Highlights

- Colm O’Connor, Portfolio Manager, Sun Life KBI Sustainable Infrastructure Private Pool , discusses active approaches to investing in sustainable infrastructure.

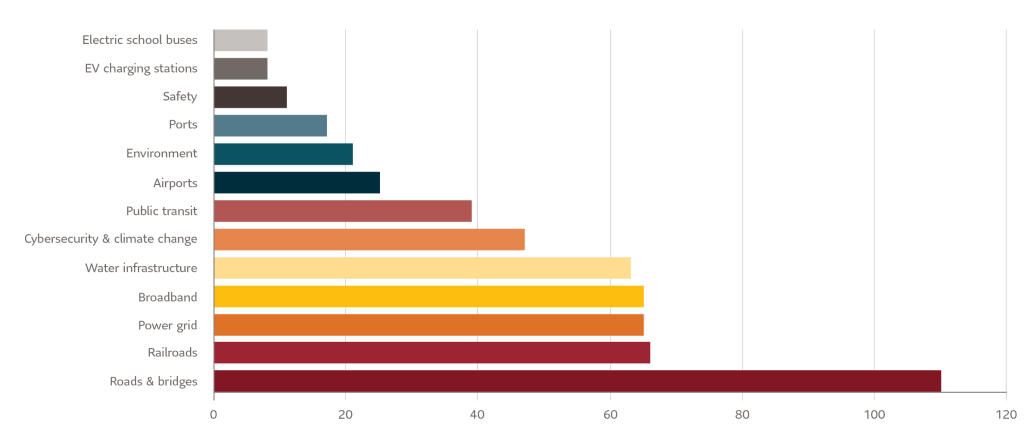

- U.S. passes Infrastructure and Jobs Act: US$1.2 trillion total, with US$550 billion in new spending.

- COP26 ends with 500 financial institutions targeting US$130 trillion to fight climate change

- Infrastructure, as a sub-category of real assets, may act as an inflation hedge

After months of debate U.S. President Joe Biden signed his US$1.2-trillion Infrastructure Investment and Jobs Act into law on November 15. The plan points to a greener future with massive investments, including in renewable energy, updating the electrical grid and building a nationwide network of electric vehicle charging stations. And like the U.S., the Canadian government is also focusing on green infrastructure, investing $180 billion in a swath of projects, including the expansion of public transit, and developing clean water technology.

Billions of dollars targeting sustainable infrastructure

Source: U.S. Senate, J.P. Morgan Asset Management. November 6, 2021.

Ensuring a clean water supply is a key part of the Infrastructure Act. When combined with the $US1.2-trillion American Rescue Plan Act passed in March,2021, it could see over US$100 billion spent in this area. In addition, under the Infrastructure Bill, US$7 billion may be allocated to building electric vehicle charging stations, with another US$73 billion targeting development of clean energy and improving the electrical grid. As well, given the critical nature of the transmission of data, US$65 billion could be spent building out the digital Infrastructure. *

*Source: Infrastructure Investment and Jobs Act, American Rescue Plan Act

The signing of the U.S. infrastructure bill came on the heels of the COP26 environmental conference which ended in a pact requiring governments to increase their efforts to slow the pace of global warming. As part of this initiative, 500 financial institutions from 45 countries agreed to make as much as US$130 trillion available to help meet the climate goals set out in the Paris Agreement, including development of sustainable infrastructure.

Implications for investors: Buyer beware, consider active management

As capital flows to sustainable infrastructure projects, experienced asset managers can review the fundamentals of infrastructure-related investments. Colm O’Connor, Portfolio Manager, KBI Global Investors, a sub-advisor to Sun Life KBI Sustainable Infrastructure Private Pool, explains why and how he is investing in the sector.

O’Connor: One of the key points emanating from the Infrastructure Act is that between it and the American Rescue Plan Act, approximately 20% is specific to water. Potentially this would be more dollars invested in this space than we have seen in decades. So, we continue to highlight water as being a huge infrastructure category, possibly accounting for somewhere between 10 and 20% of spending in the sector in the next decade and beyond. But it’s not just the U.S., we’re seeing large sums forecasted to be spent across all major regions.

It’s also worth noting that the US$2 trillion, Build Back Better Act, which still had not been passed by the U.S. Senate on Dec.1, contains approximately $555 billon for climate and clean energy. This includes, tax credits, spending for renewables, the transmission grid, electric vehicles and other goals to help with greenhouse gas mitigation. The combined objective of the three Acts is to reduce U.S. emissions by 50% (from 2005 levels) by 2030, creating a 100% carbon-pollution-free power sector by 2035 and achieve net zero by 2050.

With the push to decarbonize what are you looking to invest in?

O’Connor: All infrastructure managers seek assets that deliver stable and predictive cashflows over the long term, while providing possible inflation protection. And investors in infrastructure typically think of things like toll roads, airports and ports.

But from our view, that’s old-world, traditional infrastructure. So rather than a traditional lens, we’re using a forward-looking lens that strives to identify the key beneficiaries from future infrastructure projects with strong regulatory support. This means we’re looking at areas like decarbonizing the energy mix, improving the reliability of the electrical grid, EV charging, battery storage, carbon capture, water treatment, waste and recycling. As well, we’ll be looking at the engineering firms who may be at the forefront of adapting infrastructure to climate-related risks from extreme weather.

What are the benefits to investing in sustainable infrastructure?

O’Connor: Infrastructure investing seeks to provide investors with exposure to asset intensive, often monopolistic business models, providing an essential service or function in the global economy. We also seek potentially consistent return patterns with less volatility, and attractive income distributions that may be inflation protected.

It should also have the potential for capital appreciation. And with trillions of dollars projected to be spent on sustainable infrastructure, it could drive strong cash-flow and earnings.

What can investors expect from this strategy?

O’Connor: We are seeing a large number of global investors actively looking to increase their exposure to sustainable investment strategies. So we believe sustainable infrastructure offers investors exposure to a stable, predictable, income stream by investing in income-generating sustainable infrastructure assets that also offer a hedge against inflation. It may also provide diversification.

To learn more about sustainable infrastructure investing:

Sun Life KBI Sustainable Infrastructure Private Pool

Not all investments in Real Assets can be categorized as sustainable. However, Infrastructure is a sub-category of Real Assets, which also include real estate (e.g. REITs) and natural resources. Sun Life Granite Managed Solutions have exposure to Real Assets and several other equity and fixed income types:

https://www.sunlifeglobalinvestments.com/en/products/sun-life-granite-managed-solutions/

Infrastructure and real assets are sometimes used as inflation hedges. To learn more about inflation and investing:

For information about SLGI Asset Management Inc.’s commitment to sustainability:

https://www.sunlifeglobalinvestments.com/en/about-us/sustainable-Investing/