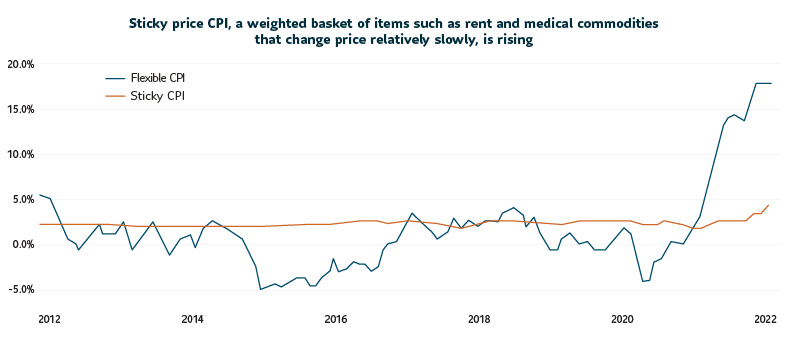

By one measure, inflation seems to be spilling over to those items whose prices change relatively slowly. The Atlanta Fed’s “Sticky-price” CPI, compiled by weighting a basket of items such as rent of primary residence and medical care commodities – things whose prices don’t jump at a whim – rose 4.2% in January 2022 over the previous year period.

Source: Federal Reserve of Atlanta

Furthermore, the services component of the CPI, has also been inching up over the past six months.

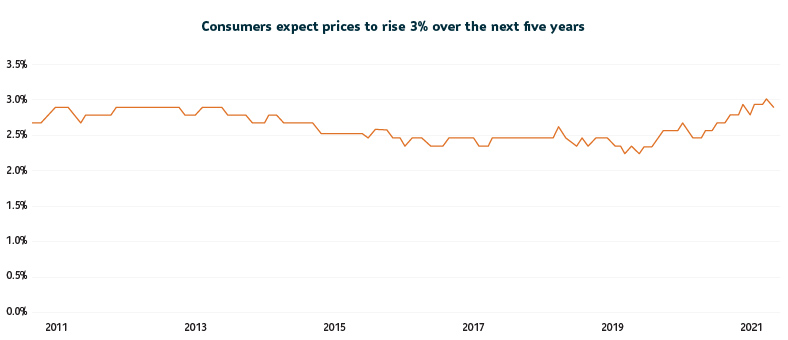

While these facts seem to suggest inflation will pick up over the short run, both consumer expectations and investor expectations point to more moderate views over the medium term.

The University of Michigan’s February 2022 survey found that consumers expect prices to rise 3.1% annually over the next five to ten years. While that might be a recent high, it is not much higher than the 2.3% those consumers forecast in February 2020.

Source: University of Michigan

Financial markets too don’t suggest runaway inflation over the next decade. Investor expectations of inflation as measured by the 10-year break-even rate (the difference between yield on the 10-year Treasury note and the 10-year Treasury inflation-protected security) stands currently around 2.5%.

At Sun Life Global Investments, we believe current inflationary pressures are due to strong demand for goods (vs. services) that COVID-19-disrupted supply chains are struggling to meet. As 2022 progresses, we believe a rotation from goods spending to services will cool demand. We also expect supply chains to continue improving, although we might see short term disruptions. Both these factors, along with base effects (i.e., being compared against a higher base) should help alleviate inflation.

Nevertheless, both the U.S. and Canada are preparing to raise rates, lest expectations for price gains get entrenched.

The fight to tame inflation

There were four major U.S. interest rate hike cycles in the past four decades: 1977-81,1994-95, 2004-06 and 2015-18. While the 2004-06 and 2015-18 rate hikes were gradual and characterized by increments of 25 basis points, the 1977-81 and 1994-95 rate hike cycles were characterized by sharper and faster jump in rates.

Despite a series of rate hikes beginning in 1976, the U.S. Federal Reserve struggled to rein in inflation. In 1979, when inflation was running at over 11%, the U.S. Federal Reserve stepped in with a stated aim of defeating inflation. The Fed raised its target rate from 11.2% in 1979 to 20% in 1981. While the Fed’s actions beat inflation, which peaked at 13.5% in 1980, its actions came at a tremendous cost to the economy. The Fed’s monetary tightening caused a double-dip recession, pushed up unemployment to over 10% in 1982, and stock markets fell through the late 1970’s before bottoming out in early 1980’s.

Again in 1994, when the economy was humming with rising prices and falling unemployment, the Fed stepped in to prevent overheating. The Fed hiked interest rates by 300 basis points for a policy rate of 6% in just a year.

While the 1994 rate hike cycle did not result in a U.S. recession or derail the equity market, it caused bond yields to spike. That in turn even caused bankruptcy in a U.S. municipality and set off economic crises in Mexico and Argentina.

If history is any guide, investors should rightfully be worried about protecting their portfolios with the impending interest rate hikes.

The traditional balanced portfolio of 60% stocks and 40% bonds had a stellar run since 2007. For nearly 15 years, the 60/40 strategy weathered everything thrown at it – the great financial crisis, taper tantrum and even the past two years of COVID-19 pandemic. It has posted just two years of negative returns since 2007.

However, with inflation hovering at multi-decade highs, there have been some questions over whether traditional balanced portfolios of stocks and bonds could continue delivering in a rising interest rate scenario.

We believe there is value in taking a more nuanced approach by incorporating a broader set of underlying market exposures across both fixed income and equities (given investor objectives and constraints). Multiple and differentiated sources of return and yield are more important than ever in an environment where core asset classes may no longer deliver enough.

Get real

In addition to traditional asset classes, investors may seek added diversification and return potential in real assets as well. This category comprises real estate, infrastructure, commodities, and even resource-based equities.

Real assets serve as a natural hedge against inflation. Real estate, both residential and commercial sectors, are likely to benefit from inflation because their leases reset higher with inflation. Secondly, some real assets have historically been a late-cycle hedge, meaning they have withstood interest rate hikes and inflation better than traditional asset classes.

History may provide some clues on what works and what does not when prices are moving rapidly. In periods of accelerating inflation between 1973 and 2019, U.S. REITS and Developed Market Resources equities handily beat more traditional asset classes such as U.S. Equities and U.S. Investment Grade Bonds. Additionally, U.S. inflation linked bonds too performed better than traditional asset classes during bouts of inflation in the past 30 years.

An allocation to real asset classes can supplement a mainstay of traditional bond and stock portfolios and help investors ride out the ensuing interest rate hike cycle. And it has the potential to keep the portfolio’s purchasing power protected from inflation.

Sun Life Real Assets

Private Pool

- Diverse portfolio of listed real assets, including: infrastructure, REITs, and natural resources (including agri-business, clean energy, and water)

- Strategically and tactically managed asset mix

- Can help diversify traditional portfolios by adding alternative investments and asset classes that have performed well during inflationary periods

- Natural resources sleeve has a focus on environmental, social & governance factors (ESG)

Sun Life KBI Sustainable Infrastructure Private Pool

Be the change. Invest better.

- Designed to capture growing opportunities in listed sustainable infrastructure; globally focused on water and food infrastructure and technological advances in clean, efficient, renewable sources of energy

- Exposure to a stable, predictable, income stream by investing in income-generating sustainable infrastructure assets that also offer a hedge against inflation

- Sustainability drivers are built directly into the investment objective and Environmental, Social, and Governance (ESG) factors are integrated in stock selection

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Investors should read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by SLGI Asset Management Inc. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. This commentary is provided for information purposes only and is not intended to provide specific individual financial, investment, tax or legal advice. Information contained in this commentary has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made with respect to its timeliness or accuracy.

This commentary may contain forward-looking statements about the economy and markets, their future performance, strategies or prospects or events and are subject to uncertainties that could cause actual results to differ materially from those expressed or implied in such statements. Forward-looking statements are not guarantees of future performance and are speculative in nature and cannot be relied upon.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada and Sun Life Financial Trust Inc. SLGI Asset Management Inc. is the investment manager of the Sun Life Mutual Funds, Sun Life Granite Managed Solutions and Sun Life Private Investment Pools.

© SLGI Asset Management Inc. and its licensors, 2022. SLGI Asset Management Inc. is a member of the Sun Life group of companies. All rights reserved.