What is SLGI Asset Management Inc.’s approach to Environmental, Social and Governance (ESG) factors in investing? In a nutshell, we incorporate ESG into our process for evaluating, selecting and monitoring sub-advisors. Here is how MFS Investment Management (one of our sub-advisors) describes their Sustainable Investing Framework:

“At MFS, we seek to achieve investors’ long-term economic objectives by allocating their capital responsibly. As an active manager, we have always sought to identify investments that can add sustainable, long-term value. While many asset managers have chased market demand by launching new ESG strategies or relabeling their existing portfolios, we have maintained a process-focused approach that ensures ESG considerations are a part of every fundamental investment decision.

“Comprehensively and holistically integrating ESG factors into our investment process improves our understanding of what is, and what is not, priced into equity and fixed income valuations. This helps us identify businesses that we believe have the potential to offer more sustainable and durable returns.

“Our multifaceted ESG integration strategy combines analytic, bottom-up research and systematic risk management, as well as active ownership through engagement and proxy voting.

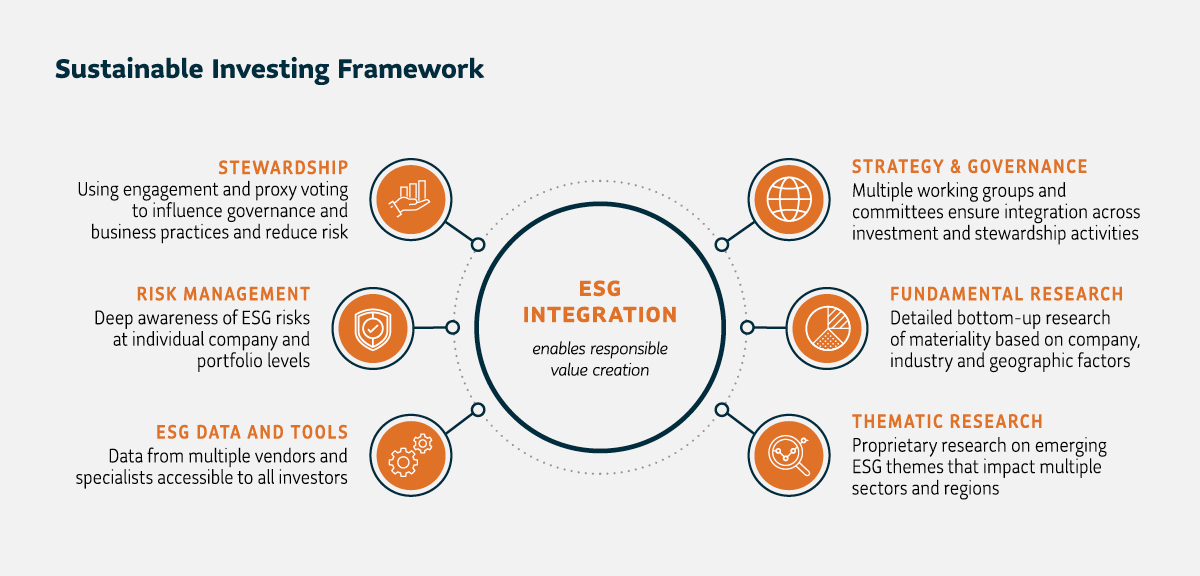

“A variety of activities, processes, data sets and governance structures supports our ability to make sound, long-term investment decisions on behalf of investors. The illustration below highlights the principal areas where we focus our time and attention.”

Stewardship

- Using engagement and proxy voting to influence governance and business practices and reduce risk

Risk management

- Deep awareness of ESG risks at individual company and portfolio levels

ESG data and tools

- Data from multiple vendors and specialists accessible to all investors

Strategy & governance

- Multiple working groups and committees ensure integration across investment and stewardship activities

Fundamental research

- Detailed bottom-up research of materiality based on company, industry and geographic factors

Thematic research

- Proprietary research on emerging ESG themes that impact multiple sectors and regions

Information contained in this article is provided for information purposes only and is not intended to provide specific financial, tax, insurance, investment, legal or accounting advice and should not be relied upon in that regard and does not constitute a specific offer to buy and/or sell securities. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by SLGI Asset Management Inc. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell.

Please note, any future or forward looking statements contained in this article are speculative in nature and cannot be relied upon. There is no guarantee that these events will occur or in the manner speculated. Please speak with your professional advisors before acting on any information contained in this article.